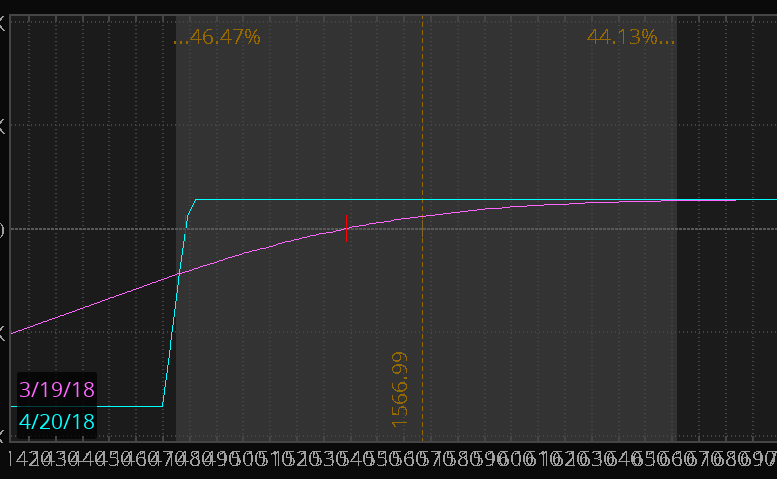

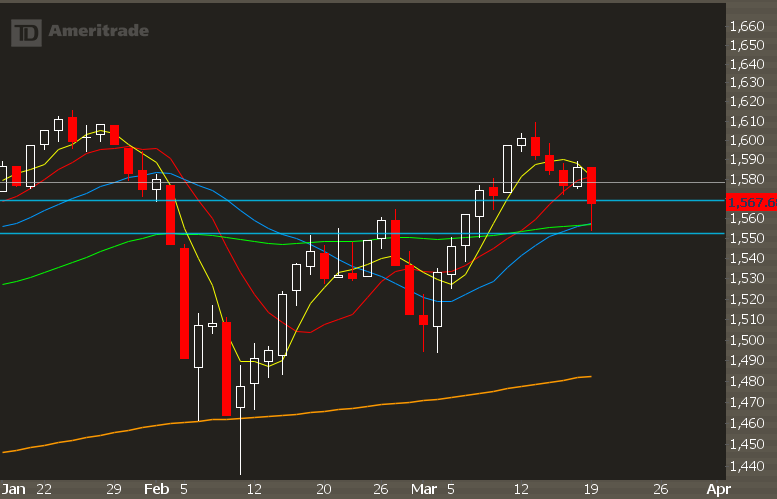

Update: March 19th, 2018

Closing out the call spreads.

Update: March 19th, 2018

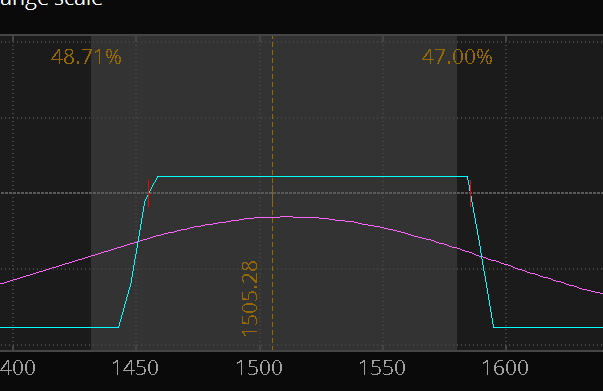

Rolling the put spreads lower and adding bear call spreads.

