Trade #1: VLO

Refiners have been a great trade, yet there’s some evidence of waning momentum over the last three pushes higher. We’ve nosed over to new highs and found sellers there, so we will look to get a push back the lower end of the trading range that’s been developing since the beginning of May.

Trade Setup

Expected Price: 119

Sell to Open VLO 15Jul22 110/105 Put Spread

Tier 1: Enter at 1, Exit at 0.32

Tier 2: Enter at 1.4, Exit at 0.68

Tier 3: Enter at 1.8, Exit at 0.9

Stop Out If Close Under 109.89

Trade #2: COP

Another oil name, very strong. We are looking for a “pullback to breakout” setup which will line up with the AVWAP from the gap lows and the 50EMA.

Trade Setup

Expected Price: 104.7

Sell to Open COP 15Jul22 97.5/95 Put Spread

Tier 1: Enter at 0.7, Exit at 0.39

Tier 2: Enter at 0.98, Exit at 0.67

Tier 3: Enter at 1.26, Exit at 0.91

Stop Out If Close Under 97.39

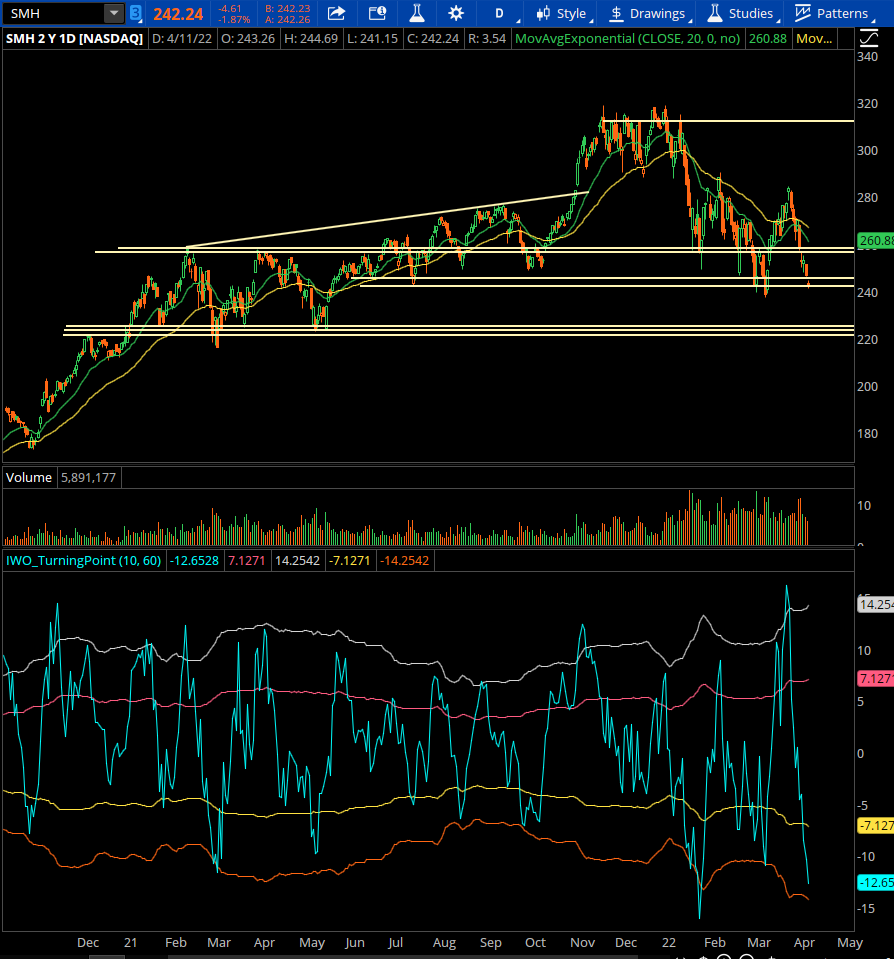

Trade #3: SMH

Semiconductors have probably bottomed, and are coming into their first big levels. Look for a small pullback and play against the lower end of the range with our credit spread strike selection.

Trade Setup

Expected Price: 243

Sell to Open SMH 15Jul22 220/215 Put Spread

Tier 1: Enter at 0.9, Exit at 0.2

Tier 2: Enter at 1.26, Exit at 0.51

Tier 3: Enter at 1.62, Exit at 0.67

Stop Out If Close Under 219.89