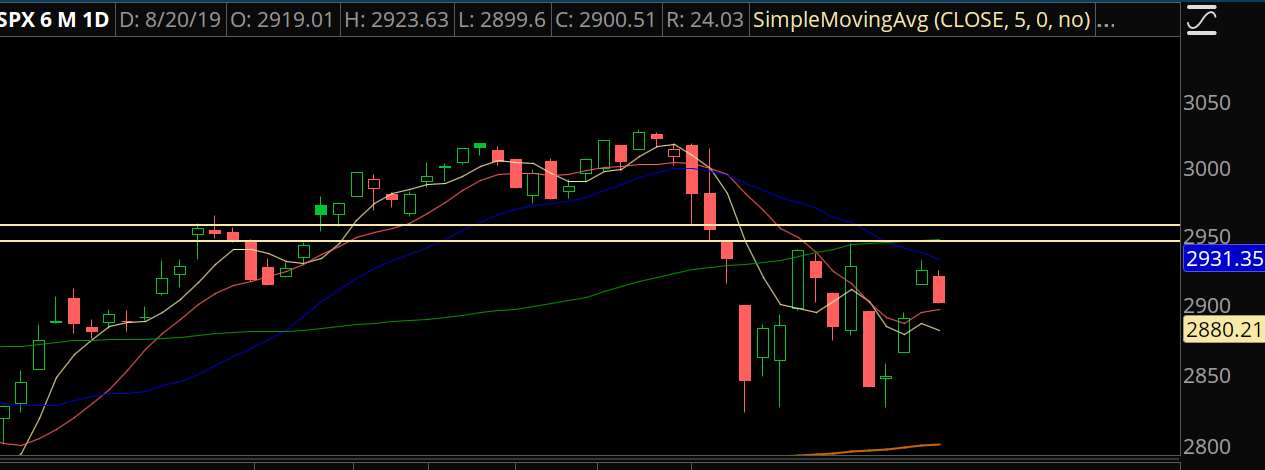

Markets are still rangebound after the drubbing from the Jul-Aug correction. The longer this goes on, and if volatility continues to cool off, the higher the odds we see an attempt of 3000 on the SPX.

There is a term called “narrative attrition” — where a story that has been around the financial markets for a while does not have the same kind of effect on the market.

This market is a great example of it. We had the China currency adjustment which led to a tidy 3% selloff… but that news is now out. It’s a “known known” and will not effect the market as much anymore. You’ve also got the yield curve inversion– again… it happened but now everyoene knows it has happened and it’s getting priced in.

Unless there is an amplification of a current narrative or an introduction to a new one… it’s difficult for the market to find fresh sellers.

On top of that… everyone that was motivated to hedge has already hedged. That in and of itself creates a structural floor on the market.

This can all change of course. 2850 has been tested a few times and all instances have shown initiative buyers coming out of the woodwork. If 2850 is tested and it *holds* then we’re due for another leg down.

