Home › Forums › Income Lab › SPX 19 MAY Iron Condor (494) › Reply To: SPX 19 MAY Iron Condor (494)

That is a great question.

The reason we buy OTM options instead of ITM debit spreads is because we want to smooth out our P/L curve on the side where it is tested. Here’s an example of an adjustment we did to reduce delta but we also want to increase gamma.

https://trades.iwopremium.com/forums/topic/spx-7-apr-iron-condor/#post-7746

Now let’s compare the same adjustment (cutting NET delta in 1/2) using ITM spreads and OTM option.

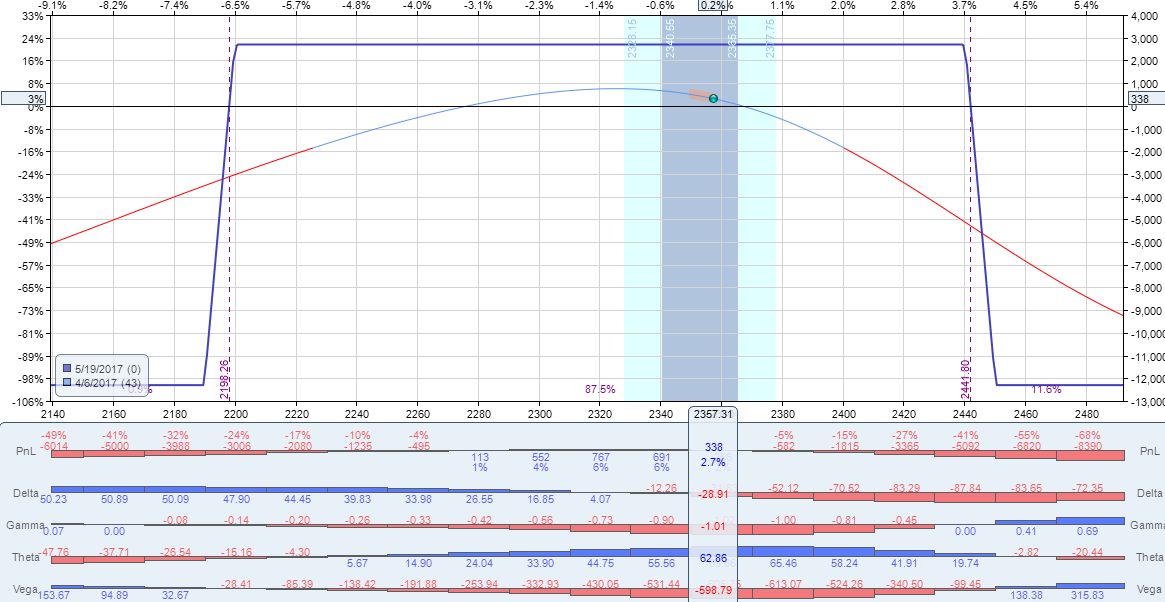

Before adjustment

Net delta is -28. To remove 1/2 of that NET delta we need to add 15 delta.

