Home › Forums › Income Lab › SPX 17 MAR Iron Condor (479) › Reply To: SPX 17 MAR Iron Condor (479)

February 14, 2017 at 2:20 pm

#7637

Participant

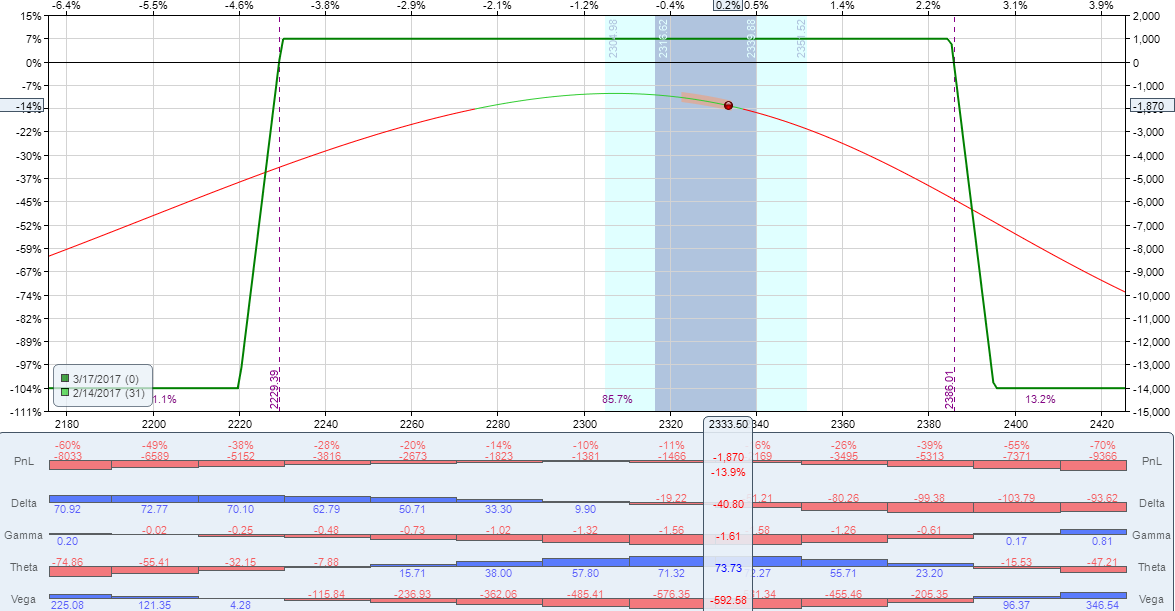

We’re going to roll up 2360/2370 Bear Call spread to 2385/2395. Because we have 2395 calls that we bought as a hedge, we dont need to buy as many calls as we’re going to sell 2385 calls. In our case, we have 15 2360/2370 Bear Call spreads and 2 2395 Calls. We’re going to BUY TO CLOSE 15 2360/2370 spreads and sell 15 2385 and buy 13 2395 calls. This will reduce our overall credit and give us a little more room to the upside. We’re going to hold this position no more than 2 days before expiration and we’ll use 1.5X initial credit as our stop level.

New P/L graph:

| IncomeLab Order Ticket | |||||

| Type | Size | Asset | Duration | Strike | C/P |

|---|---|---|---|---|---|

| BTC | Full Size | SPX | 17 MAR 17 | 2360 | Call |

| STC | Full Size | SPX | 17 MAR 17 | 2370 | Call |

| STO | Full Size | SPX | 17 MAR 17 | 2385 | Call |

| BTO | Full Size | SPX | 17 MAR 17 | 2395 | Call |

| Total Debit: | $1.50-$1.60 | ||||