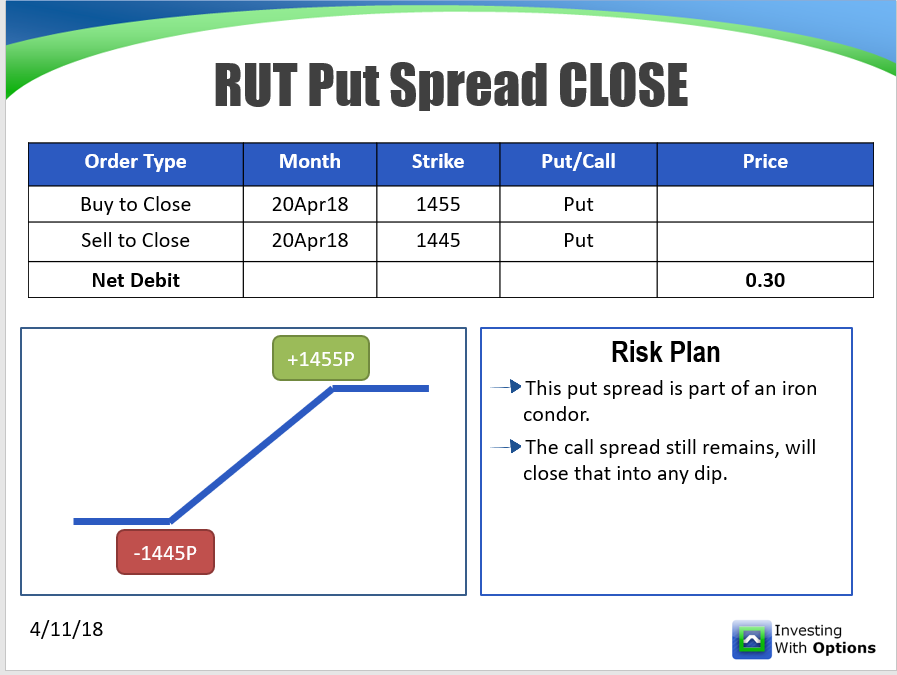

Update: April 11th, 2018

Closing out the put spreads.

