Quite the stick save today. There was a hard probe lower across multiple sectors… I thought we’d see a decent rollover, but buyers showed up aggressively and we finished at the highs of the day.

This is not bearish price action, and it feels like money is being forced back into names. It could go back to how rates faded today, and there’s just too much liquidity in the system right now, with not as many investible assets available.

Today we’re focused on two post-earnings plays, and a stock that I’ve been stalking short for a bit that is ready to go.

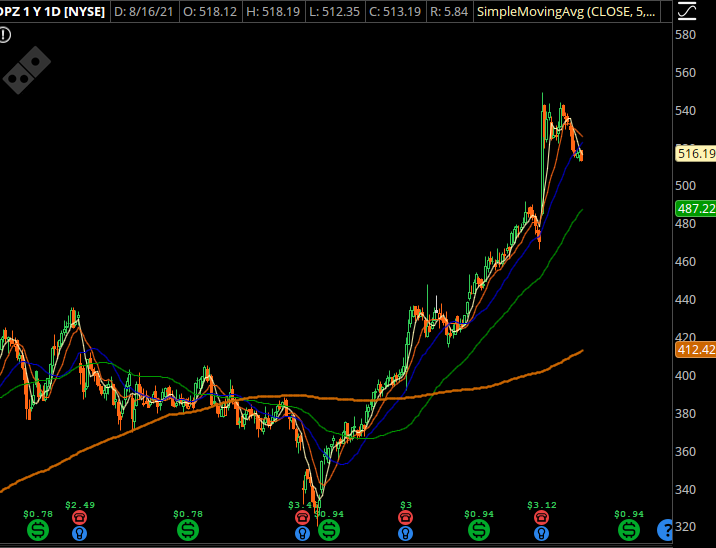

Trade #1: DPZ

Domino’s had a great run topped off with a solid earnings report. It’s been a little weak, and odds are we will need to probe a bit lower for new buyers to show up.

Trade Setup

Expected Price: 500

Sell to Open DPZ 17Sep21 480/470 Put Spread

Tier 1: Enter at 1.8, Exit at 0.4

Tier 2: Enter at 2.52, Exit at 1.02

Tier 3: Enter at 3.24, Exit at 1.34

Stop Out If Close Under 479.89

Trade #2: KLAC

After a nice earnings report, KLAC faded hard with the rest of the semiconductor space, and is near the top of the trading range from the past few months. It also has the rising 50 DMA coming into play right around these levels.

Trade Setup

Expected Price: 326.44

Sell to Open KLAC 17Sep21 300/290 Put Spread

Tier 1: Enter at 1.5, Exit at 0.05

Tier 2: Enter at 2.1, Exit at 0.52

Tier 3: Enter at 2.7, Exit at 0.65

Stop Out If Close Under 299.89

Trade #3: COST

It’s time to pull the trigger to the short side on this one. The price action is reaching extremes and odds are high for a rug pull before its earnings event.

Trade Setup

Expected Price: 456

Sell to Open COST 17Sep21 475/480 Call Spread

Tier 1: Enter at 0.75, Exit at 0.02

Tier 2: Enter at 1.05, Exit at 0.26

Tier 3: Enter at 1.35, Exit at 0.32

Stop Out If Close Over 475.11