Home › Forums › Market Discussion › Market Talk 3/13 – 3/19

- This topic has 12 replies, 6 voices, and was last updated 7 years, 2 months ago by

Suresh.

-

AuthorPosts

-

March 14, 2016 at 8:57 am #4964

Steven Place

KeymasterMarch 14, 2016 at 8:59 am #4966Steven Place

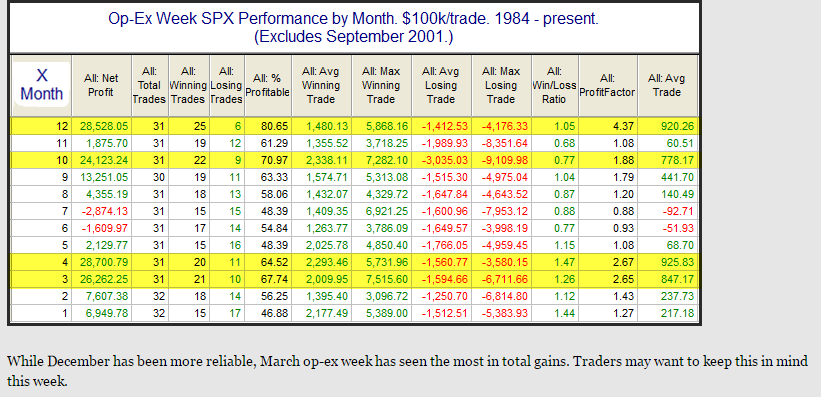

KeymasterSome market stats to start your week:

ver 90% of SPX stocks trading above their 3, 5, 10, and 20-day moving averages. This in itself is not a common occurrence. Going back to 2006, I could only find 12 instances of this happening when VIX has been below 20. Interestingly, 3 were up, 9 down the next day for a net loss, but 10 were up, 2 down after 3 days.

March 14, 2016 at 9:53 am #4967Steven Place

KeymasterUpside stats in March opex:

March 14, 2016 at 10:05 am #4969

March 14, 2016 at 10:05 am #4969Steven Place

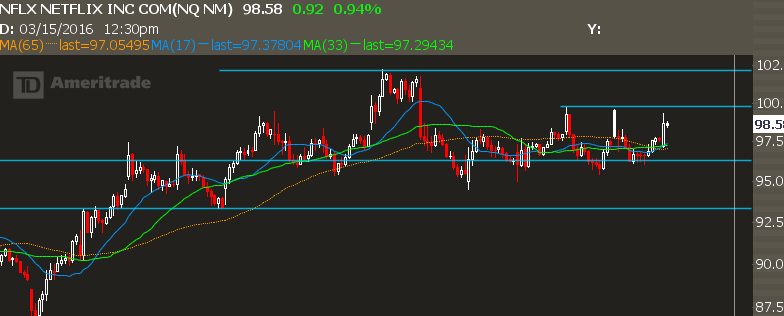

KeymasterNFLX has had 3 attempts at breaking 100. Odds are the break happens this week.

I’m buying the NFLX Mar 100 calls @1.70, stop on move below 97

March 14, 2016 at 12:00 pm #4975Steven Place

KeymasterBailing on CAT

March 16, 2016 at 12:25 pm #5018Steven Place

KeymasterHere’s my gut feel on the market right now.

Traditional investing focuses mainly on one kind of risk… downside risk. You buy stocks, stocks go down, you feel like garbage.

When you move into forex or commodities, you learn about bi-directional risk. You short gold, gold rips higher, you feel like garbage.

With options there’s not only directional risk but also volatility risk. If you sell calls and the stock doesn’t go anywhere… you’re fine. But if you sell calls and the stock rips, then you feel like garbage.

I think we are still in a combination of a FOMO (fear of missing out) market combined with WAYYYY too many call sellers.

A week or so ago, Goldman put out a note that it was the best time to buy calls, not just because of being bullish but the fact that sooooo many people were selling calls the premium got driven down so it didn’t offer good risk/reward.

And who can blame them? After looking like western capitalism was going to fail (again), the S&P 500 rallied all the way back up to 2000. Previous support, potential resistance.

That leads to a bunch of people selling calls against their stock positions.

And it’s a crowded trade.

So here we sit, into another Fed meeting. I could care less what the Fed says, it’s more about the reaction to the Fed.

And I think there are plenty of people still in cash. And plenty of people who sold calls.

If we run higher, it will be fueled by FOMO buyers as well as the call sellers who will be forced to cover.

In other words, the upside risk still is the biggest risk in this market.

March 16, 2016 at 12:45 pm #5019Marco

ParticipantI’m personally watching the gold/oil ratio. If it breaks down (and it’s on that verge right now on the daily chart), that would still be risk on for the market with a rip higher.

March 16, 2016 at 1:59 pm #5025IncomeLab (Old)

ParticipantSPX weeklys that expire today are pricing in 15pt in either direction with 2 min before FED decision..

March 16, 2016 at 2:10 pm #5026IncomeLab (Old)

Participant March 17, 2016 at 3:36 pm #5044

March 17, 2016 at 3:36 pm #5044Andras Salamon

ParticipantFSLR trades above 73. …plan was to take some risk off at this resistance zone.

March 18, 2016 at 11:22 am #5055Cody

ParticipantLooking to short BA here and just trying to figure out the best way to do so…

Call credit spreads might be tricky because May 145/150 probably doesn’t give enough credit yet, and 140/145 might be a little too close.

Scaling put calendars starting with 125 and adding 130 if it squeezes higher maybe?

Keeping it simple I guess we could just look at buying puts as well…

March 18, 2016 at 11:23 am #5056Marco

ParticipantYou probably wanna check if you go with calendar the next earnings date to take that as back month if there is enough time

March 18, 2016 at 1:18 pm #5059Suresh

ParticipantRUT hit 1100+. Any adjustments to the put flies yet?

-

AuthorPosts

- You must be logged in to reply to this topic.