An IncomeLab member asks:

“Do you have an opinion on the best way to hedge against a crash or flash crash?”

Just like many other concepts in trading, there is no easy answer to this.

Before we start looking at hedges, remember with iron condors on the indexes we tend to have a lot more downside wiggle room than upside.

That’s because of the market skew. Investors aren’t scared about market rallies, they are scared about crashes. Because of this you can sell option premium much further out of the money on the put side compared to the call side.

Now think about what happens when we see a big volatility move to the downside.

Option premium skyrockets. Which means your iron condor trade can be pretty easily rolled down in strikes without a huge hit in your opex expiration.

So while crashes can lead to poor performance in iron condors, it’s not as terrible as you think.

With that being said, let’s take a look at some possibilities if you really, really want to do this.

Put Calendars

This is one of my favorite hedges. It won’t give you the “immediacy” if the crash comes the next day.

But c’mon… nobody is that good to get into a disaster hedge right when disaster hits. That is the entire reason why we can profit from iron condors in the first place.

With put calendars, you’re selling near term premium and buying next term premium.

Simply put, the short option will finance the cost of your long option.

So you can go out and pick strikes about 15% to the downside and slap on some calendars. The duration should be at least 1 month out on the short strike.

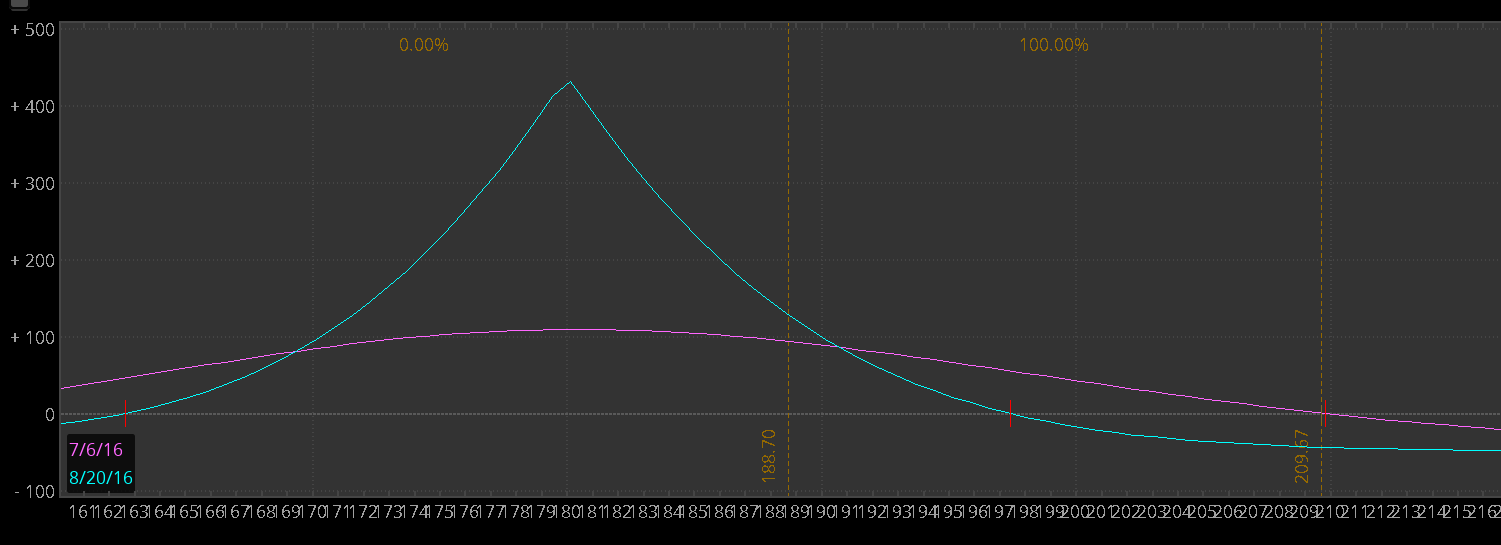

So here’s an example. SPY is trading at 209… so 15% lower is 177. Let’s round up to 180 and take a look at the Aug/Sep 180 put calendar.

Total cost for this spread is .50, and if we did see a crash down to 190 you’d be up a double. If the SPY hangs out around those levels, you then benefit from positive theta.

And if the crash doesn’t happen within the next 30 days, then the front month expires and you’ve got some cheap options as some kind of a disaster hedge.

Unit Puts

I think these make a little more sense from the institutional side, but it’s worth noting.

Unit puts are basically options you buy that are around 1-5 delta. They normally don’t cost a whole lot, and you should expect to lose all your capital on them.

A recent example is an institution went out and purchased 25,000 Aug16 115 puts for a total cost of $0.02

Now is someone really betting that the market will run from 200 all the way down to 115? No.

They’re making a convexity bet, and it’s most likely a small hedge for a massive short gamma position.

And if the market crashes, those puts will probably go up from 0.02 to something like 0.05. A pretty big move on a percentage basis.

If you haven’t seen the problem with unit puts, it’s this…

For a retail investor, the commissions will significantly impact the cost of this hedge. So unless you have a sweet deal with someone on the CBOE floor, it’s not cost effective.

VIX Plays

This could be a massive discussion in and of itself. But I’ll try to keep it simple.

At some point, VIX calls get cheap enough to justify picking up some exposure.

Because VIX is a mean-reverting instrument you’ll have to take profits quickly.

And you must understand that VIX options don’t trade off spot VIX, but off of VIX futures pricing.

The simplest entry point to start hedging is to look at the VVIX, which is the VIX of VIX

Basically, anytime this gets under 85 is when you want to start stalking for VIX call buys.