The way we trade iron condors at IncomeLab can seem a little advanced.

If you come from a directional investing background, then you can buy a stock, place a stop, and place a target.

With iron condors, we’re dynamically managing our risk until the rewards come in.

At IncomeLab, we’re looking to adjust the iron condor if the delta of a short option hits 20.

The question is… can we find this out before price moves to it?

I’ll show you a pretty simple way to find that price.

Trade Example

Let’s start with a brand new iron condor trade.

This is the SPX Aug4 1930/1940 2210/2220 iron condor for a credit of 1.70.

So far so good.

So at what price points would we need to adjust?

Well, let’s start with the call side.

Remember– we’re not looking at NET delta, we’re looking at the individual option delta.

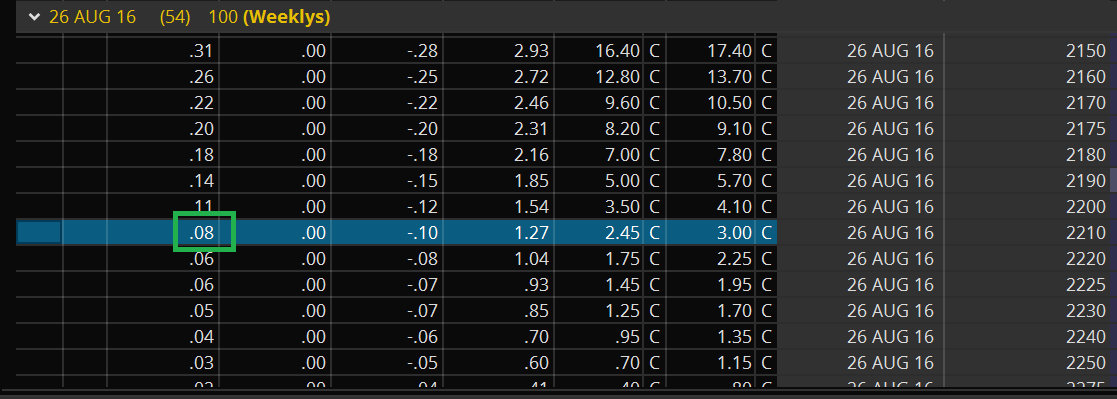

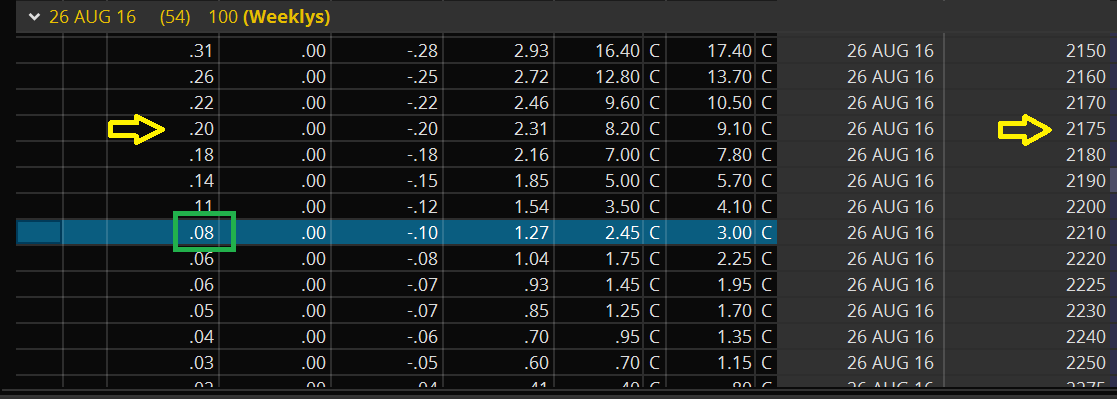

The short call option is the 2210 strike, so we can go look at the option board to see the current delta of all the strikes.

So when can we figure out when the option will hit 20 delta?

Quick and Dirty Method

Step 1: Find the option that has 20 delta already. In this example, it would be the 2175 call.

Step 2: Subtract the difference between your short strike and the current 20 delta strike.

In this case, your short strike is 2210, and the 20 delta is 2175.

That gives us a distance of 35 points.

Step 3: Adjust SPX price based off that distance.

So if current SPX price is 2100, and the distance is 35, then you should be expecting to adjust your position at the 2135 level.

