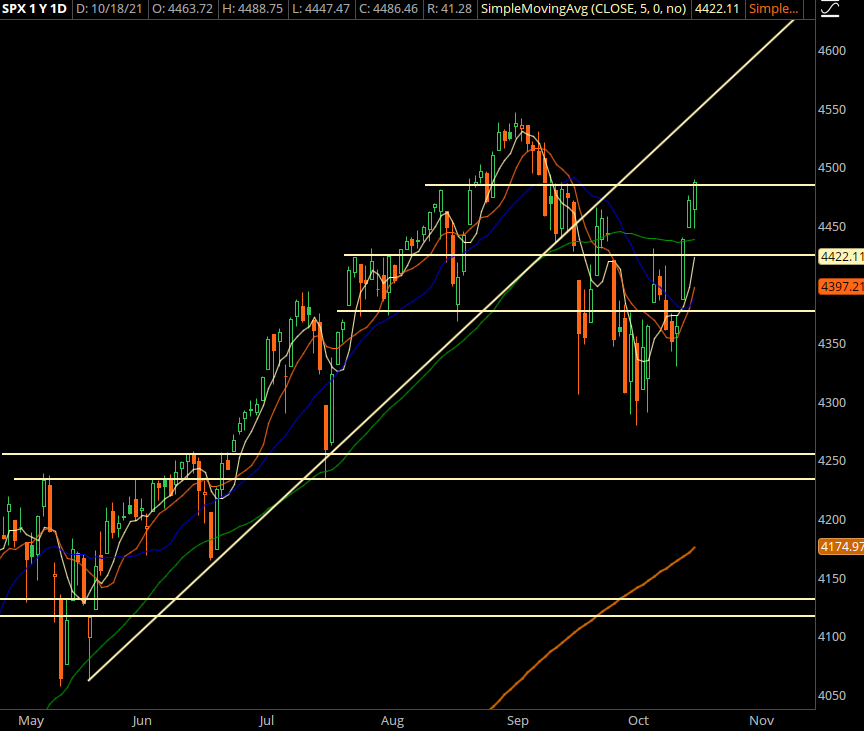

Large cap is seeing a squeeze over the past few days. It’s a combination of large cap tech being oversold, option dealer adjustments, way too many people selling calls, and a lack of “new” news coming out over the weekend.

Don’t let where we sit discount the past two months’ price action– it has been a hot mess. And odds are, it will continue to be. Headlines aside, this is a very choppy market with high volatility, and for markets to “normalize” to lower vol… well, it takes time for that process to work out. That doesn’t make me super bearish, just neutral.

This time is very tricky for us. The markets have ripped so there aren’t quality pullback plays available right now. On top of that, we’re headed hot into earnings season, which takes a lot of names out of play until after their earnings events.

We’ll focus on a few names where we can plan for pullbacks, where those pullback could hit post-earnings.

Trade #1: HD

Looking for a pullback to the previous breakout level… will use the most recent gap fill as the first tier for entry.

This does have earnings risk involved.

Trade Setup

Expected Price: 343.82

Sell to Open HD 17Dec21 320/315 Put Spread

Tier 1: Enter at 0.82, Exit at 0.1

Tier 2: Enter at 1.148, Exit at 0.36

Tier 3: Enter at 1.476, Exit at 0.48

Stop Out If Close Under 319.89

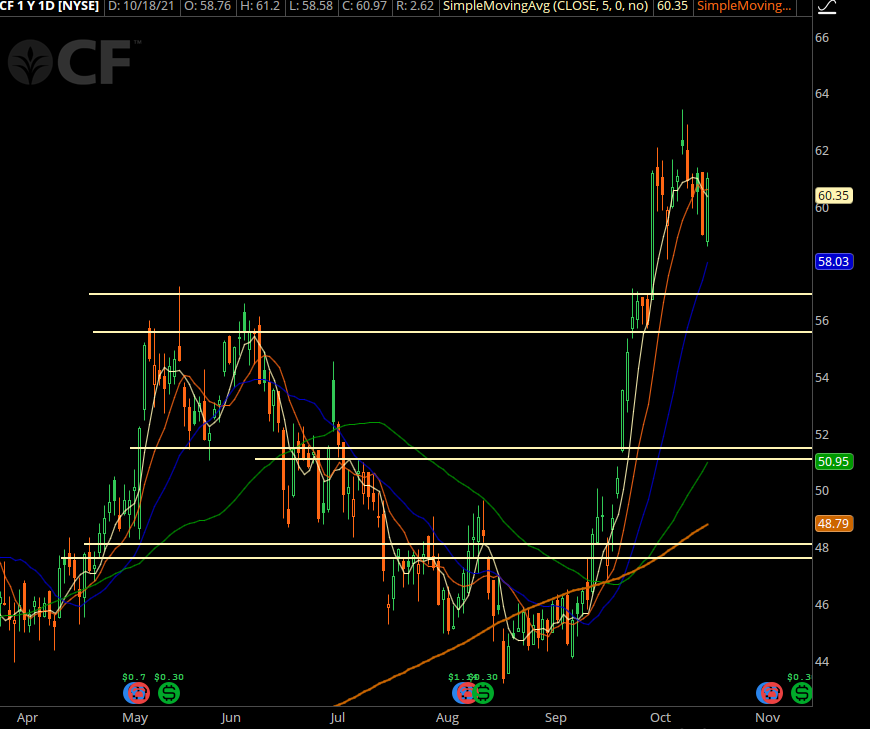

Trade #2: CF

Another solid breakout. If we get a pullback it will be a great entry, but odds are this sucker shoots to $70 before we get an entry. But if we do, we want to be prepared.

Trade Setup

Expected Price: 55

Sell to Open CF 17Dec21 52.5/50 Put Spread

Tier 1: Enter at 0.7, Exit at 0.39

Tier 2: Enter at 0.98, Exit at 0.67

Tier 3: Enter at 1.26, Exit at 0.91

Stop Out If Close Under 52.39

Trade #3: XLNX

Great breakout in this semi stock. I’m looking for a retest of the breakout area.

Now if earnings comes out and this stock gaps down to 120, then this is a no-trade. But if we see a vanilla pullback through or after its earnings event, then we’ll look to play it.

Trade Setup

Expected Price: 160.86

Sell to Open XLNX 17Dec21 140/135 Put Spread

Tier 1: Enter at 1, Exit at 0.32

Tier 2: Enter at 1.4, Exit at 0.68

Tier 3: Enter at 1.8, Exit at 0.9

Stop Out If Close Under 139.89