- This topic has 2 replies, 2 voices, and was last updated 6 years, 5 months ago by .

Viewing 3 posts - 1 through 3 (of 3 total)

Viewing 3 posts - 1 through 3 (of 3 total)

- You must be logged in to reply to this topic.

Become a Great Options Trader

Home › Forums › Open Trades › Income Calendar in GS

What. A. Move.

Goldman is up almost 10% over a 3 day period.

So it’s a combination of the yield curve steepening and some election voodoo.

Either way, I’m treating this as an earnings-like event, where the stock has seen a strong volatility move and is searching for new equillibrium levels.

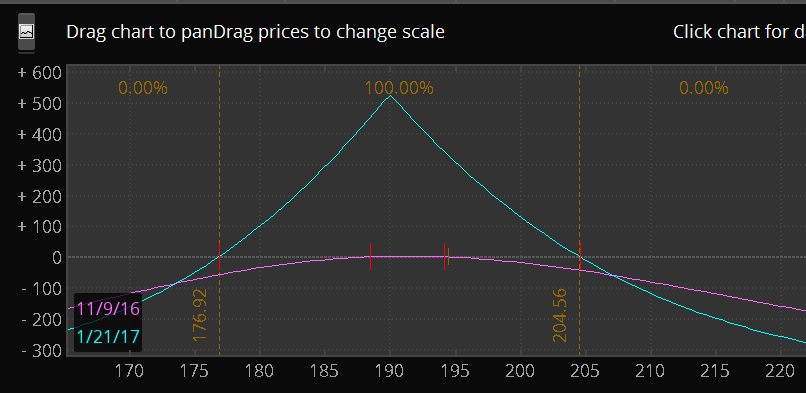

So here’s the trade setup:

| IWO Premium Order Ticket | ||||

| Type | Asset | Duration | Strike | C/P |

|---|---|---|---|---|

| STO | GS | 20 Jan 17 | 190 | Put |

| BTO | GS | 21 Apr 17 | 190 | Put |

| Total DEBIT: | 3.8 | |||

Now look, if this thing continues to get jammed, we will simply scale into the trade some more. So a move to 205 or a selloff to 180 will cause an add.

Goal is 20% return on risk. After the Fed rate hike, the Jan options will get smoked and we’ll be able to exit then.

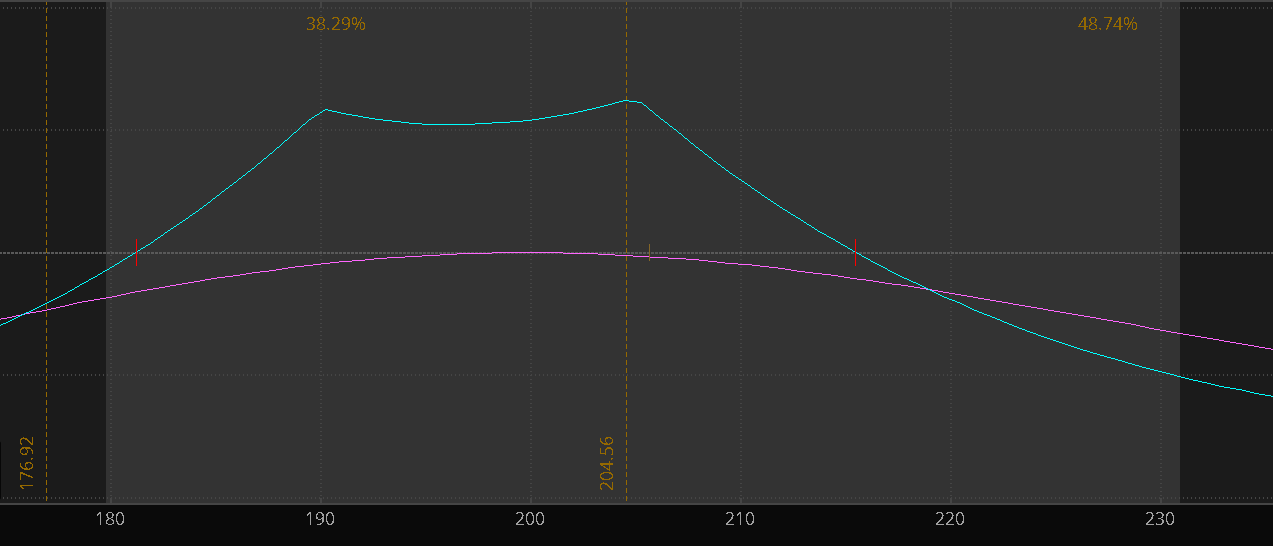

Adding to this trade:

| IWO Premium Order Ticket | ||||

| Type | Asset | Duration | Strike | C/P |

|---|---|---|---|---|

| STO | GS | 20 Jan 17 | 205 | Put |

| BTO | GS | 21 Apr 17 | 205 | Put |

| Total DEBIT: | 4.45 | |||

Thoughts on this trade lately?