Home › Forums › Income Trades › December SPX Income Trade

- This topic has 7 replies, 3 voices, and was last updated 7 years, 6 months ago by

Steven Place.

-

AuthorPosts

-

October 21, 2015 at 1:20 pm #4438

Steven Place

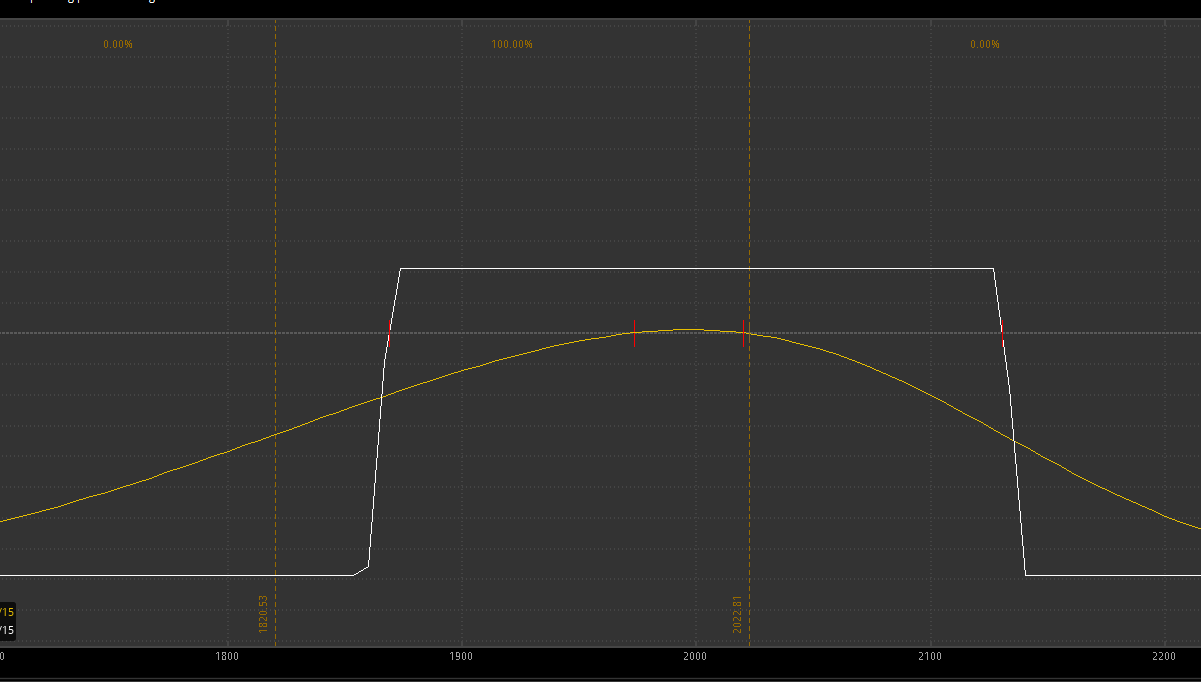

KeymasterSell to Open SPX 2130/2140 Bear Call Spread @1.15 or higher

Sell to Open SPX 1870/1860 Bull Put SPread @1.10 or higher

We will remove delta if 2060 or 1930 is broken.

Attachments:

You must be logged in to view attached files.October 21, 2015 at 1:42 pm #4441Jens Kristianson