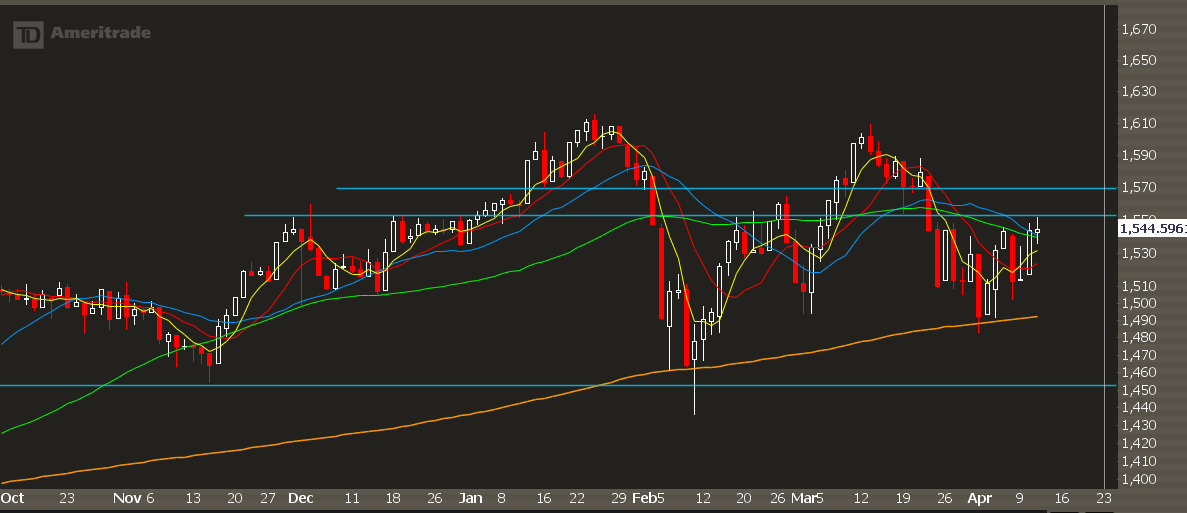

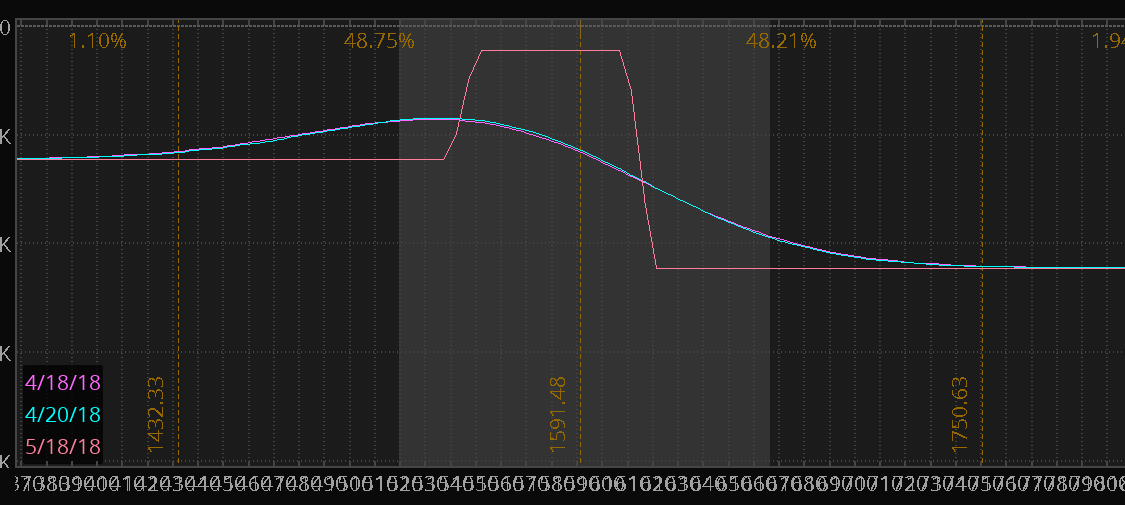

Update: April 18th, 2018

Rolling up and out and adding new put spreads.

