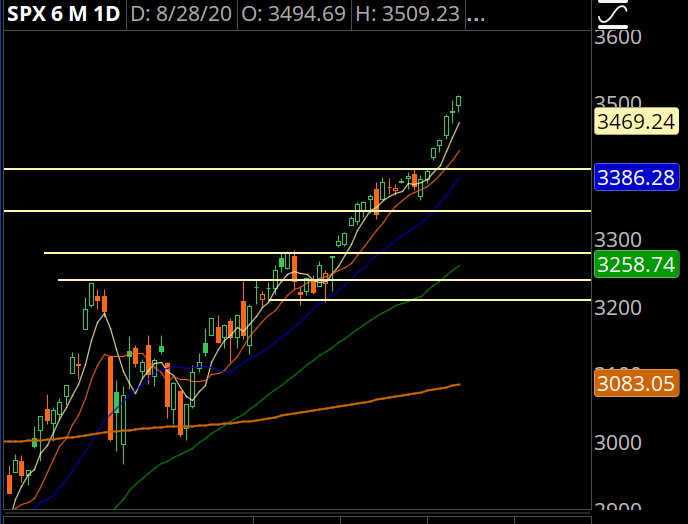

We’re starting to see evidence of parabolic action in the markets. Large cap tech is seeing a “convexity squeeze,” where enough call buyers are skewing the market higher as the market makers are forced to buy the stock as the stock rallies.

This week could come down to AAPL. The stock has rallied hard into a split and if it sees aggressive profit taking, then a “rug pull” in tech could drag the rest of the market down. Or we could just continue grinding higher… which would be a lot less fun.

Trade #1: NKLA

This SPAC has started to turn, and I think it can see a push to 50 and potentially higher.

Trade Setup

Expected Price: 41.35

Sell to Open NKLA 18Sep20 36/34 Put Spread

Tier 1: Enter at 0.5, Exit at 0.24

Tier 2: Enter at 0.7, Exit at 0.44

Tier 3: Enter at 0.9, Exit at 0.59

Stop Out If Close Under 35.89

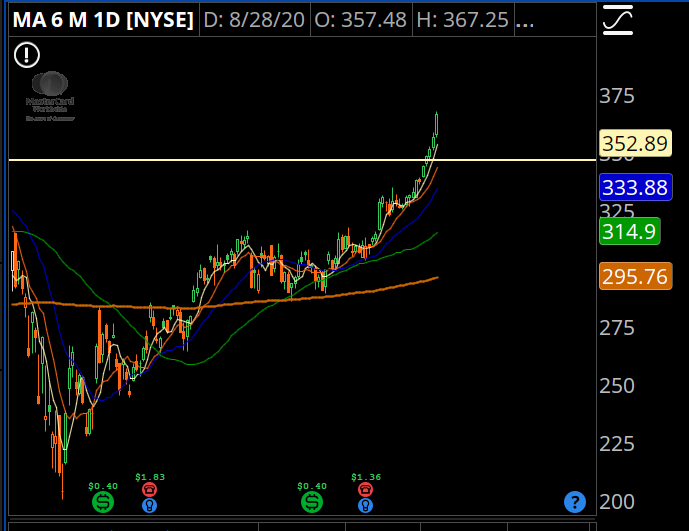

Trade #2: MA

Mastercard is seeing range expansion after a 12-day rally. This signals parabolic action, and I want to start playing for a fade if the stock sees one more push higher.

Trade Setup

Expected Price: 370.33

Sell to Open MA 18Sep20 395/400 Call Spread

Tier 1: Enter at 0.7, Exit at -0.04

Tier 2: Enter at 0.98, Exit at 0.17

Tier 3: Enter at 1.26, Exit at 0.21

Stop Out If Close Over 396.11

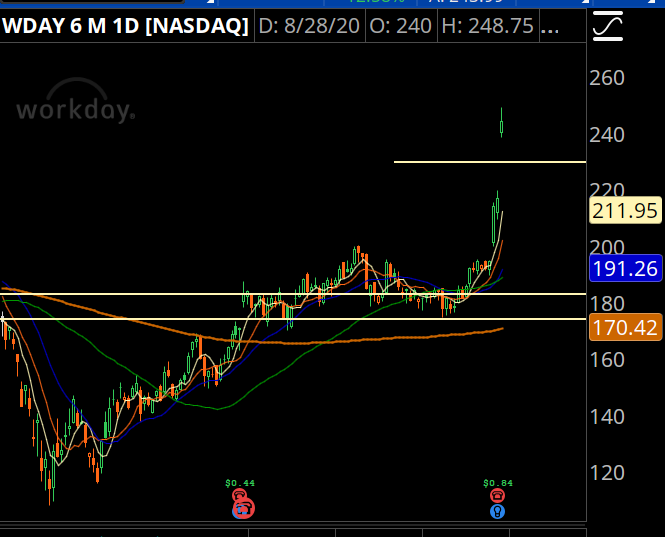

Trade #3: WDAY

WDAY had a monster move on earnings, and the earnings… well, they weren’t terrible. I think we’ll see some profit taking first, and I want to target a half gap fill to buy the dip. Options are a little less liquid on this one, so we will take some extra “wiggle room” by going further out in time on the spread sales.

Trade Setup

Expected Price: 228.31

Sell to Open WDAY 16Oct20 200/195 Put Spread

Tier 1: Enter at 0.95, Exit at 0.26

Tier 2: Enter at 1.33, Exit at 0.59

Tier 3: Enter at 1.71, Exit at 0.78

Stop Out If Close Under 199.89