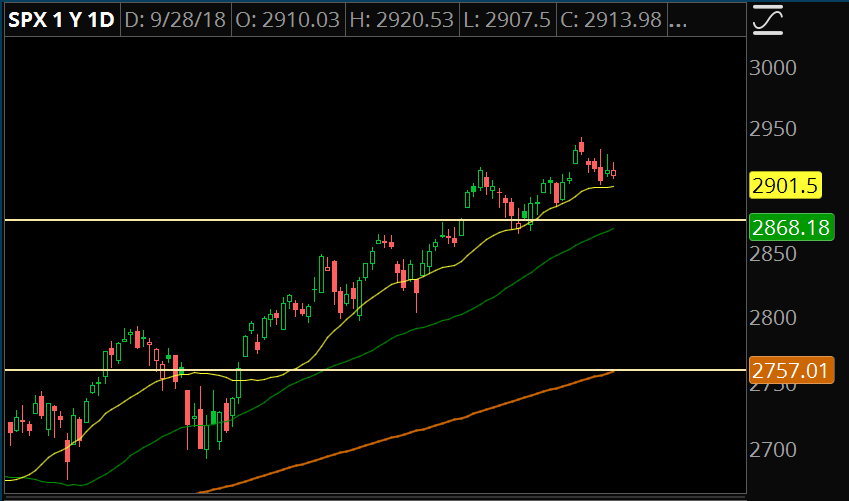

Markets still showing no sign of aggressive weakness. Right now it just feels like light selling and not much action as we head into earnings season. My bullish line in the sand sits at 2870 which coincides with the rising 50 day moving average. Any fast move under that and we’ll be due for a deeper correction.

The longer we hold above 2870 the higher the odds of trend continuation.

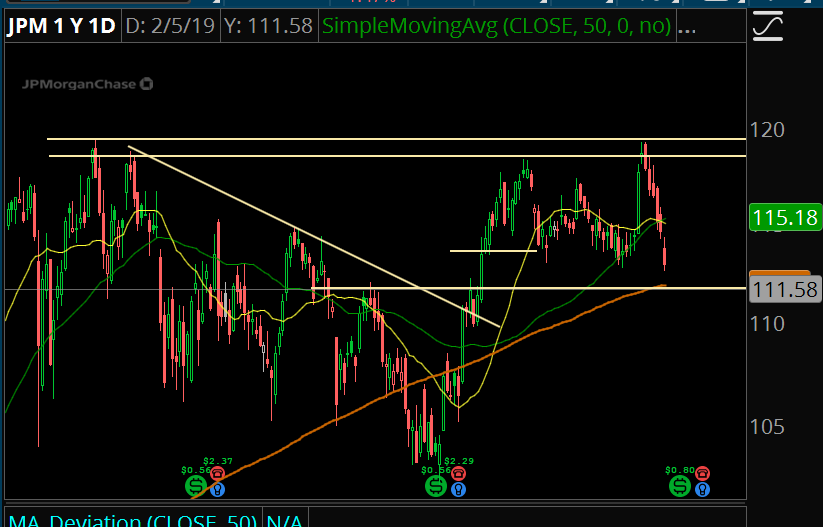

Trade #1: JPM

Updating the trade setup from September 13th. Nasty failed breakout in most large cap financials, and I think JPM is still the best in the group from a technical basis. I’m looking for support to come into play at the rising 200 day moving average.

