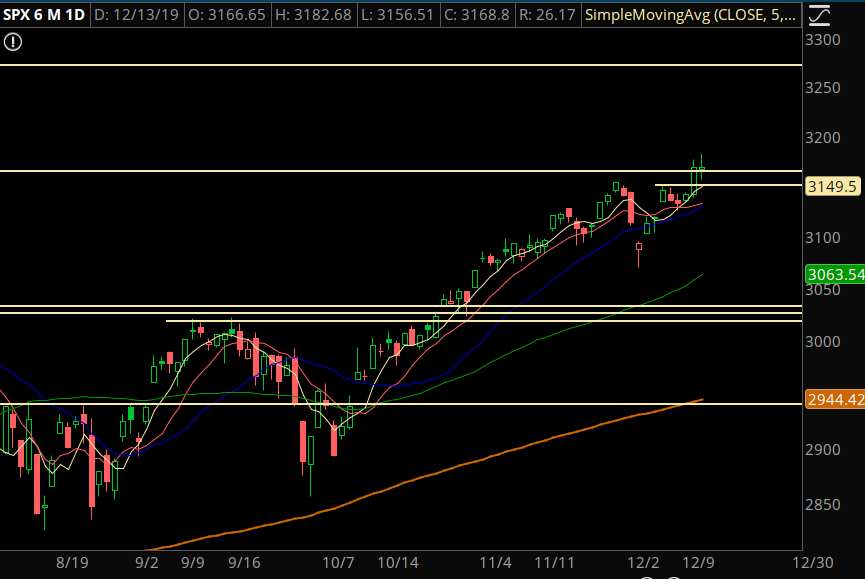

Markets are looking pretty good now that the “kick the can” trade on tariffs went through. The key level I’m watching is 3150 on the S&P and as long as that holds, we should see an end of year meltup.

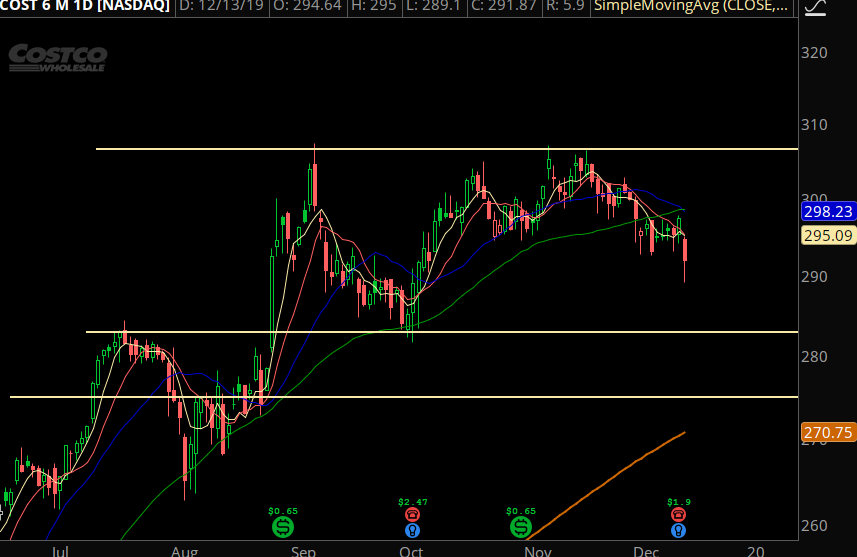

Trade #1: COST

COST got hit on earnings. It was good earnings, they beat their number, but perfection was priced in and we’re seeing more technical selling… like a hangover in the stock. I expect the stock will at least hold its range into the end of the year.

Trade Setup

Expected Price: 291.87

Sell to Open COST Jan 280/275 Put Spread

Tier 1: Enter at 0.74, Exit at 0.22

Tier 2: Enter at 1.036, Exit at 0.356

Tier 3: Enter at 1.332, Exit at 0.412

Stop Out If Close Under 279.79

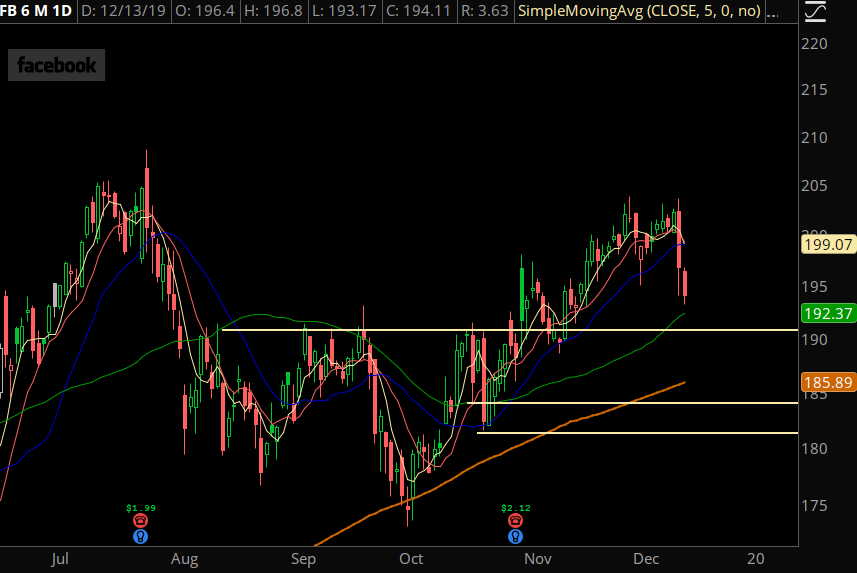

Trade #2: FB

FB caught some sellers on news that the FTC is going after them. This has been a persistent risk in the stock for years and it’s not a surprise that this is coming into play headed into 2020.

I want to see a test of the internal pivot level to place a trade.

Trade Setup

Expected Price: 190

Sell to Open FB Feb 175/170 Put Spread

Tier 1: Enter at 1.02, Exit at 0.54

Tier 2: Enter at 1.428, Exit at 0.818

Tier 3: Enter at 1.836, Exit at 1.036

Stop Out If Close Under 174.89

Trade #3: ADBE

ADBE broke to new highs on good earnings. I think the stock will continue to drift higher.

Trade Setup

Expected Price: 318.15

Sell to Open ADBE Jan 305/300 Put Spread

Tier 1: Enter at 0.87, Exit at 0.37

Tier 2: Enter at 1.218, Exit at 0.568

Tier 3: Enter at 1.566, Exit at 0.706

Stop Out If Close Under 304.89