Home › Forums › Income Trades › Scaling Butterflies in RUT

- This topic has 7 replies, 3 voices, and was last updated 7 years ago by

Steven Place.

-

AuthorPosts

-

March 30, 2016 at 9:59 am #5212

Steven Place

KeymasterWe’re not properly overbought, but we’re getting close. As the market runs into areas not seen since November, we should expect some consolidation.

I feel “early” on this trade so I’m going to add some more trade management parameters to this setup.

Buy to Open RUT May 1040/1090/1140 Put Butterfly @11.30 HALF SIZE

ADD To the Trade at 10.00

IF/WHEN RUT Hits 1135, we will add the 1070/1120/1170 put butterfly, scaling in.

IF/WHEN RUT Hits 1165, we will add the 1090/1140/1190 put butterfly, scaling in.

I want to respect the fact that this market can continue to rip higher, so it makes sense to slowly build in a position in each tier.

Target is 20-25% Return on max Risk.

If this trade seems complex… well, it is. Ask questions in the replies box below the trade alert and I’ll answer them.

Attachments:

You must be logged in to view attached files.March 30, 2016 at 9:37 pm #5226Cody

ParticipantJust want to clarify on the half size piece of this and how it relates to the add points of 1135 and 1165. If/when we hit 1135, you’ll add the new fly but again at half size just like the initial and then add the other half on a run up that’s slightly higher but not quite up to the next add point of 1165? If I’m thinking about it correctly then if all add points were hit you have to plan for 6 buys in total, correct? If that’s the case I may look at IWM to scale down the capital required.

March 31, 2016 at 9:36 am #5227Steven Place

Keymaster@Cody, that sounds right.

And IWM can work fine in this case, too.

And if you don’t feel like scaling in, just take the average basis and use that price as a fill if you want.

April 19, 2016 at 10:51 am #5468Steven Place

KeymasterGoing to add another round here.

Buy to Open RUT May 1070/1120/1170 Put Butterfly @14.60 HALF SIZE

Add the other half at 12.00

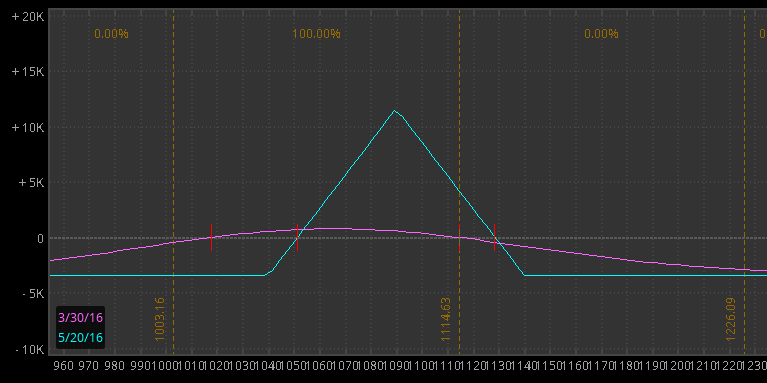

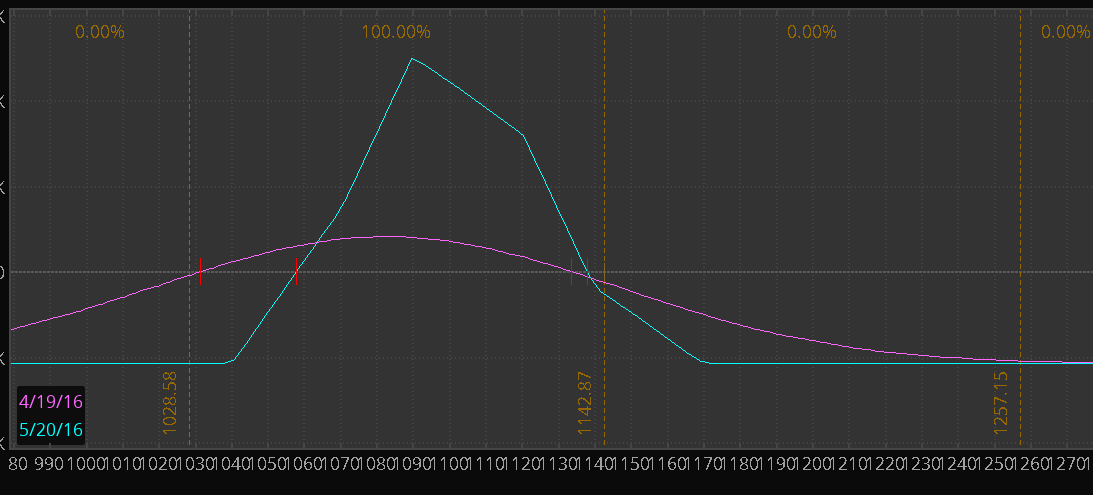

Here’s the current risk:

April 19, 2016 at 9:12 pm #5495

April 19, 2016 at 9:12 pm #5495Dale Ryker

ParticipantHi Steve, this trade is very interesting. How did you choose the price points for the second round of each fly? For example, the first 1090 fly was purchased at 11.30, and the second “round” of that 1190 was 10.00. How did you choose 10.00?

Same goes for the 1120 fly. How did you choose the 12.00 price for the second round of 1120 butterflies?

Thanks!

DaleApril 27, 2016 at 1:45 pm #5587Steven Place

KeymasterIt’s a combination of whole numbers and looking at the price of the RUT and where it’s been in the past.

April 29, 2016 at 10:12 am #5606Steven Place

KeymasterThis trade is in a pretty good place… unless the market decides to rip next week.

What I am going to do is close the lower end of this butterfly to cut capital and cut risk.

Sell to close RUT May 1040/1090/1140 Put Fly @10.50

Full size.

With the original entry at 11.30 and the add at 10.00, basis was 10.65 so this is a small loss.

May 6, 2016 at 9:57 am #5686Steven Place

KeymasterBailing on the rest of the trade:

Sell to close RUT May 1070/1120/1170 Put butterfly @24.00

27% return on risk.

-

AuthorPosts

- You must be logged in to reply to this topic.