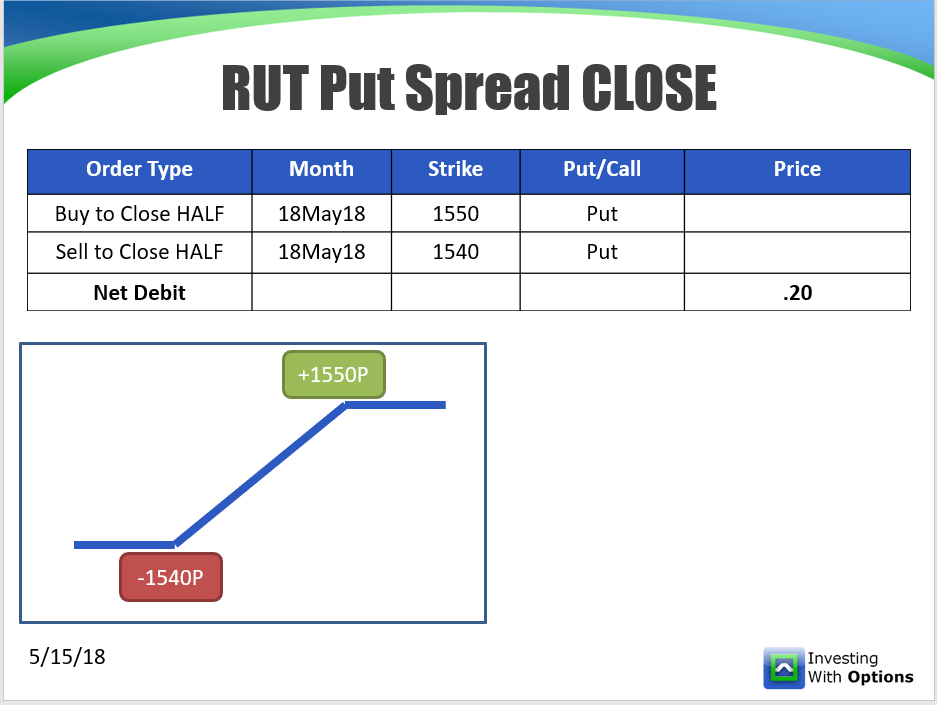

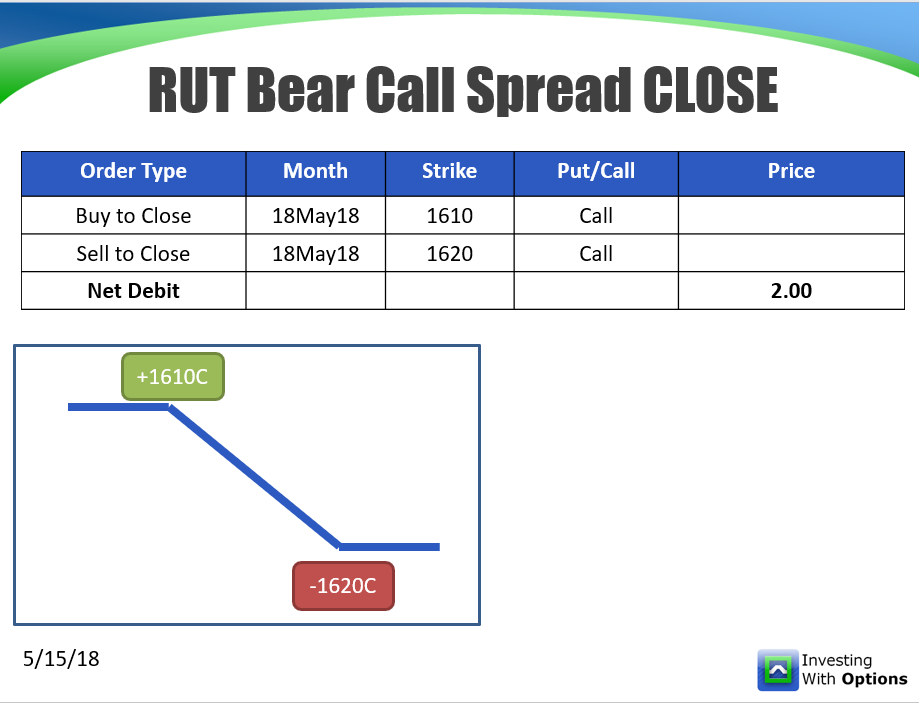

Update: May 15th, 2018

Closing out the rest of the iron condor.

