Home › Forums › Market Discussion › Market Talk 3/27 – 4/2

- This topic has 15 replies, 5 voices, and was last updated 7 years, 1 month ago by

Steven Place.

-

AuthorPosts

-

March 28, 2016 at 3:02 pm #5149

Steven Place

KeymasterMarch 29, 2016 at 9:06 am #5155Steven Place

KeymasterIf an AAPL pullback does come, I’ll be ready:

March 29, 2016 at 9:07 am #5156Steven Place

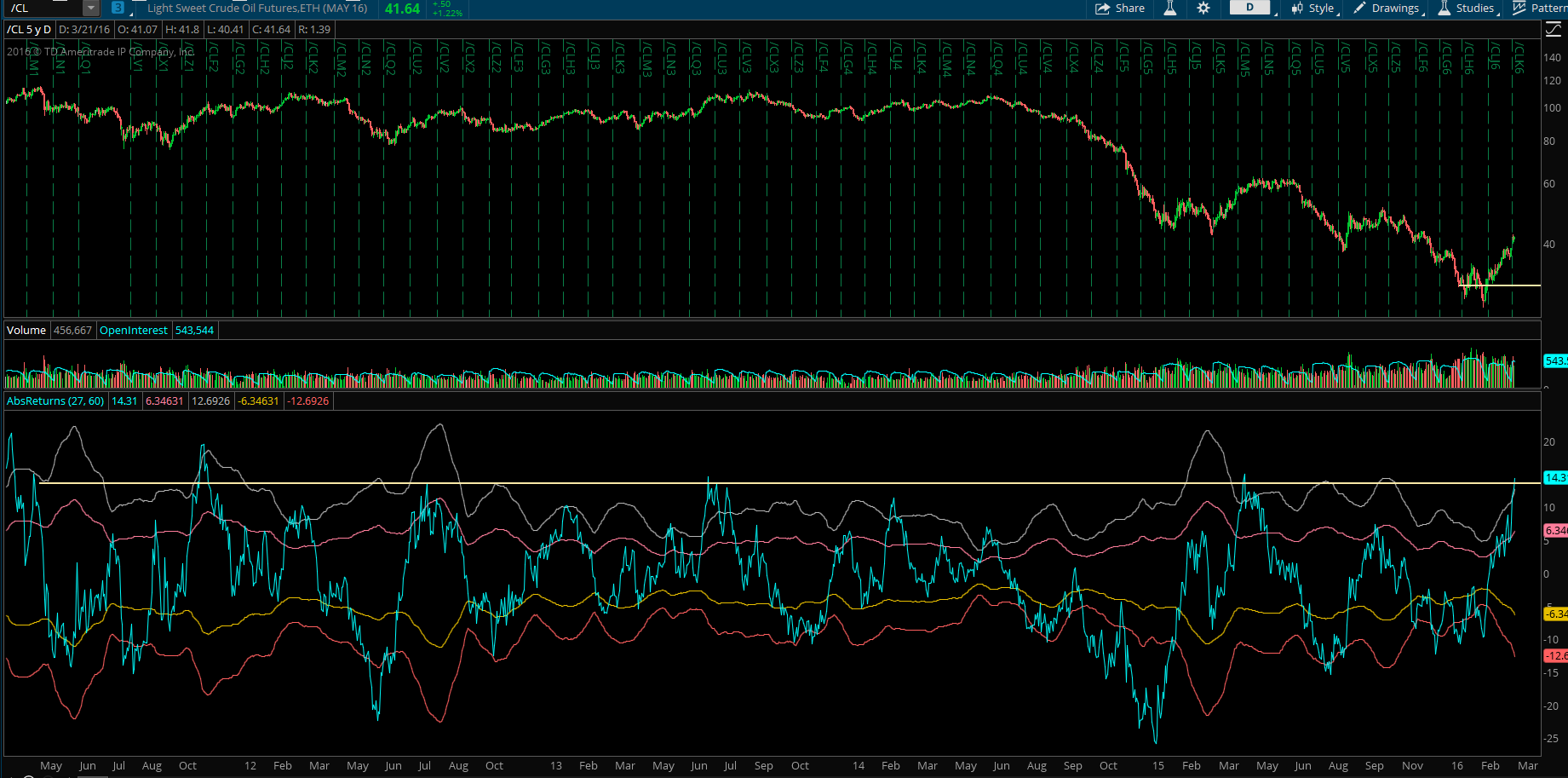

KeymasterSome more indepth thoughts on the oil space right now:

I don’t think there’s been enough bloodletting yet.