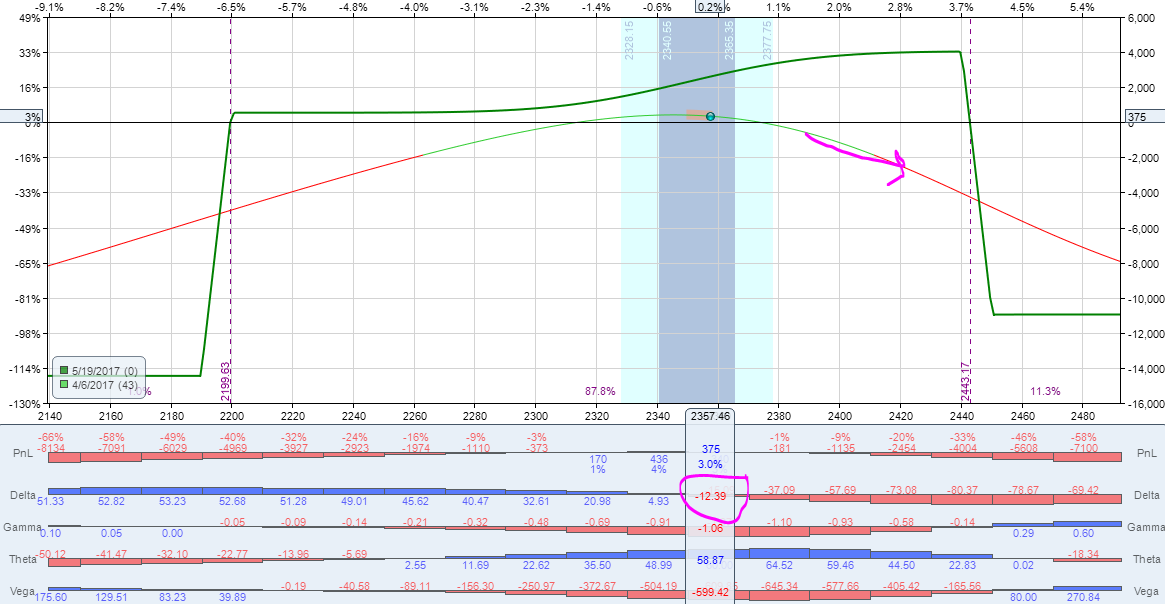

Adjustment 1. Buying 60 delta call (ITM) and selling 45 delta call.

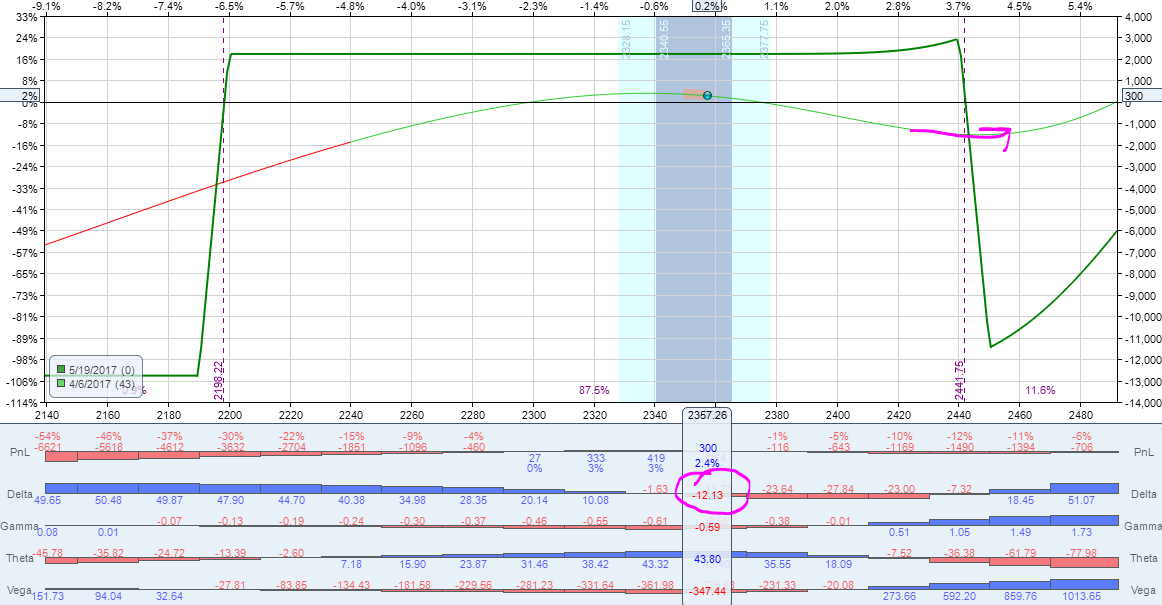

Adjustment 2. Buying TWO (2) seven delta calls.

As we can see, buying ITM spread will reduce NET delta BUT if the underlying makes a big move then our P/L curve is still pointing down and we can get stopped out before we get to roll up the tested call spread. Also, buying a call spread caps your potential upside and that may not be enough to reduce the cost of a roll. The most important part of this adjustment (buying OTM option) is to smooth out our P/L curve so that any further move against us will not blow out the trade and will give us time to make a further adjustment (roll the tested spread and sell the hedge).