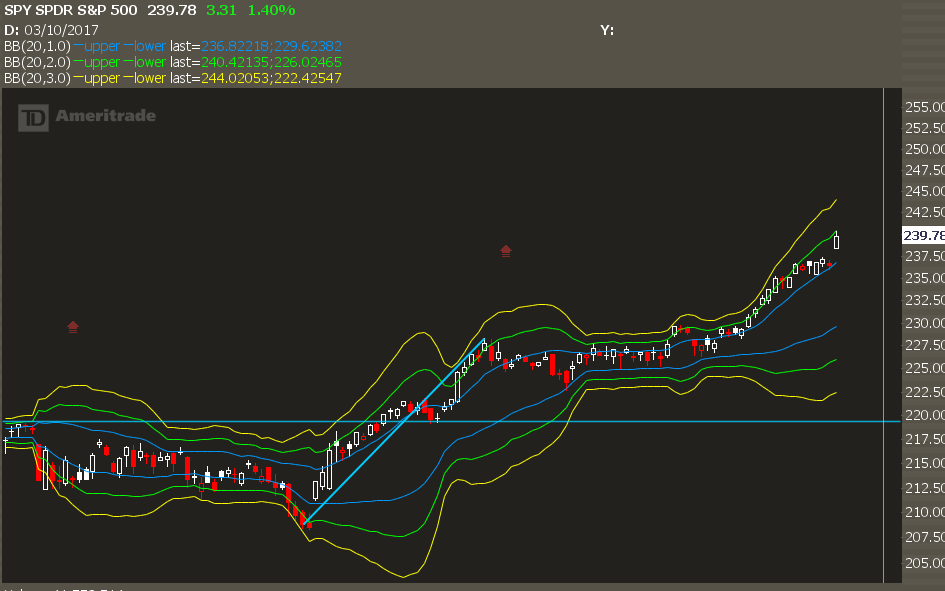

We can talk about streaks, and overbought levels, valuations, and all sorts of reasons why the market is due for a correction.

But when momentum takes hold of the market…

Sometimes…

The animal spirits simply take over. Sellers disappear and money on the sidelines has to be stuck somewhere.

Keep in mind, over the past few years we’ve seen net outflows out of stock etf and mutual funds. There was a slow unwind as the market went sideways.

So yeah, it’s not surprising that the market simply “bled higher.”

This most recent move, however, is the equivalent of an upside crash.

It’s not uncommon to have stocks rally over 1% in a day. And 1.4% in a day is not unheard of.

Yet, when we see violence to the upside it normally comes on the back of a market selloff.

It rarely happens as we jam into new highs.

A market like this isn’t due for an outright collapse anytime soon. Odds are the correction will be sideways and rotational in nature.

In the previous newsletter I talked about how the structure of the options market makes it incredibly difficult to sell credit spreads. That means don’t go crazy trying to short everything in the market… make sure you pick your spots well.

In fact, there are some instances where the strength of the market allows you to sell spreads simply for trend continuation purposes. Keep an eye out for those setups as well.

Trade #1: BA

The stock is up 13% in a month, and is currently 12% above its 50 day moving average. Both of these are statistically overbought signals. The momentum has been helped by news of an increased US defense budget along with some other things… but for a stock with this large of a market cap to run this much, a correction is expected.

Trade Setup

Expected Price: 185

Sell to Open BA Apr 195/200 Call Spread

Tier 1: Open at 0.75, Close at 0.25

Tier 2: Open at 1.05, Close at 0.75

Tier 3: Open at 1.35, Close at 1.05

Trade #2: BIDU

The stock got hit pretty hard on earnings, and found support at 172.50. I don’t expect that level to hold, and for it to break underneath that level and trade sub 170. Into that downmove, especially if it comes swiftly, we will be able to take advantage of oversold levels and start to sell some spreads against it.

Trade Setup

Expected price: 168

Sell to Open BIDU Apr 155/150 Put Spread

Tier 1: Open at 0.55, Close at 0.15

Tier 2: Open at 0.85, Close at 0.55

Tier 3: Open at 1.05, Close at 0.85