Margin and P/L Calculations

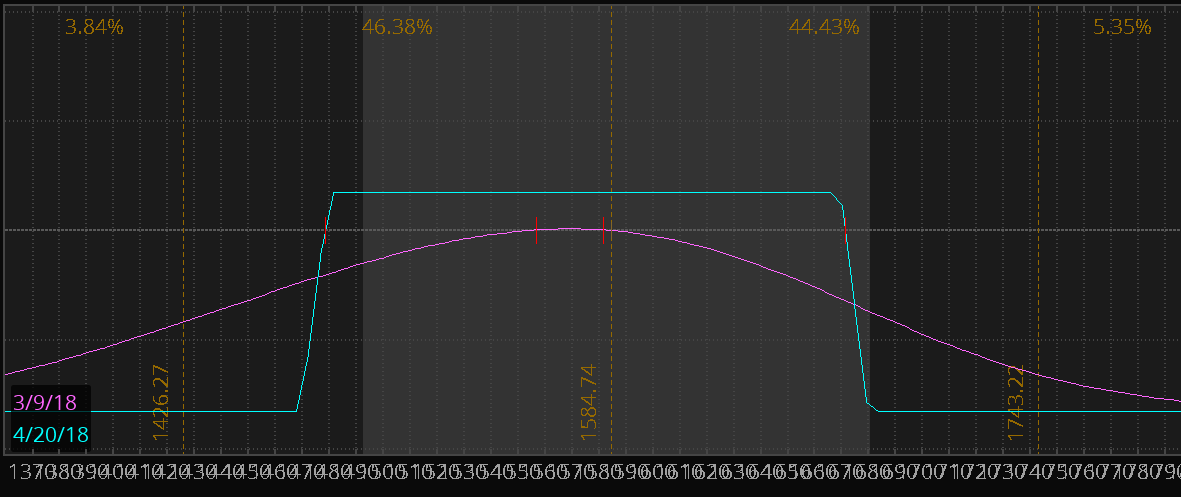

Trade #1

Sell to Open 1470/1480 Put Spread

Sell to Open 1670/1680 Call Spread

Credit 1.70

Max Credit: 1700

Max Risk: 8300

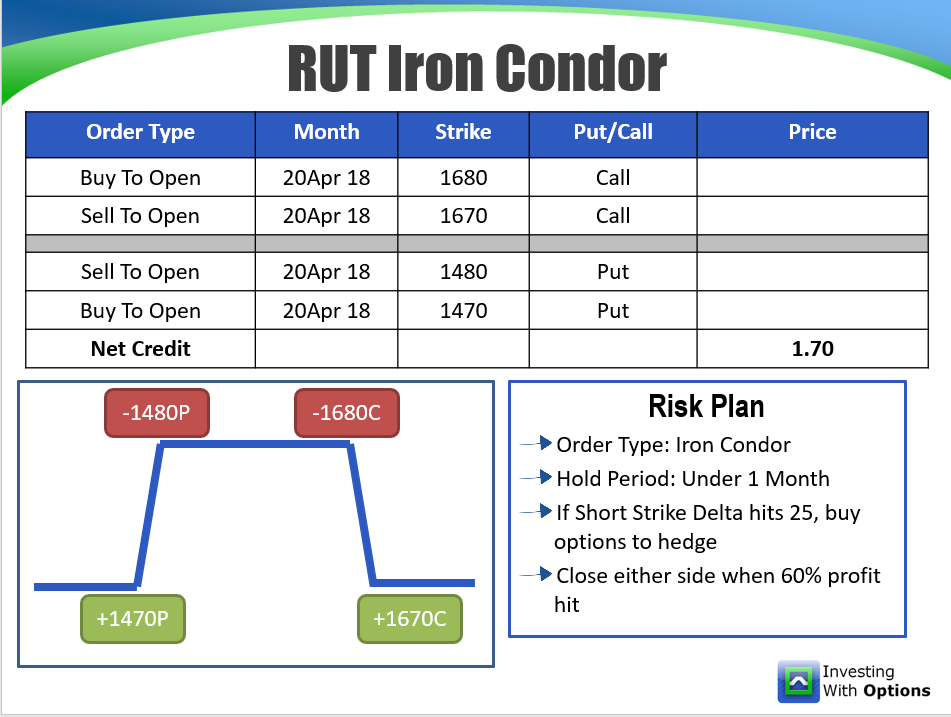

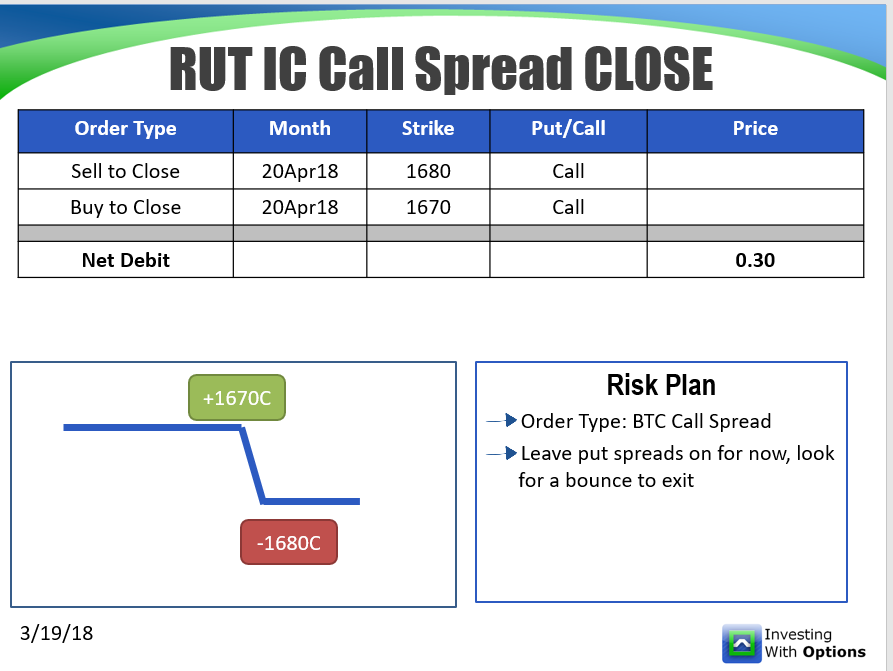

Trade #2

Buy to Close Apr 1670/1680 Call Spread

Debit 0.30

Max Credit: 1400

Max Risk: 8600

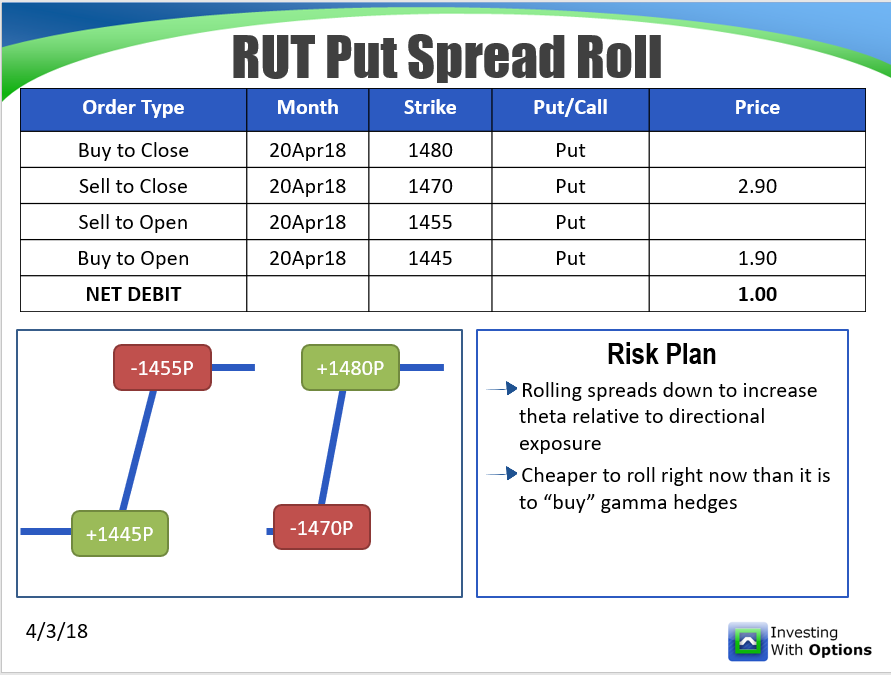