Sure, the last few months have been ugly for oil stocks… and odds are we won’t experience the same kind of nasty downside action that we saw late last year.

Yet there haven’t been enough fundamental catalysts to justify oil stocks starting a new bull market.

We need more dividend cuts, more dilution through secondaries, and more pain for investors before this is all over.

Given the fact that many of these oil stocks have seen aggressive rallies since January, now is a time to consider some new downside trades.

A Quick Look At Oil

The major reason that many of these stocks have bounced has been because oil has stopped collapsing.

The premise here is simple:

If the price of oil is lower than your cost to pull it out of the ground, you’re in trouble.

And if you can’t generate enough cash to finance your outstanding debt, you’re in more trouble.

That was the overall driver for many of the leveraged oil stocks last year.

That story hasn’t gone away, it just has subsided because oil has seen one of its strongest moves in a very, very long time.

If oil starts to rollover and if we start to see downside catalysts, that selling momentum could pick up very soon.

How to Trade It

Put Buys On Leveraged Oil Stocks

With this large countertrend rally in oil, now is the time to consider a strategy of anticipating dilutive events in oil stocks that are still in a position of weakness in the market.

Kinder Morgan (KMI) is a great example.

A year ago, the stock was in the 40s.

2 months ago, the stock was headed to the single digits as investors puked up their shares. Odds are the company will have a dilutive event sooner than later, and that tends to hurt the share price of the stock.

These broken oil companies will be forced to raise cash not to finance growth, but just to survive.

The main risk here is that some of these companies could find strategic alternatives… going private (not likely) or a buyout from a firm like XOM. Because of that asymmetric risk, it’s best to consider some put buys that limit your risk.

The KMI Jun 15 put is currently priced at 0.50.

Considering the implied volatility of KMI options has been holding around 60% since it’s collapse, these puts are relatively cheap and could offer a good payout if oil softens and we see a secondary come into play.

Investing in the Majors Will Be Easier

If you do want to take a shot with some long oil stocks, then it makes sense to go with larger market cap stocks with better balance sheets.

Exxon Mobile (XOM) is the best example of this.

They’ve got enough cash to weather this kind of ugliness in the oil markets. It may not be all roses, but they probably will never have a problem with debt issuance and their business model will survive.

The technicals align with this idea. While the rest of the oil patch was getting obliterated, XOM made a higher low this year. Same for Chevron (CVX).

Furthermore, it’s actually very difficult to get exposure to oil. Oil exchange traded funds (ETFs) have issues with futures rollover and many of them will continue to structurally underperform as long as the oil markets are in contango. It’s easier to just buy a company and collect the dividend.

If you’re looking for an ETF, then XLE is going to be your best bet as 30% of the total size in the ETF is just XOM and CVX.

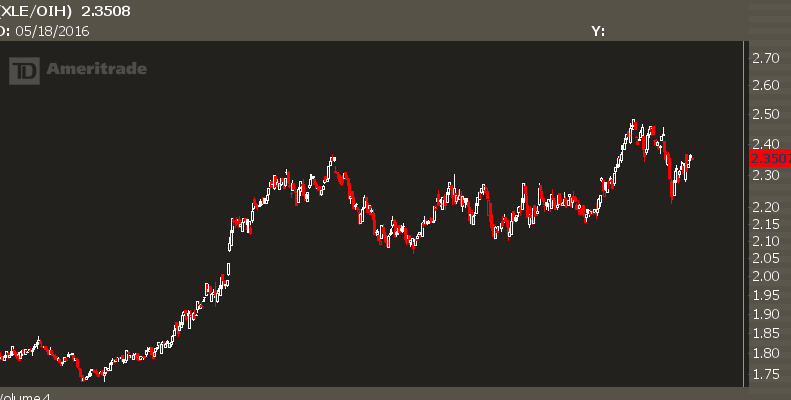

Pairs Trade ETFs

One trend I expect to continue is the outperformance of XLE relative to OIH. The balance sheets are better and there are less risks involved with the larger companies.