Analytics Method

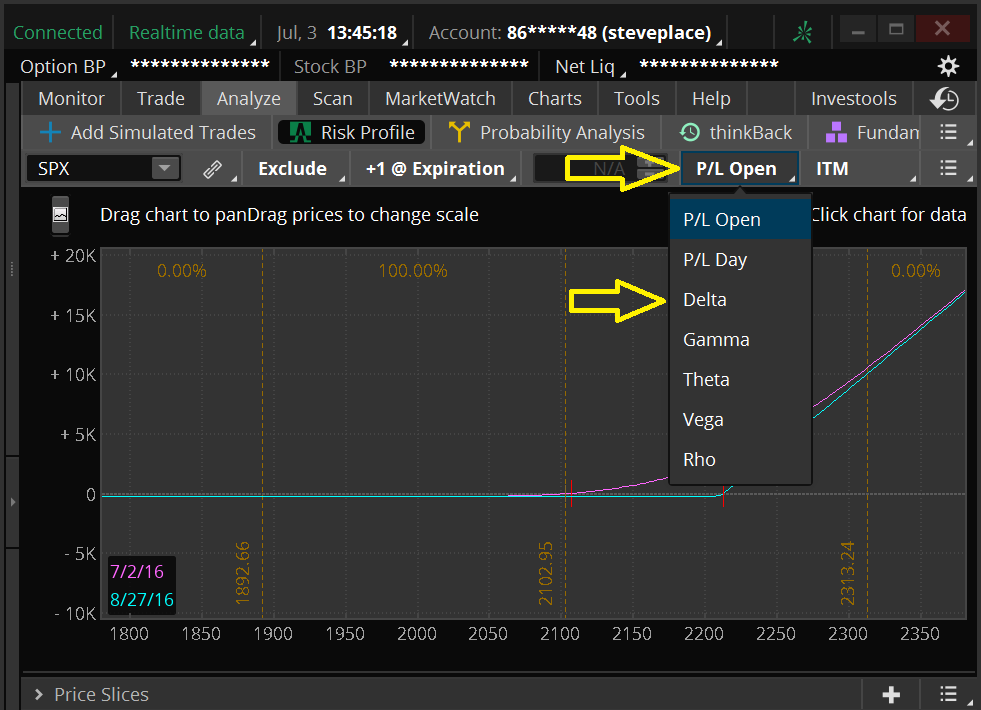

The more sophisticated way to do it is to analyze the single option.

So the first step would be to simulate what buying the 2210 call would be like:

Now instead of looking at your P/L, you want to look at the delta. In the dropdown menu, change the p/l to delta.