ParticipantFilled @ 1.15 for the Call vertical and 1.10 for the Put Vertical

October 26, 2015 at 1:53 pm #4459Steven Place

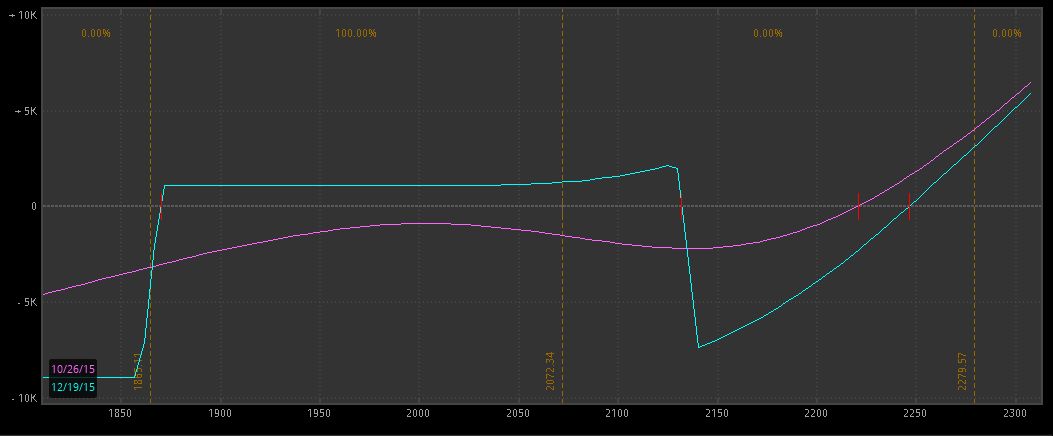

Keymaster2060 hit pretty quickly here.

What we are going to do here is reduce risk by buying calls in January. Since this iron condor is in december, by buying Jan calls we reduce our delta without removing the rewards we receive from time decay.

Current delta on 10 iron condors is 35. So buying a 20 delta call will cut deltas by about half.

Here’s the trade:

Buy to open SPX Jan 2160 Call @ 12.00

If you have smaller size, look to the SPY Jan 210 call and scale up until your directional exposure is cut in half.

Now, IF SPX CLOSES ABOVE 2100 here is what we will do:

1. Close out the long calls for a profit

2. Use those profits to roll the call side higher.

3. Roll the put side higher for a credit.The technicals of the market show that there *should* be a brick wall coming up here for SPX, but we’ve seen before how the wall of worry can squeeze higher… I don’t want it to happen but we just need to be prepared for the possibility.

October 26, 2015 at 1:58 pm #4460Marco

Participantfilled on the call at 11.6

November 3, 2015 at 3:30 pm #4483Steven Place

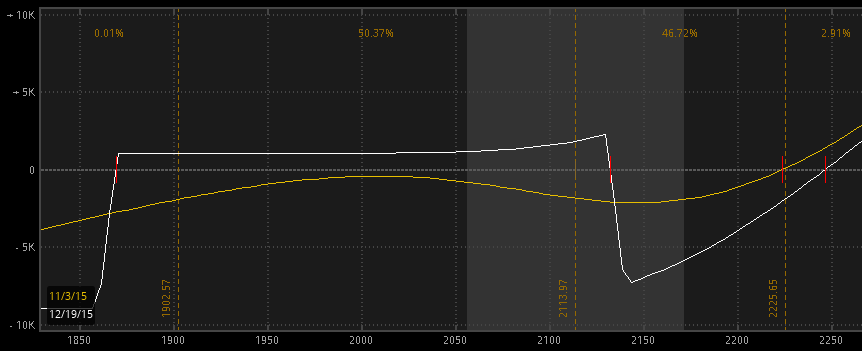

KeymasterAnd just like that, SPX is above 2100. The speed of this move is not something I’ve seen in years (2011)… I do think reversion is just around the corner but we need to adjust here.

Here’s the trade right now:

As planned here’s what we are going to do:

1. Close out the long calls for a profit:

Sell to Close SPX Jan 2160 Call @20.10

2. Roll the Put Side Higher for a credit

Buy To Close Dec 1870/1860 Put Spread @0.20

Sell to Open Dec 1970/1960 PUt Spread @0.80

3. Use the profits from both of those trades to roll the call side higher.

Buy To Close SPX Dec 2130/2140 Call Spread @4.70

Sell To Open SPX Dec 2160/2170 Call Spread @3.00

Do the trades in this order… if all the fills workout fine then there is no additional margin to this trade and the risk/reward remains similar to when we initialized it.