Any time this relationship stretches to the downside, consider starting a position.

Put Sales Post Secondary

Once you see some kind of ugly fundamental catalyst, the downside momentum will generate higher option premiums and a good opportunity for longer term investors.

Of course, there’s always the possibility that a stock just goes to zero. That’s the risk you’re playing with.

You could consider buying calls to limit your downside, but then you run the risk of the stock just going sideways and nothing happening.

March 29, 2016 at 9:54 am #5162Steven Place

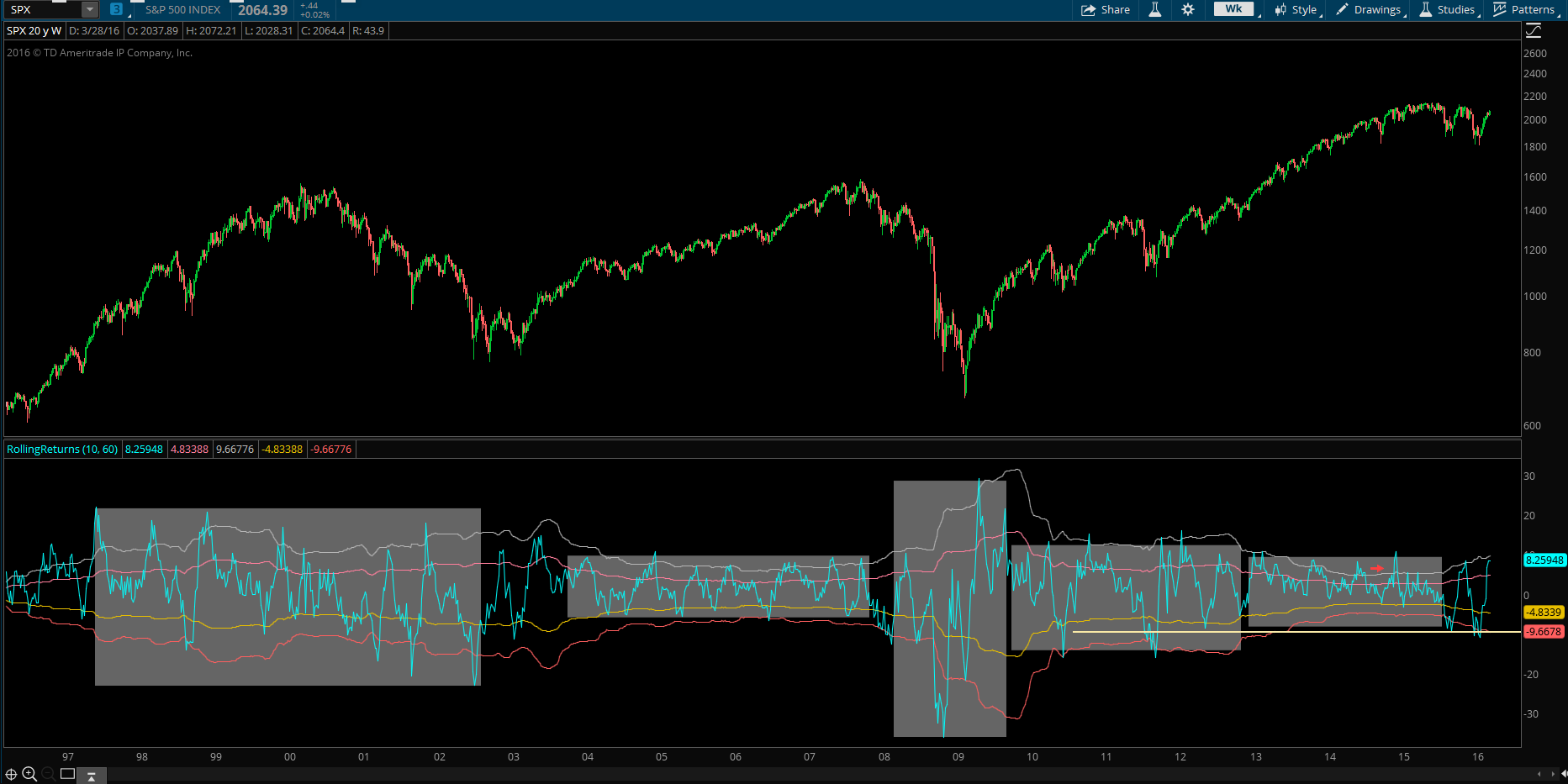

KeymasterIn case there’s any dooubt… Oil matters to the market right now.

