If you’re wondering how the market is doing, you first have to ask… “which market?”

Energy and financial stocks are on an absolute tear, and tech names have are bruised and broken. It’s a rotational correction.

It all ties back into the recent move in rates and the expectations of reflation across the board. When rates are up, it helps banks. When commodities run, it helps energy and materials names.

This all feels a little “late stage” in terms of the business cycle, but it could just be some more reversion from 2020.

The next question you’re wondering if this pullback is “it” for tech stocks. There’s no clear answer, and for us it doesn’t matter too much as we can embrace the volatility with the Proactive method. Scale in and scale out!

Due to the volatility, there are times where you can enter a trade, exit for a profit, and have the ability to reenter for a similar price. That’s what I will be doing– trading a little more aggressively to take advantage of the elevated vol (both actual and implied) for some nice profits.

The theme today is “heartbreak.” We want to look at some high beta stocks that appeared as though they bottomed on Friday, but may see one more stop run into levels.

If the market is still feeling too risky for you, then you can just take the approach we use and transfer it into sector bets– QQQ, TAN, ARKK, and XBI are good traders for this.

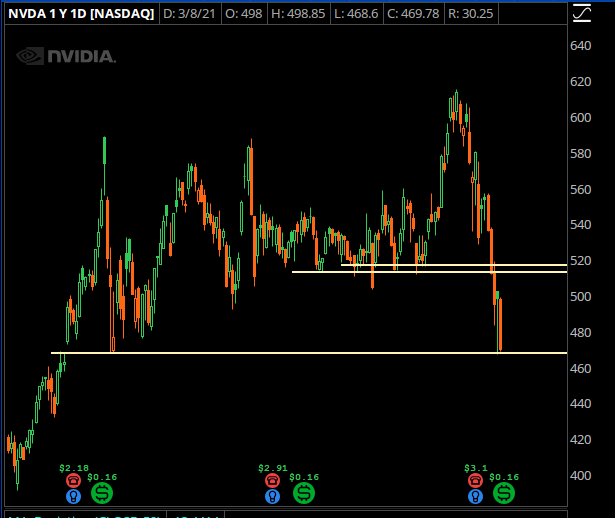

Trade #1: NVDA

There were a ton of chasers into the breakout above 600, and they’re all underwater and in the process of getting stopped out. Semiconductors as a whole haven’t traded very well, eyt this is within the context of the sector running 150% off the lows from March.

There’s a gap fill just above 460 that I want to play. It will look like an “obvious” breakdown, but that’s what the move from 520->470 was, and we’re close to a strong bounce in the stock.

Trade Setup

Expected Price: 462.61

Sell to Open NVDA 16Apr21 410/405 Put Spread

Tier 1: Enter at 0.98, Exit at 0.29

Tier 2: Enter at 1.372, Exit at 0.64

Tier 3: Enter at 1.764, Exit at 0.85

Stop Out If Close Under 409.89

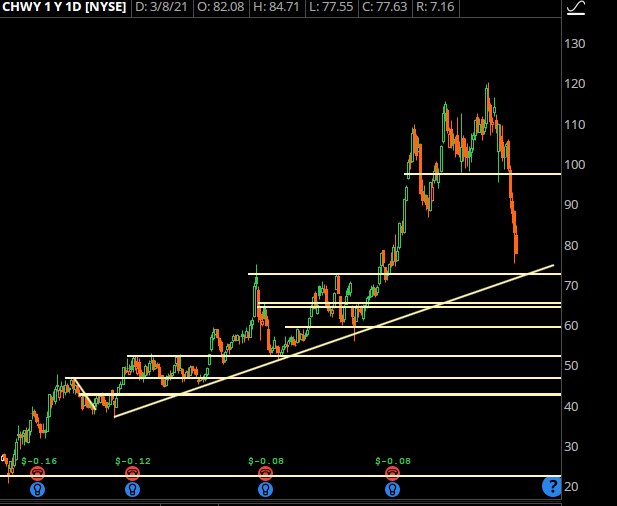

Trade #2: CHWY

One of my favorite traders– the stock had a solid breakout from 70 and ran to 110, only to round trip it. We’re now coming back to the lower end of the trading range, and I think this is a good place to start putting on some risk.

Trade Setup

Expected Price: 77.36

Sell to Open CHWY 16Apr21 65/60 Put Spread

Tier 1: Enter at 1.05, Exit at 0.37

Tier 2: Enter at 1.47, Exit at 0.76

Tier 3: Enter at 1.89, Exit at 1.01

Stop Out If Close Under 64.89

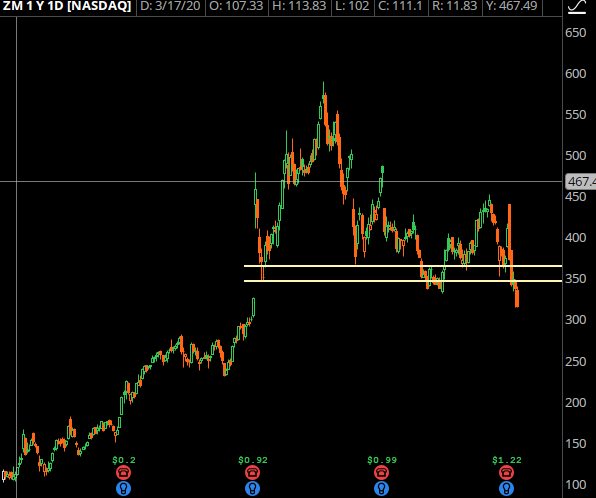

Trade #3: ZM

Another momentum darling that has been taken out. It’s attempting to fill the earnings gap from last quarter, and I think there’s one more push into 300 that should crack as whole number stops are taken out. Into that, I want to fade it.

Trade Setup

Expected Price: 295.06

Sell to Open ZM 16Apr21 270/260 Put Spread

Tier 1: Enter at 2.95, Exit at 1.75

Tier 2: Enter at 4.13, Exit at 2.95

Tier 3: Enter at 5.31, Exit at 3.99

Stop Out If Close Under 269.89