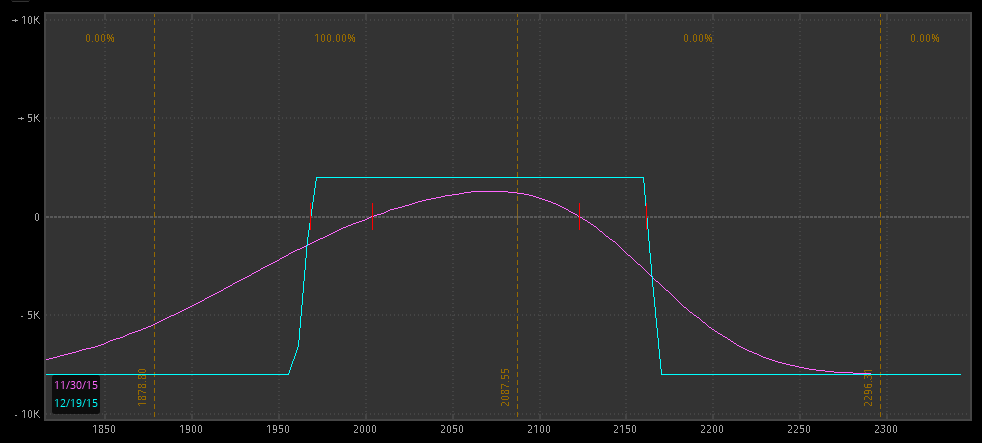

Here’s what the risk looks like after:

November 4, 2015 at 10:47 am #4484

November 4, 2015 at 10:47 am #4484Marco

Participantok i was impatient. Here are my fills:

buy to close old call spread: 4.75

sold to open new bear call spread: 2.7

spy call to hedge: sold at 5.28 for +1.80.Still need to fill the low side with the new put spread, and close the old one.

November 4, 2015 at 11:13 am #4485Marco

Participanttook a different set of strikes for the puts: sold to open 1980-1970 at 1.10.

Still have the old put side to close

November 30, 2015 at 11:51 am #4536Steven Place

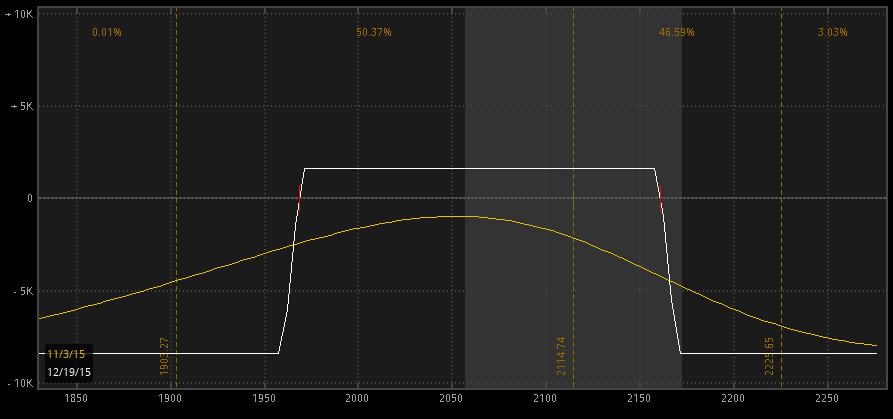

KeymasterThe sideways action over the past few weeks has really helped this trade out. We’ve overstayed our welcome to begin with so it’s time to bail on the trade.

Buy to close Dec 2160/2170 Call Spread @.50 or lower

Buy to close Dec 1970/1960 Put Spread @0.30 or lower

Trade is sitting around 14% return on current max risk, but when I include the capital for the hedge bought it’s around 12% RoR.

-

AuthorPosts

- You must be logged in to reply to this topic.