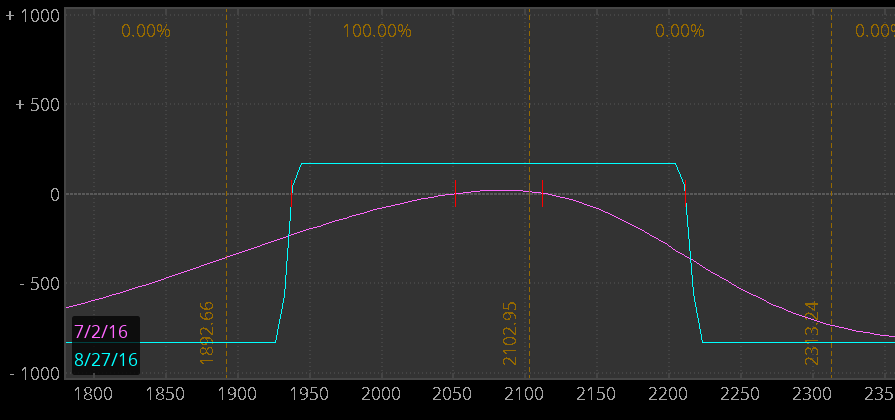

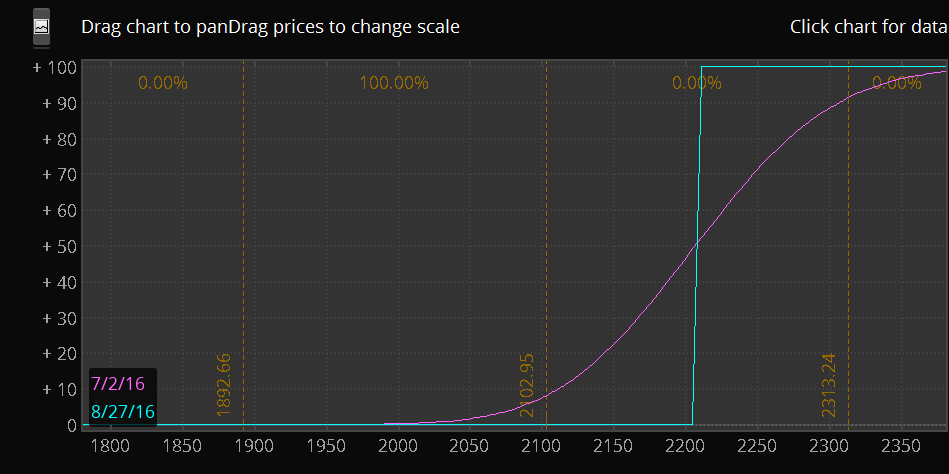

That will leave you with a chart looking like this:

Now I’m not a big fan of this because it shows your delta at opex… it really doesn’t matter here, because you know that at options expiration all out of the money options have a delta of 0 and all in the money options have a delta of 100.

So I’ll change the “+1 Expiration” menu to “+3 day step” with a 7 day interval. This will make sense in just a second.

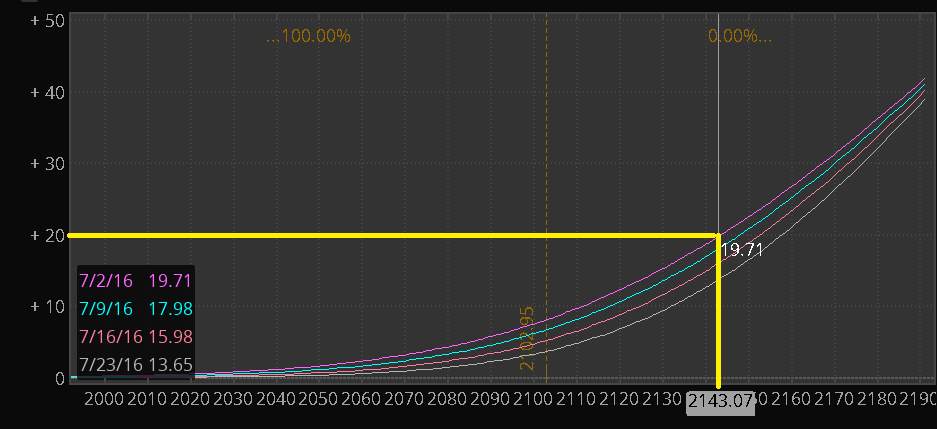

Now, to figure out where your delta hits 20, simply line up the graph…

So according to the option pricing analytics, this short option will hit a delta of 20 if the SPX runs to 2143.

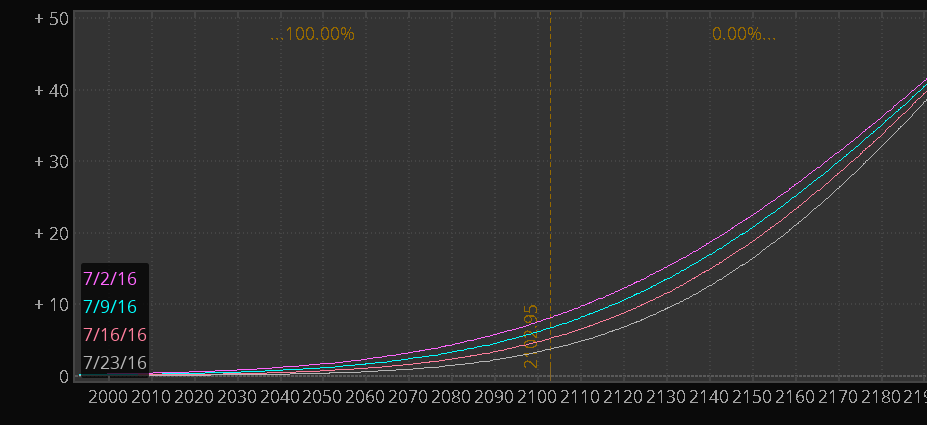

Now here’s where it gets interesting.

There are multiple lines on this graph. You can see that as time goes on, the delta curve shifts a little bit.

This is what is known as delta decay.

And it means as time goes on, it will require more price movement to hit a delta of 20. Every week, the adjustment point moves out about 5 points.