Believe it or not, we’ve had a correction.

Granted, it’s been a small one and it’s been sideways.

Yet underneath the surface things got a little fast to the downside. Specifically in the commodities space — take a look at stocks like X, CAT, and CLF.

I still think we can see a deeper correction. It’s been 93 days since the S&P 500 has seen a 1% correction.

Now into any kind of correction, I’ll be looking to sell put spreads into it. When we see moves like this it’s not bearish over the intermediate term so I’ll be looking to take advantage of it.

In the mean time I have two bearish ideas here.

Now the problem with bearish ideas are two fold.

First, you’re looking at stocks that are incredibly strong and have the potential to stay incredibly strong. The way stocks act during overbought times is completely different than oversold times.

Second, you have an issue with the option skew. People are more scared about the downside vs. the upside, so they buy puts and sell calls.

This leads to an instance where the premiums available for call spread sales will not be that great.

Here’s an example…

The market’s currently trading at 2367.

If we look 100 points to the downside, the Apr 2265 put has a price of about 13.60

If we look 100 points to the upside, the Apr 2465 call has a price of about 4.00.

See what I mean?

That means you have to be super picky about the call credit spreads you choose, and make sure that you’re going into a trade where you can see “the whites of the eyes” of the other side.

Trade #1: AMGN

After earnings, the stock is rallying hard into key resistance levels from the past two years.

Into 177 I want to sell some call spreads.

Trade Setup

Expected Price: 177

Sell to Open Apr 190/195 Call Spread

Tier 1: Open at 0.60, Close at 0.20

Tier 2: Open at 0.90, Close at 0.60

Tier 3: Open at 1.20, Close at 0.90

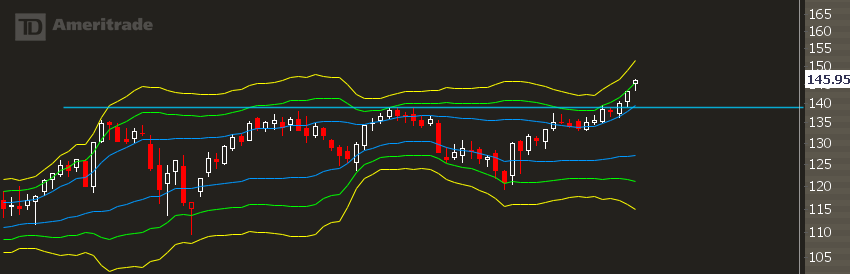

Trade #2: HD

This stock has the look that it’s about to go parabolic. I don’t think it’s a short yet but if it does go up in one direction in a short amount of time, it will need to correct.

Now I’m structuring this in a way where I tell myself “there’s no way that this will get hit” because odds are, it will. I’m looking for 153 before I sell any spreads. I want to make sure I get the absolute best prices so I don’t get runover by parabolic action. And if it pullsback before I get a chance, I’ll definitely be looking at selling some put spreads.

Trade Setup

Expected Price: 153

Sell to Open Apr 160/165 Call Spread

Tier 1: Open at 0.60, Close at 0.20

Tier 2: Open at 0.90, Close at 0.60

Tier 3: Open at 1.20, Close at 0.90