Trade #3

Roll Put Spreads Down to 1455/1445

Debit: 1.00

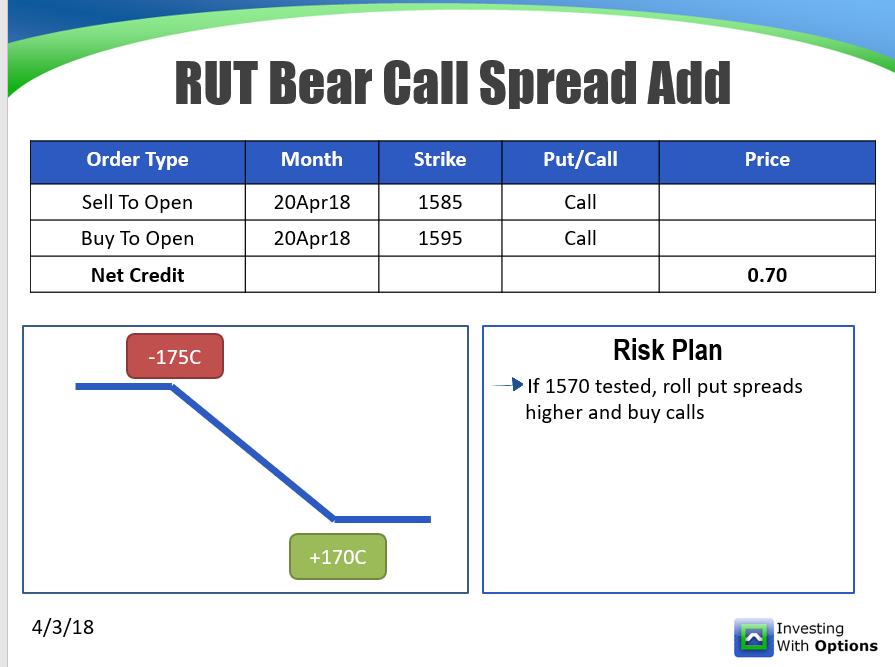

Sell Apr 1585/1595 Call Spread

Credit: 0.70

Max Credit: 1100

Max Risk: 8900

Trade #4

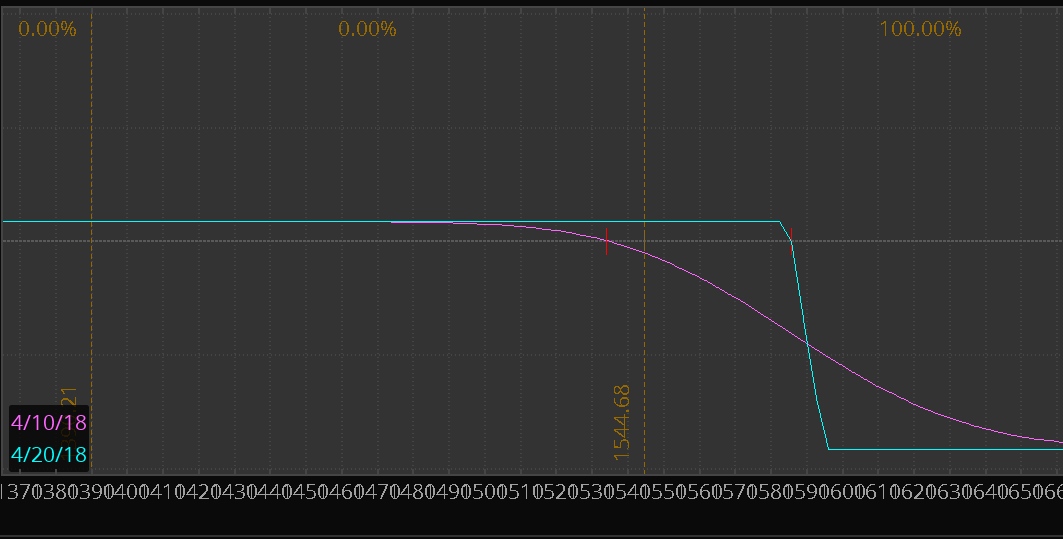

Buy to Close Apr 1455/1445 Put Spread

Debit: 0.30

Max Credit: 800

Max Risk: 9200

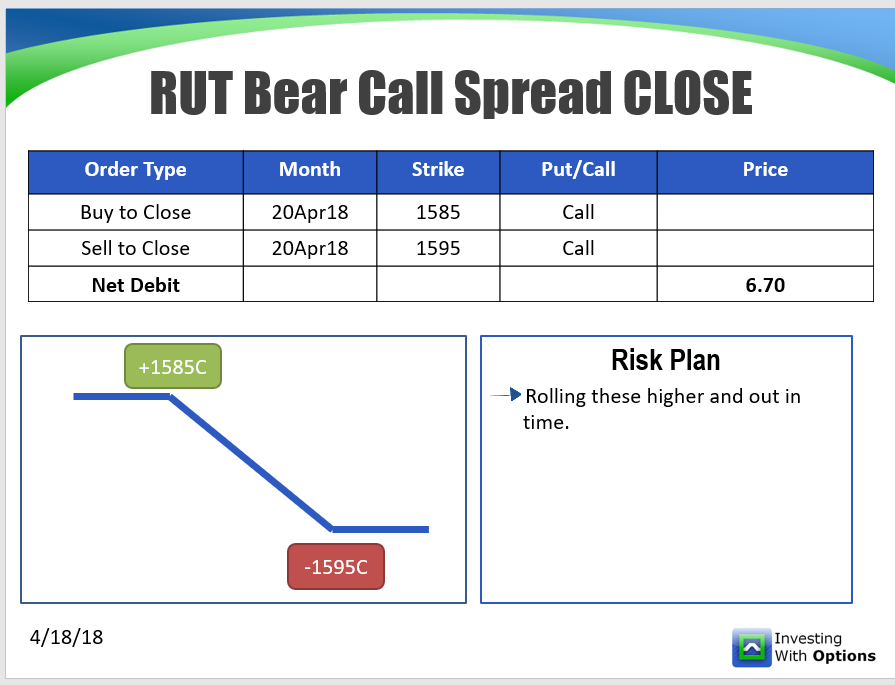

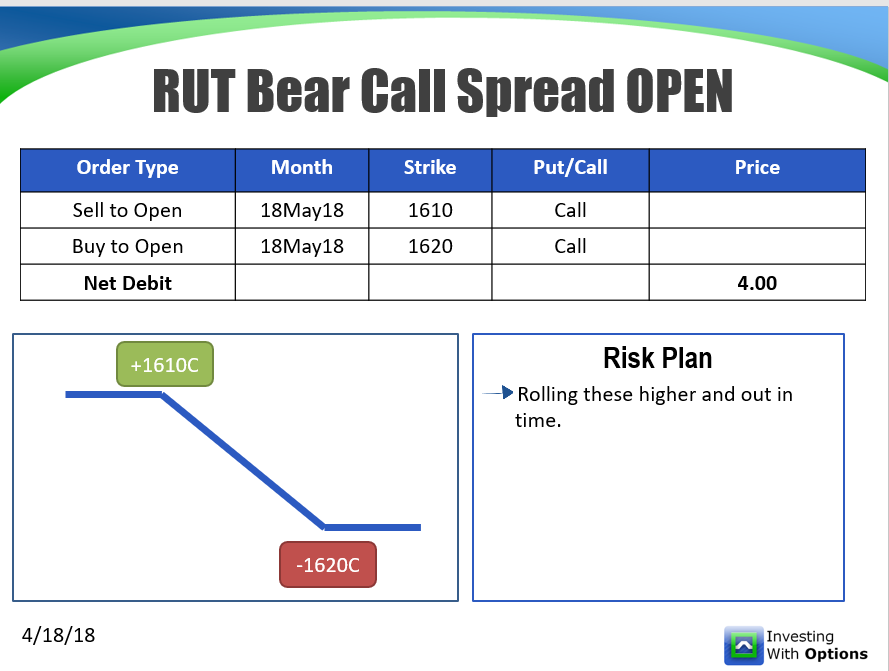

