Home › Forums › Income Lab › SPX 23JUN Iron Condor (529) › Reply To: SPX 23JUN Iron Condor (529)

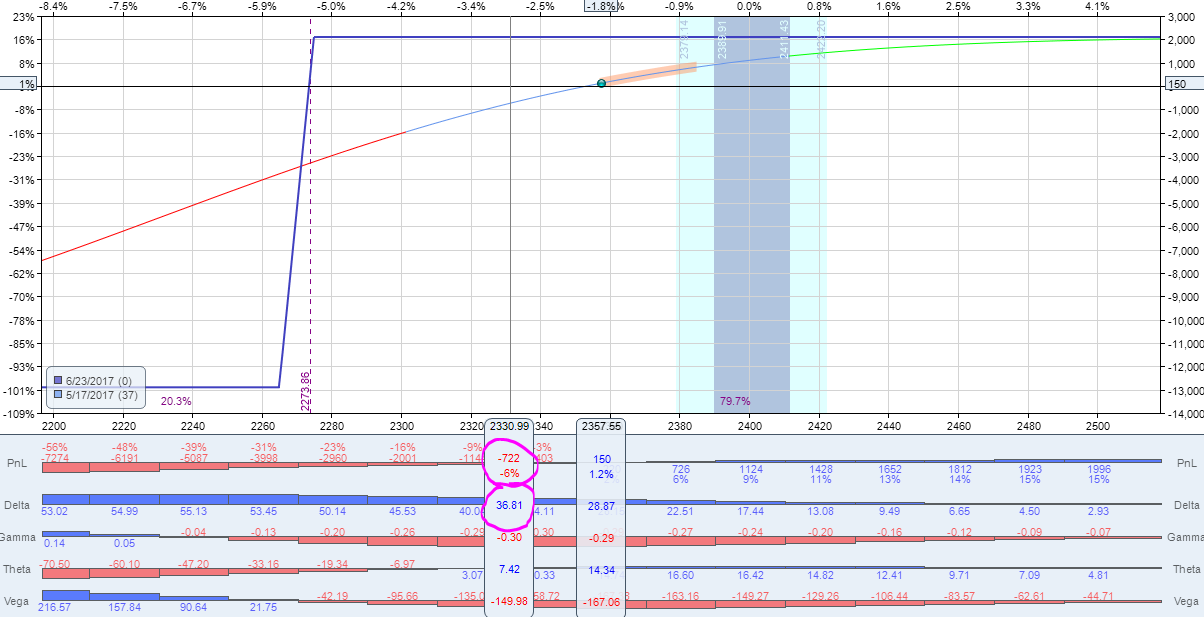

The first thing I did was BTC bear call spread when it was trading around .20-.30c. This spread wasn’t going to decay much more and my put side needed a potential adjustment. This is what this P/L graph looked like at end of the day

