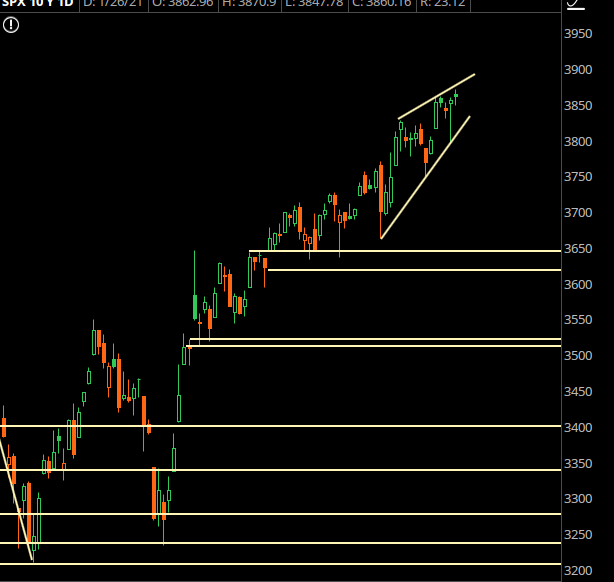

Above is a chart of the S&P 500. Hasn’t really done much… there was a rug pull on Monday that held, and it looks like we’re closing in on all time highs.

Pretty tame, right? Not so fast!

The S&P and the Nasdaq 100 are very “top heavy” with much of their returns being driven by AMZN, AAPL, MSFT, GOOGL, FB, and TSLA.

There’s other, wilder things going on underneath the surface…

GME is squeezing out all the shorts, and the stock traded up to 160 yesterday. It’s not just that, we’re seeing squeezes across the board in highly shorted names like PLUG, AMC, BLNK, and many others.

Most of these names are not within the universe of what we trade at Full Time Profits, but we must consider them when it comes to risk appetite.

This is a massive short squeeze in the risker parts of the market. When that happens I get a little nervous about how that will leak over into the indices once those positions start to unwind. It may not matter, but we have seen instances where parabolic spikes in risk assets eventually do bleed over into the broad markets.

As an aside, if you’re trading these names, understand that this is NOT a normal market, and I think if/when GME starts to unwind it will take many of these stocks down.

Ok what about the universe of stocks we normally look at? Well, many of them are coming hot into earnings season, espcially the mega cap tech stocks, and that absolutely will have a material effect on the markets.

We can make the case that earnings can be a “sell the news” event. AAPL has rallied a good amount and it’s very possible that perfection is being priced in, and I think we can use that to our advantage.

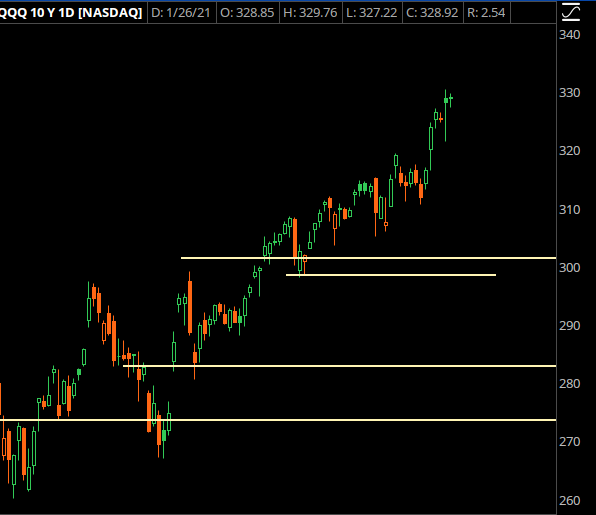

Trade #1: QQQ

The nasdaq has seen a strong rally over the past few days. AAPL and FB report earnings after the close on the 27th, and I think much of the upside has been priced in here, so I want to start a fade in the Q’s and scaling in, just in case I’m early.

Trade Setup

Expected Price: 328.81

Sell to Open QQQ 19Feb21 343/346 Call Spread

Tier 1: Enter at 0.67, Exit at 0.27

Tier 2: Enter at 0.938, Exit at 0.51

Tier 3: Enter at 1.206, Exit at 0.69

Stop Out If Close Over 343.11

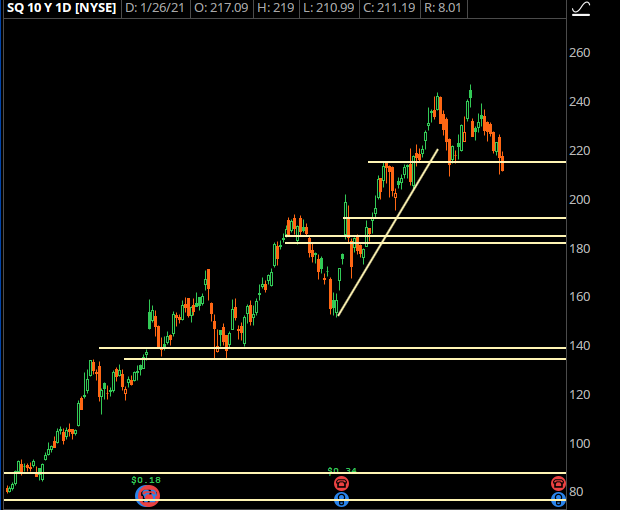

Trade #2: SQ

When I was going through my watchlist, I was surprised that SQ wasn’t jamming higher with everything else, and I think this gives us a good opportunity when capital starts to rotate back into some other names.

Earnings are on the 23rd of Feb, so we can use Feb options for this.

Trade Setup

Expected Price: 204.06

Sell to Open SQ 19Feb21 185/180 Put Spread

Tier 1: Enter at 1.13, Exit at 0.47

Tier 2: Enter at 1.582, Exit at 0.89

Tier 3: Enter at 2.034, Exit at 1.19

Stop Out If Close Under 184.89

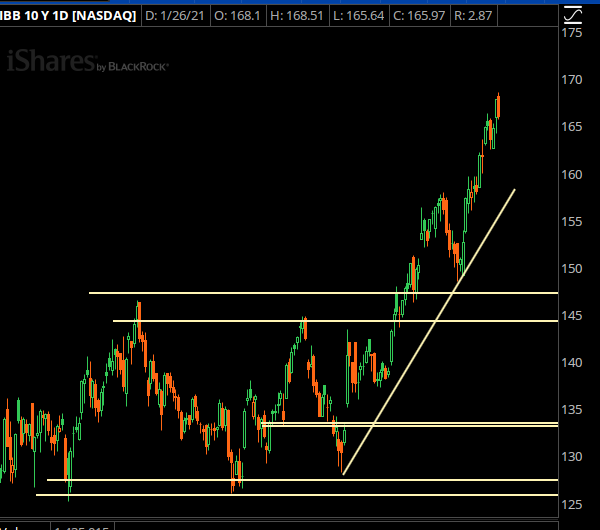

Trade #3: IBB

Looking for a normal pullback in IBB. I am looking for a decent push and am Ok if I miss out on a shallow dip.

Trade Setup

Expected Price: 158.35

Sell to Open IBB 19Feb21 152/149 Put Spread

Tier 1: Enter at 0.59, Exit at 0.18

Tier 2: Enter at 0.826, Exit at 0.38

Tier 3: Enter at 1.062, Exit at 0.51

Stop Out If Close Under 151.89