Home › Forums › Income Lab › SPX 24 MAR Iron Condor (481) › Reply To: SPX 24 MAR Iron Condor (481)

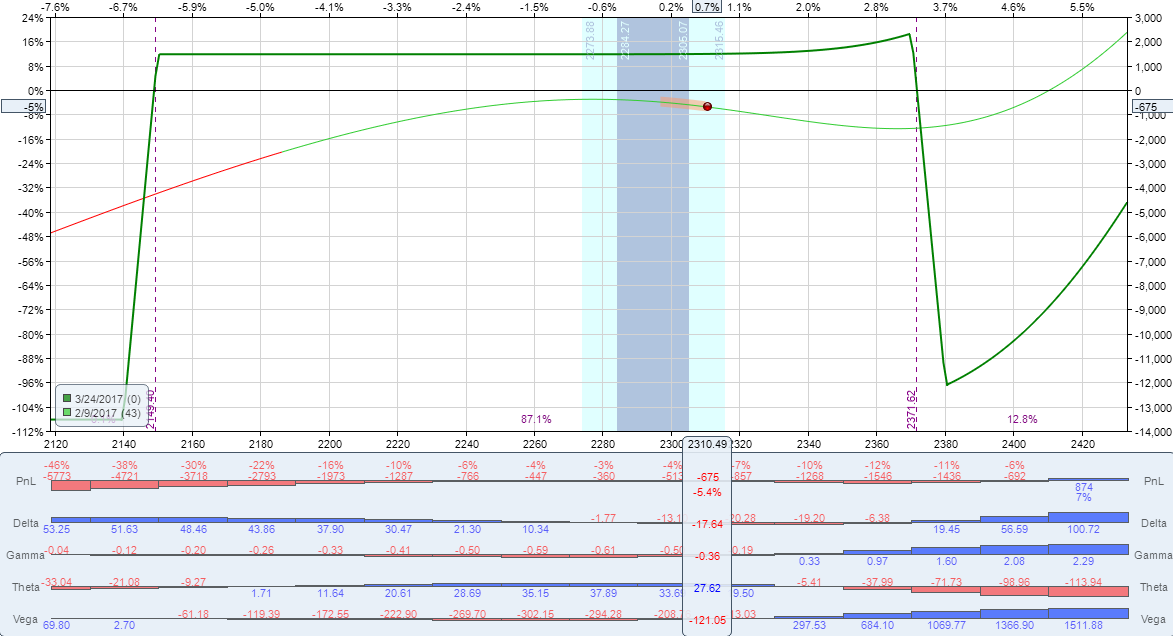

2370 Call has a delta around 18 with SPX trading at 2310. We usually make adjustments when our short call’s delta reaches 20. If SPX goes up another 15 points tomorrow then we will sure need to make an adjustment. We’re going to make this adjustment slightly early. Our NET delta of this Iron Condor is around -47. We need to buy options to reduce this number by 25. We’re going to BUY TO OPEN 3 (three) 7APR calls around 8-10 delta. This should reduce our NET delta from -47 to between -23 and -17.

Keep in mind, we’re adjusting a position of 15 contracts. Different size trades may need different strikes and/or number of options to reduce NET delta by 50%. If you have any questions about this adjustments stop by the chat and ask.

| IncomeLab Order Ticket | ||||

| Type | Asset | Duration | Strike | C/P |

|---|---|---|---|---|

| BTO | SPX | 7 APR 17 | 2410 | Call |

| Total Debit: | $3.30 | |||