Home › Forums › Income Lab › SPX 31 AUG Iron Condor (586) › Reply To: SPX 31 AUG Iron Condor (586)

July 14, 2017 at 12:39 pm

#8245

Participant

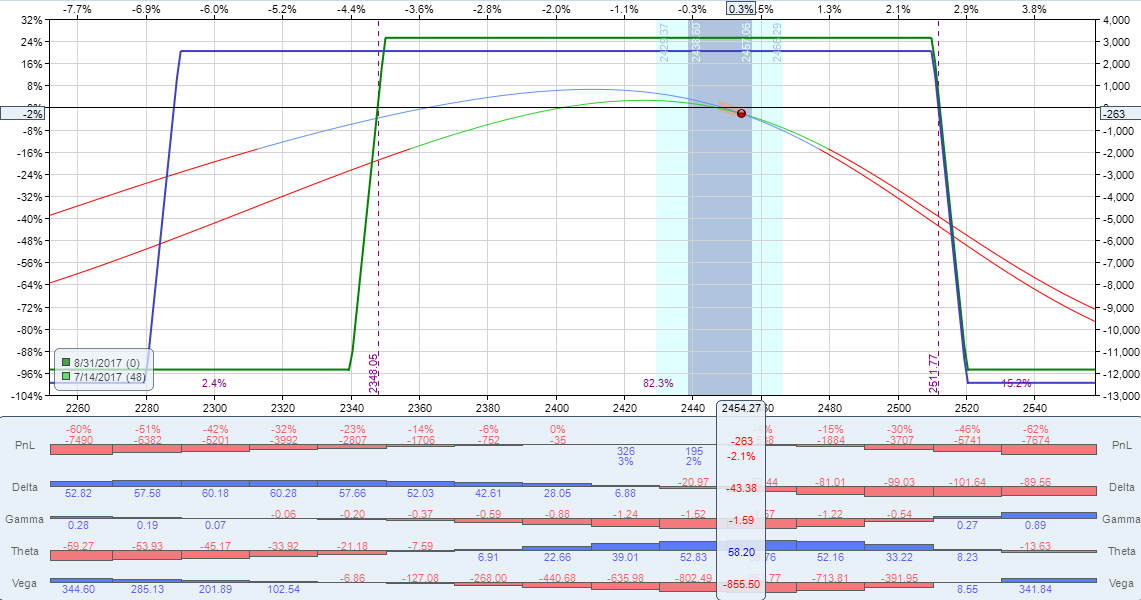

We’re going to roll up our put spread from 2290 to 2350 in 2 steps:

1. BUY TO CLOSE 2290/2280 BULL PUT SPREAD

| IncomeLab Order Ticket | ||||

| Type | Asset | Duration | Strike | C/P |

|---|---|---|---|---|

| BTC | SPX | 31 AUG 17 | 2290 | Put |

| STC | SPX | 31 AUG 17 | 2280 | Put |

| Total Debit: | $0.40 | |||

2. SELL TO OPEN 2350/2340 BULL PUT SPREAD

| IncomeLab Order Ticket | ||||

| Type | Asset | Duration | Strike | C/P |

|---|---|---|---|---|

| STO | SPX | 31 AUG 17 | 2350 | Put |

| BTO | SPX | 31 AUG 17 | 2340 | Put |

| Total Credit: | $0.80 | |||

Note: This adjustment does NOT fix the upside, but it brings in an additional credit that can be used to hedge the upside IF SPX breaks out above previous all time highs. Our plan is to use OTM options to hedge on the upside when short strike’s delta goes above 20 (currently about 16 or so).