Home › Forums › Income Lab › SPX 21 JUL Iron Condor (544) › Reply To: SPX 21 JUL Iron Condor (544)

June 22, 2017 at 10:14 am

#8122

Participant

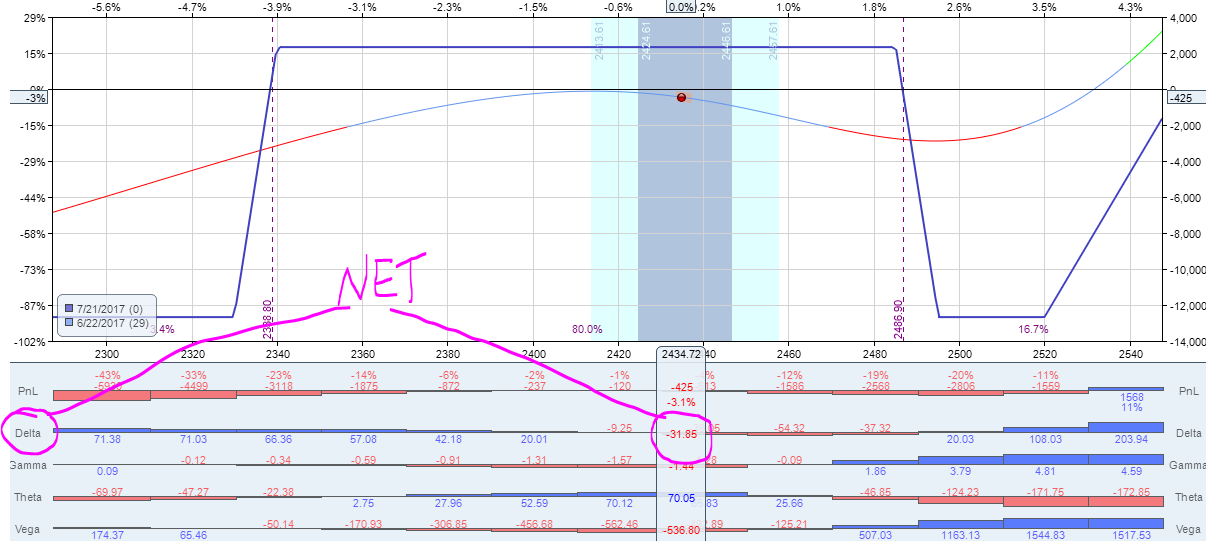

We’re going to cut our NET delta exposure again as original OTM call hedges lost some of its value and delta has decayed in those options. We’re going to look at our NET delta for all options of this trade and use 28JUL (36DTE) cycle to cut our NET delta by 50%.

This is what our current P/L graph looks like

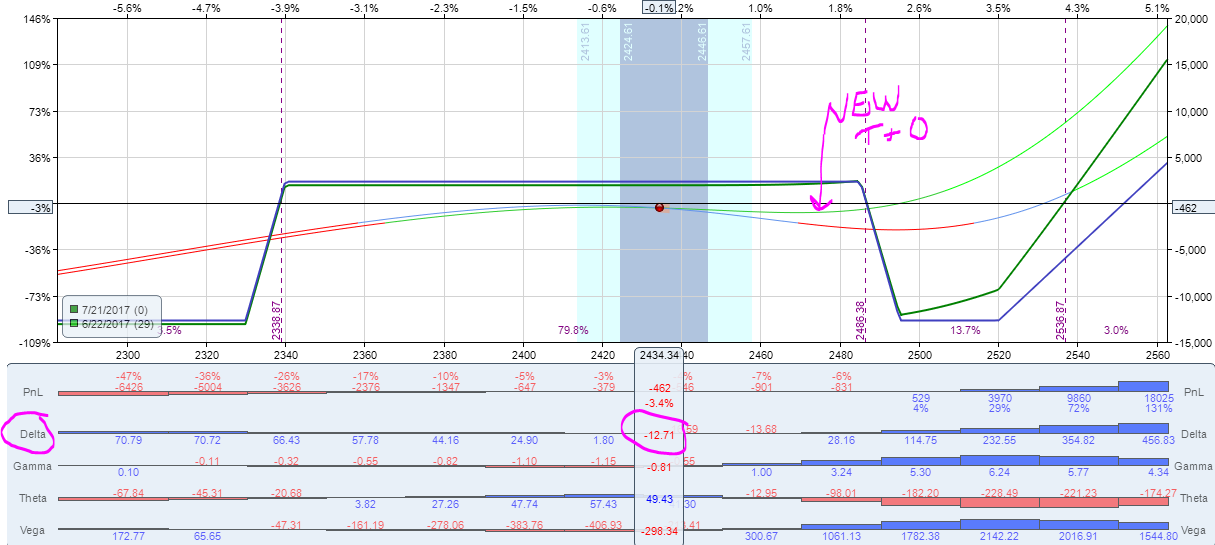

Our current NET delta is about -30. We’re going to pick up +15 delta by buying (2) 28JUL 2505 calls and this will reduce our NET delta from -30 to about -15 and will lift our T+0 line on the upside.

| IncomeLab Order Ticket | ||||

| Type | Asset | Duration | Strike | C/P |

|---|---|---|---|---|

| BTO | SPX | 28 JUL 17 | 2505 | Call |

| Total Debit: | $2.00 | |||