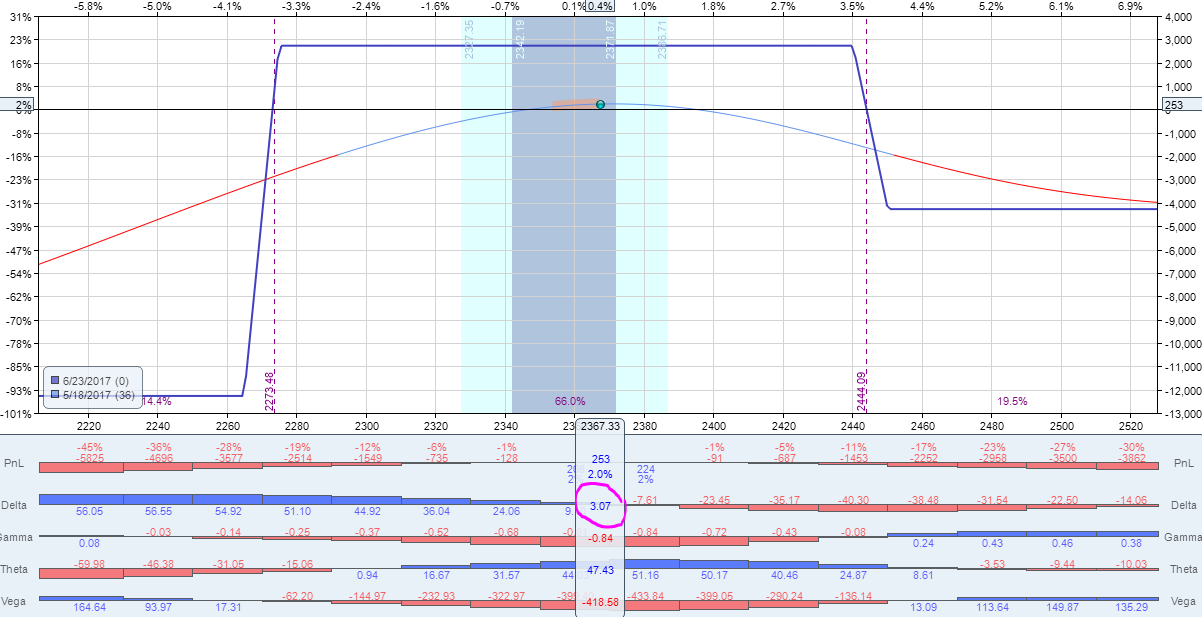

Obviously, I didn’t know if SPX was going to continue lower or bounce back. IF it did continue lower I’d have to buy OTM puts to reduce my NET delta which was around +29. I decided to sell another Bear Call spread, half size to reduce my NET delta exposure before buying puts to defend my Bull Put spread. By selling this call spread, IF SPX continued lower, I wouldn’t have to buy as many puts to defend my BPS because now my NET Delta was very slightly positive.

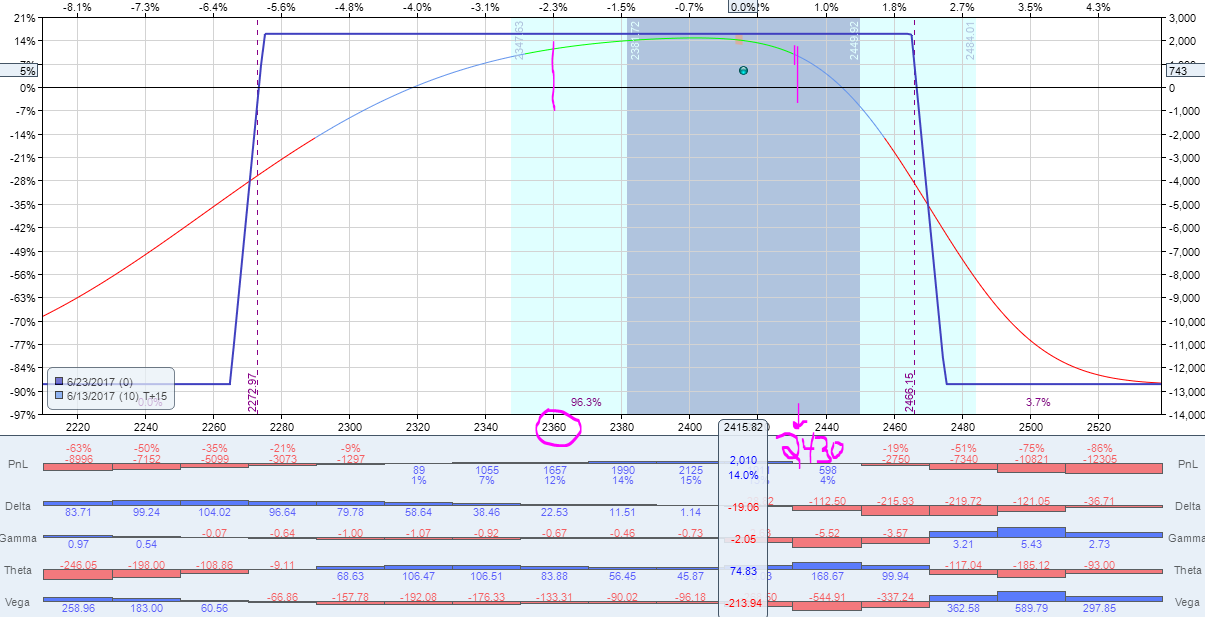

It was my intention to close this Bull Put spread and roll it up to a higher strike IF SPX was going to make a sharp reversal and trade higher. That is what I did on 5/25. Now, if SPX is between 2360 and 2430 over the next 15 days, I may be able to take this trade off for around 10% ROR.