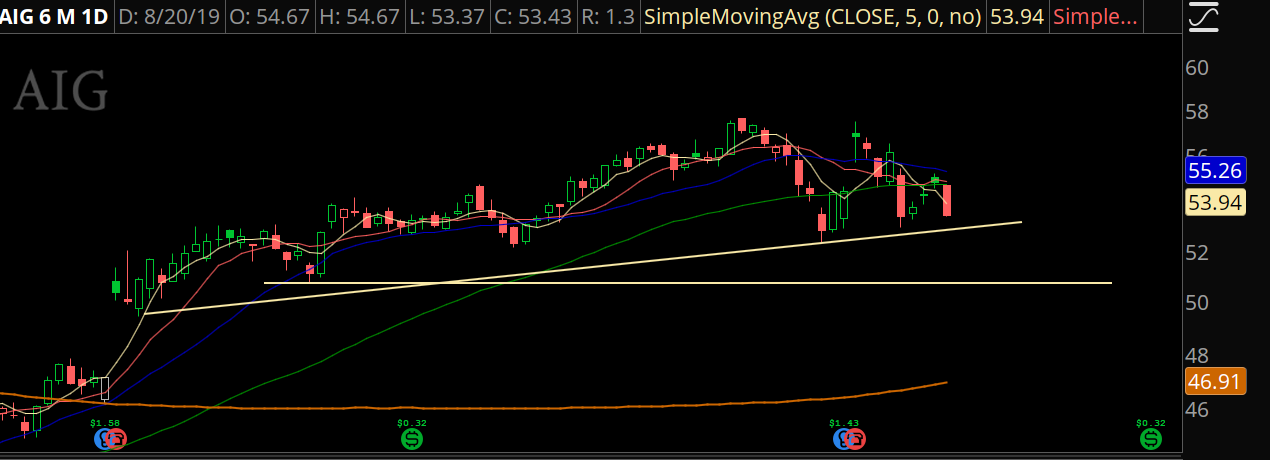

Trade #1: AIG

Yeah… AIG of all things. On my relative strength screener it’s up near the top. It could use a pullback, and that’s what I’m anticipating, down to the low 50s to previous support and a rising 100 day moving average (not shown on chart).

Trade Setup

Expected Price: 50.69

Sell to Open AIG Sep 49/47 Put Spread

Tier 1: Enter at 0.40, Exit at 0.10

Tier 2: Enter at 0.60, Exit at 0.30

Tier 3: Enter at 0.80, Exit at 0.50

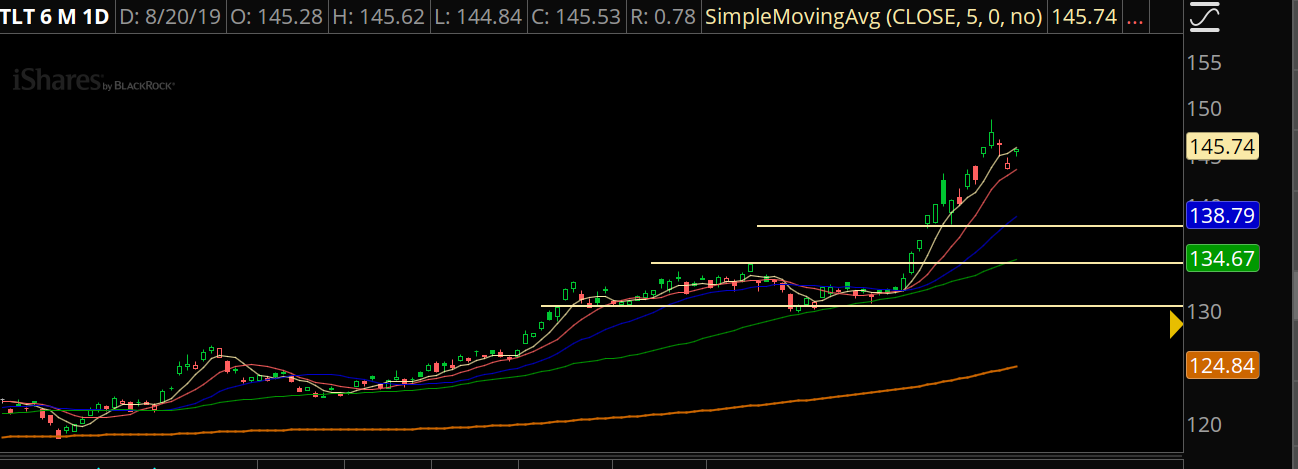

Trade #2: TLT

Looking for a retest of the breakaway gap open.

Trade Setup

Expected Price: 138.14

Sell to Open TLT Oct 133/130 Put Spread

Tier 1: Enter at 0.50, Exit at 0.10

Tier 2: Enter at 0.70, Exit at 0.30

Tier 3: Enter at 0.90, Exit at 0.40

Trade #3: GDX

Gold and gold miners are certainly a crowded trade, and it’s been a while since GDX has seen a proper pull. The obvious support is the rising 50 day moving average… I want to play just under that.

Trade Setup

Expected Price: 26.30

Sell to Open GDX Oct 25/23 Put Spread

Tier 1: Enter at 0.46, Exit at 0.06

Tier 2: Enter at 0.86, Exit at 0.26

No Tier 3