Home › Forums › Income Lab › SPX 21 JUL Iron Condor (544) › Reply To: SPX 21 JUL Iron Condor (544)

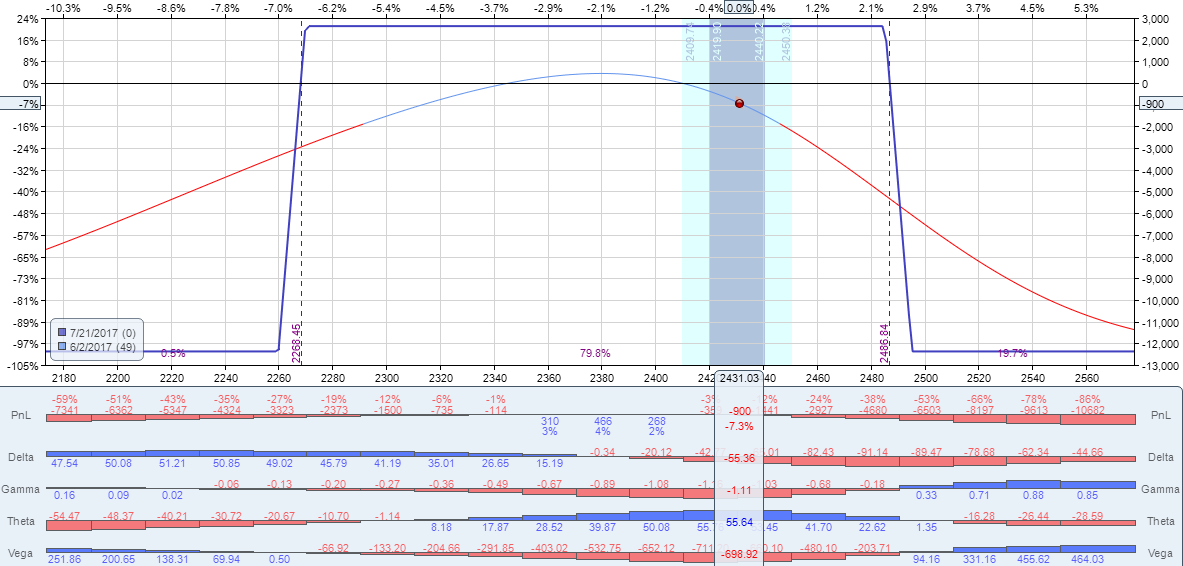

In my opinion, there isn’t a big difference between buying OTM options and buying back one of the short options of a bear call spread. This is what this IC looked like at the time when an adjustment needed to be made:

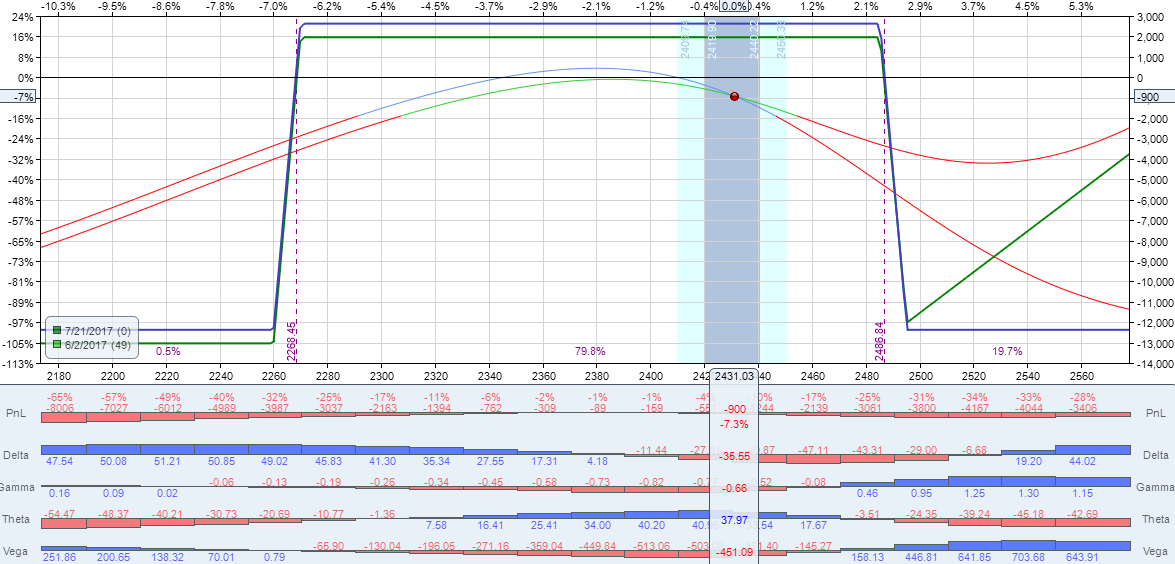

Buying back one of the short 2485s would look like this:

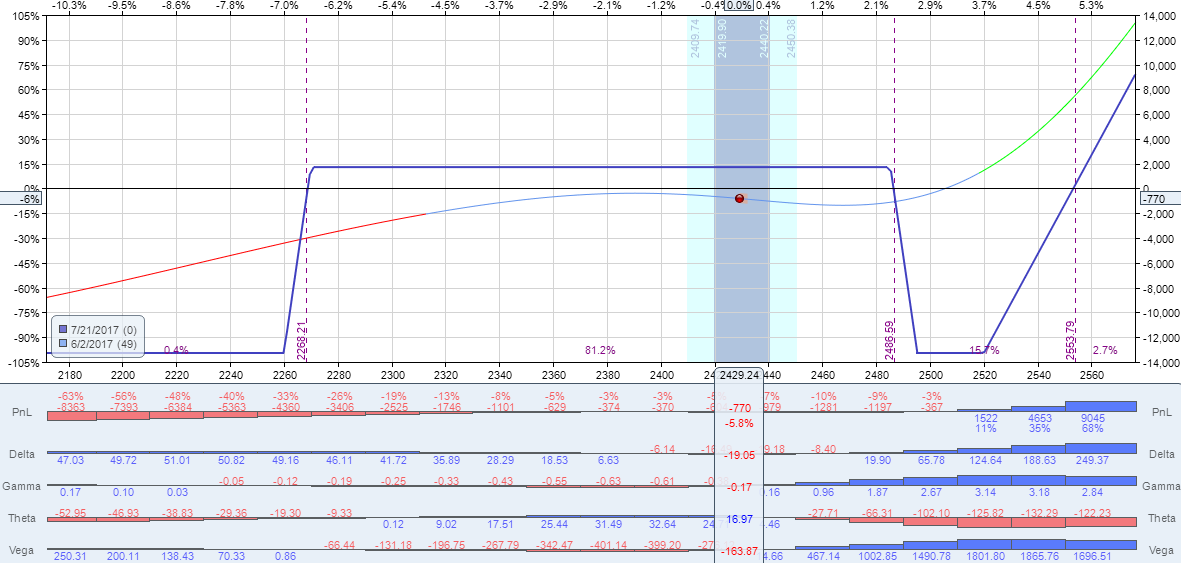

And buying several OTM calls would look like this:

This IC NET delta before adjustment was -55. I wanted to remove 2/3 or 60% of my NET exposure. 60% of 55 is 33, so I needed to add 33 deltas to this IC to lift my T+0 line. 2485 was a delta 20 at the time and buying back 1 call wouldn’t cut NET delta enough for me. I went with buying (4) 8 delta calls. I like to use OTM options to cut delta because if the underlying makes a sharp move higher those options will gain value quick (due to gamma) and those profits will help me offset the cost of rolling up the call spread that’s under pressure.