- This topic has 2 replies, 1 voice, and was last updated 9 years, 9 months ago by .

Viewing 3 posts - 1 through 3 (of 3 total)

Viewing 3 posts - 1 through 3 (of 3 total)

- You must be logged in to reply to this topic.

Become a Great Options Trader

Home › Forums › Income Trades › September Income Trade in GLD

We are going to put on an income trade in GLD that makes money if GLD pulls back, but if it decides to rip higher we will be protected.

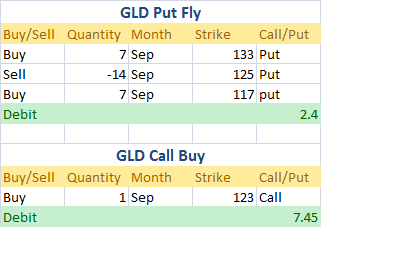

This strategy is called a put fly + call buy combo.

The put fly is the true income trade and it is a little bearish, and the call buy helps to reduce that bearish exposure.

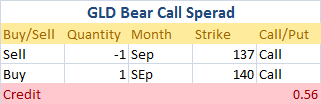

Here is the trade:

Adjustment points are 133 and 122.50

Adjustment points are 133 and 122.50

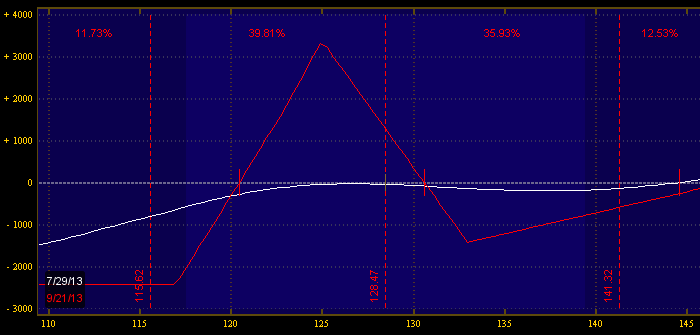

If gold rallies up to 133, we will take the call buy off for a profit and roll the put side of the butterfly higher.

If gold sells off, we will roll the call down.

Profit target is +360.

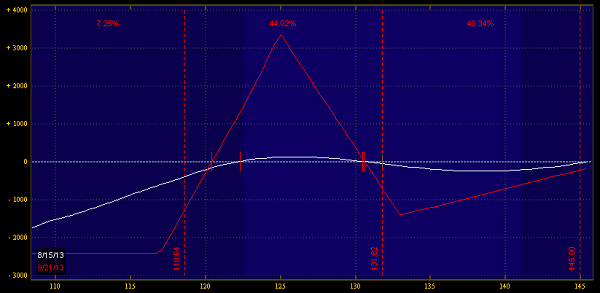

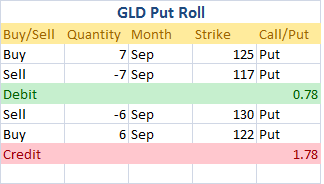

With the breakout in gold, our income trade has gone to the outside of our “theta range.” To compensate for this we are going to roll the lower side of the butterfly higher and add a single extra bear call spread.

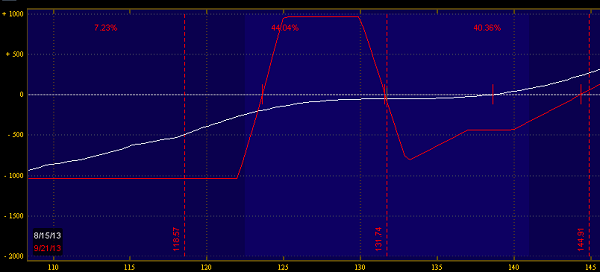

Here is our current risk

Here are the new adjustments:

This reduces the cash in this trade and gets us back to delta neutral.

If GLD pulls back we don’t have to do anything. If it continues to rip (around 133-134), then we will take profits on the long call and then adjust our spreds to get us back on the +theta side of things.

Here is the risk after:

GLD is breaking out right here, leaving the trade with a small loss. Here is what it looks like right now:

Because September now has under 30 days left to expiration, there is no reason to try and adjust this trade to try and get back any profits. The best thing to do here is to cut losses while they are still small and move on to potential trades in October.