One month and two month correlation between crude futures and SPX is >90%

March 29, 2016 at 9:58 am #5164

March 29, 2016 at 9:58 am #5164Steven Place

KeymasterPost earnings bull flag in FDX:

Two ways to play it… Either wait for the failed breakdown under 160 or play strength on a clearance of y’day highs.

April 165 calls weapon of choice.

If the stock manages to squeeze past that I’ll be looking at income calendars.

March 29, 2016 at 10:06 am #5166Steven Place

KeymasterLooking for a FBF pattern here.

FBF = Failed Breakout Failure

Premise is this: very obvious resistance level right at 125. The stock is hanging just underneath that and will most likely pop.

If this were a lower market cap stock or high growth or whatever, you’d probably see some more followthrough.

But odds are the initial breakout buyers are going to get smoked somehow. We want to look for them to get stopped out.

So a breakout above 125, a move back below 125, and then some kind of stabilization after a stop run. Into that stabilization start buying some calls.

March 29, 2016 at 11:58 am #5182Jose Fabian Paniagua Reyes

ParticipantWhat do you think about FB? i want it to go down.

March 29, 2016 at 5:02 pm #5201Marco

ParticipantBig caps look really good here. AMZN, NFLX, GOOG, AAPL are all exiting a consolidation. FB is going nuts. Yes FB might pullback but this is not what i would bet here.

March 29, 2016 at 7:52 pm #5202Cody

ParticipantHey Steve, is the MA Deviation study that you’ve had on in a few of the recent market wraps one that you created yourself? I don’t see it in my TOS study list.

March 30, 2016 at 9:11 am #5208Steven Place

Keymaster@Jose — I think FB is part of a broader move into high beta tech stocks. Look at NFLX, GOOGL as examples as well.

I do think as we come into this big resistnace level it does make sense to start up some short exposure.

A good way to do that is to consdier put calendars.

March 30, 2016 at 9:11 am #5209Steven Place

KeymasterHere is the code for the MA deviation study:

declare lower; input price = close; input length = 200; def SMA = Average(price[0], length); plot DEV =(price/SMA -1 )*100; DEV.SetDefaultColor(GetColor(1));March 30, 2016 at 9:17 am #5210Steven Place

KeymasterOk time for a little soapbox time.

It’s very popular to criticize the Federal Reserve.

And to be honest, it’s nothing new.

Back in the 70’s when Paul Vockler was in charge, he jacked up interest rates to crazy high levels to help curb inflation. Plenty of critics there.

And while Greenspan was basically a god during his reign, the decision to keep rates too low too long definitely helped to push the housing bubble.

Finally, back when Bernanke was chair it was super easy to make fun of him because the market was in the toilet. In hindsight the decisions they made could have preserved the financial system… we’ll never truly know because a “control group” doesn’t exactly exist.

Which brings us to the tenure of Janet Yellen.

It’s not about the policy decisions.

It’s about the lack of consistency from the entire Board.

Yesterday we had Yellen talk and say that the baseline scenario may have too much downside risk to justify taking action.

And then Evans this morning started pushing rate hikes again.

This non-unified message has roiled markets for MONTHS.

It’s been going on since 2015.

I don’t recall the Fed Board of Governors being this divided during Bernanke or Greenspan.

And sure, you have the rate hawks and the rate doves… but they normally do it behind closed doors.

It seems that every day another joker is on TV contradicting the Fed chair.

It’s absurd.

Ok stepping off the soapbox.

March 30, 2016 at 10:07 am #5215Steven Place

KeymasterI’m buying the SPY Apr1 205 Put @0.30

Looking for a gap fill by end of week.

Will sell half @.60 and let the rest run

This is a full risk bet.

March 31, 2016 at 11:20 am #5232Steven Place

KeymasterIf you think the past few months were “scary”

Well…

It’s kind of normal

March 31, 2016 at 1:46 pm #5236

March 31, 2016 at 1:46 pm #5236Jared

Participant.

-

AuthorPosts

- You must be logged in to reply to this topic.