Home › Forums › Income Trades › October Income Trade in SPX

- This topic has 2 replies, 1 voice, and was last updated 9 years, 8 months ago by

Steven Place.

-

AuthorPosts

-

August 27, 2013 at 12:28 am #2246

Steven Place

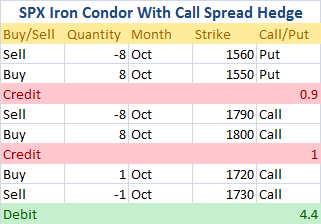

KeymasterWe are going to deploy capital into our October Income Trade.

Due to the illiquidity in the options, you will need to split each trade up into vertical spread orders.

Adjustment points are at 1730 and 1640

If the upside adjustment is hit, we will close out the long call spreads, roll the put spread higher, and buy SPY calls to reduce deltas.

If the downside adjustment is hit, we will roll down the short call spreads and buy some put calendars to reduce deltas.

August 28, 2013 at 3:36 pm #2248Steven Place

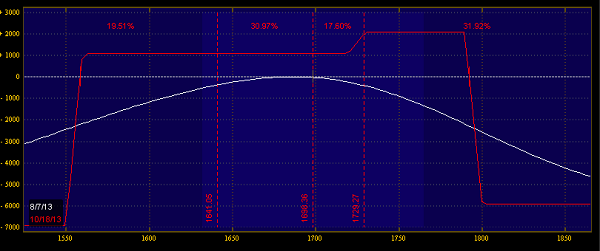

KeymasterWe are at our first adjustment point on our SPX income trade. The goal here is to get our deltas much lower to prevent bigger losses.

Here is our current risk:

Currently at a small unrealized loss with a delta of 20. That means if the market continues lower, we could be in trouble.

Currently at a small unrealized loss with a delta of 20. That means if the market continues lower, we could be in trouble.We are going to do two things:

1. Roll the call side lower for a credit

2. Buy a calendar hedge

The call spread roll is going to be tricky as there is no liquidity out there– be patient on your fills.

Here is what our new risk looks like– it takes our delta from 20 to 7.

If the SPX loses 1600 we will adjust again.

September 24, 2013 at 1:53 pm #2247Steven Place

KeymasterI’m going to close the SPX October income trade at a small loss. The options have under 24 days left to expiration, and if the market sees any pop, we end up with a very large loss. The ability to roll or adjust is not good as the cost to roll is too high (due to being closer to opex), and there are no capital efficient adjustments to reduce the upside risk we have.

Here is the risk profile currently:

Looking back on this trade, it may have been a case of choosing the wrong adjustment. Rolling the call spread down to lower strikes is what is really hurting this trade, so I’m removing that adjustment strategy from my playbook.

If we didn’t adjust, here’s what the trade would look like right now:

To close the trade out, start with the bear call spreads, specifically buying back the 1790/1800. Then sell to close the extra bull call spread for a small profit. From there you’ve got a calendar and bull put spread left, so close those when you can, but the main risk is in those bear call spreads.

-

AuthorPosts

- You must be logged in to reply to this topic.