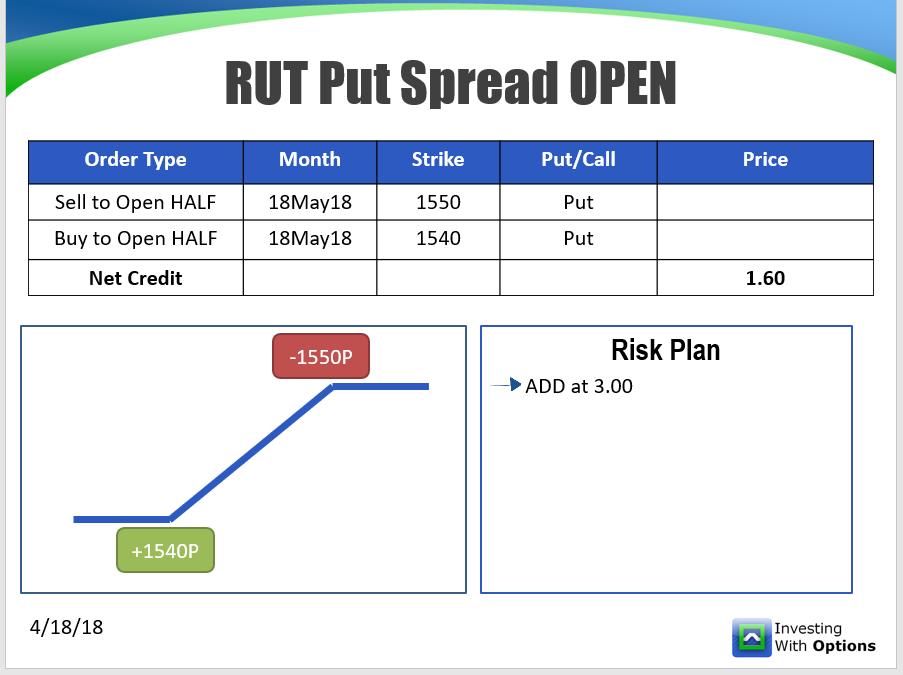

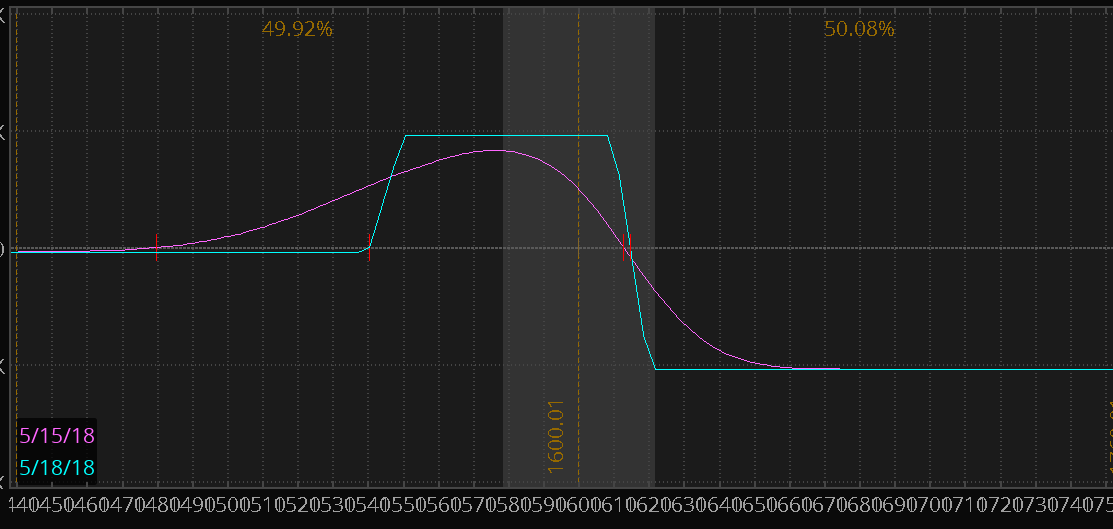

Trade #5

Buy to Close Apr 1585/1595 Call Spread @6.70

Sell to Open May 1610/1620 Call Spread @4.00

Debit: 2.70

Sell to Open Half Size May 1550/1540 Put Spread

Credit: 1.60 (0.80 size adjusted)

Net Debit: 1.90

Max Credit: -1,100

Max Risk: 10,300

Trade #6

Buy to Close May 1550/1540 Put Spread @0.20

Buy to Close May 1610/1620 Call Spread @2.00

Original Iron Condor (1470/1480 1670/1680)

Opened for 1.70 Credit

Call Spread Closed For 0.30

Put Spread Rolled For 1.00

Put Spread Closed For 0.30

Net Profit: 0.10

Apr 1585/1595 Call Spread

Opened for 0.70 Credit

Rolled for 2.70

Closed for 2.00

Net Loss: -4.00

May 1550/1540 Put Spread

Opened 1.60

Closed 0.20

Net Profit: 0.80 (0.40 Size Adjusted)

Total Net Loss: -3.50