Trade Setup

Expected Price: 111.80

Sell to Open JPM Nov 105/100 Put Spread

Tier 1: Enter at 0.65, Exit at 0.15

Tier 2: Enter at 0.95, Exit at 0.45

Tier 3: Enter at 1.25, Exit at 0.75

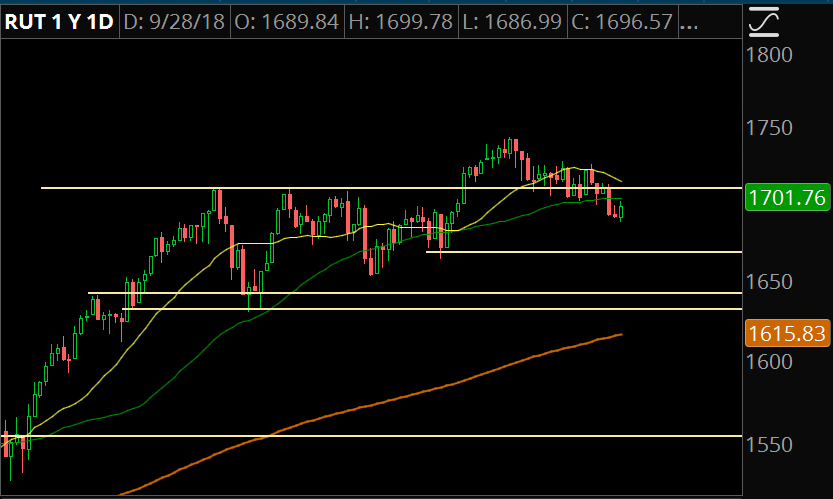

Trade #2: RUT

RUT has failed to breakout. When we see failed breakouts, there is often a swift move to the previous pivot level or the lower end of the range. I’m targeting the Aug 15th lows as a dip buy opportunity.

Trade Setup

Expected Price: 1666

Modeling the prices on this one is a little off as I’m doing it during the market close. Make sure to use best prices available when the market comes into this level.

Sell to Open RUT Nov 1610/1605 Put Spread

Tier 1: Enter at 0.80, Exit at 0.30

Tier 2: Enter at 1.10, Exit at 0.60

Tier 3: Enter at 1.40, Exit at 0.90

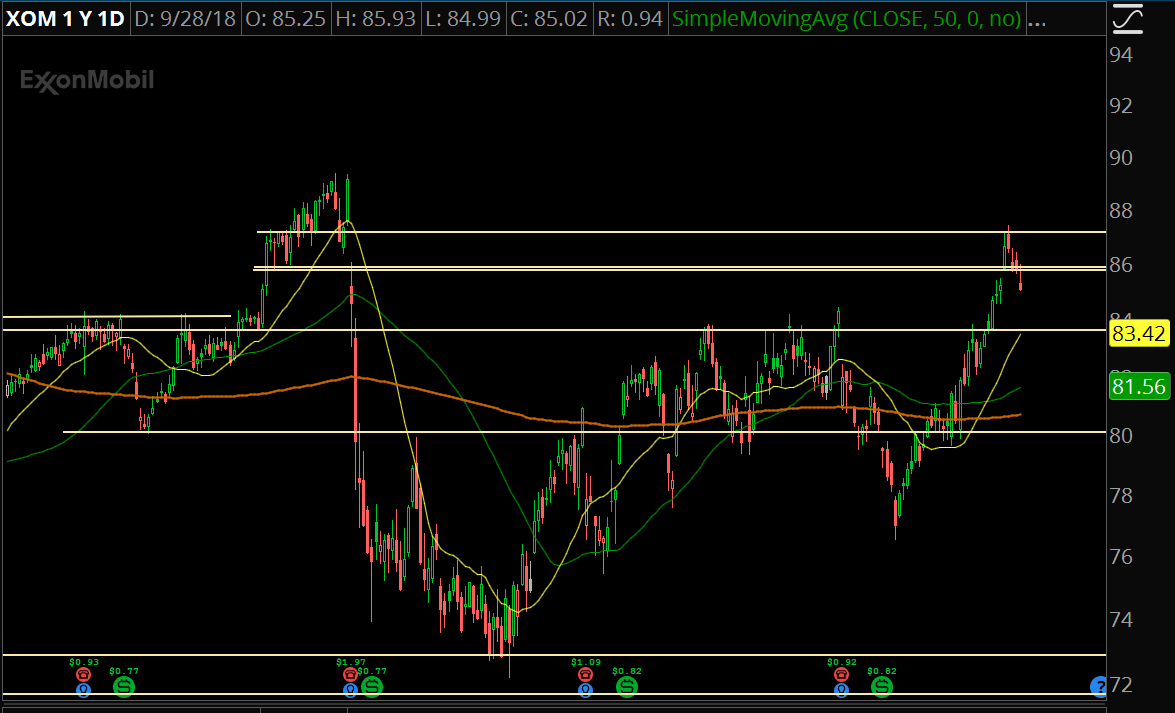

Trade #3: XOM

XOM is seeing a sharp pullback after a non-stop rally higher. I’m looking for a test of the previous range highs, which coincides with a rising 20 day moving average.

Trade Setup

Expected Price: 84

Sell to Open XOM Nov 80/77.50 Put Spread

Tier 1: Enter at 0.38, Exit at 0.13

Tier 2: Enter at 0.53, Exit at 0.28

Tier 3: Enter at 0.68, Exit at 0.43