The grind continues.

We can’t really say the market is properly overbought. It’s not extended from the averages to say it’s “parabolic.” What makes this market feel like a runaway freight train is the lack of reverison. Just a slow, steady march higher every single day.

This happens sometimes. You can blame the Fed, or buybacks… whatever. I think the best way to view it is that program buying is occurring at any price.

Think about this possibility. It’s the end of the year, and you see that the market YTD was up over 30%. Then you look at your broker statements and they pulled you out of the market during the crash in 2018. So you’re upset, and you call your broker to get back in.

I think that’s a more reasonable scenario– during 2018-2019 there was a persistent outflow from stocks and into bonds, and when stocks cracked all time highs, it left many leaning the wrong way. This rally is simply a correction of that.

There is one risk I see in the market that could cause a pullback, and I think it’s a likely bet. You’ve got a few stocks reporting earnings soon — AAPL, V, GOOGL, FB — and they’ve all seen massive rallies during the past 30 days.

If their earnings reports are short of perfect, or if perfection is priced in, you’ll see some sellers step up. And because these stocks represent such a large amount of the S&P 500, it will drag the market back down to earth.

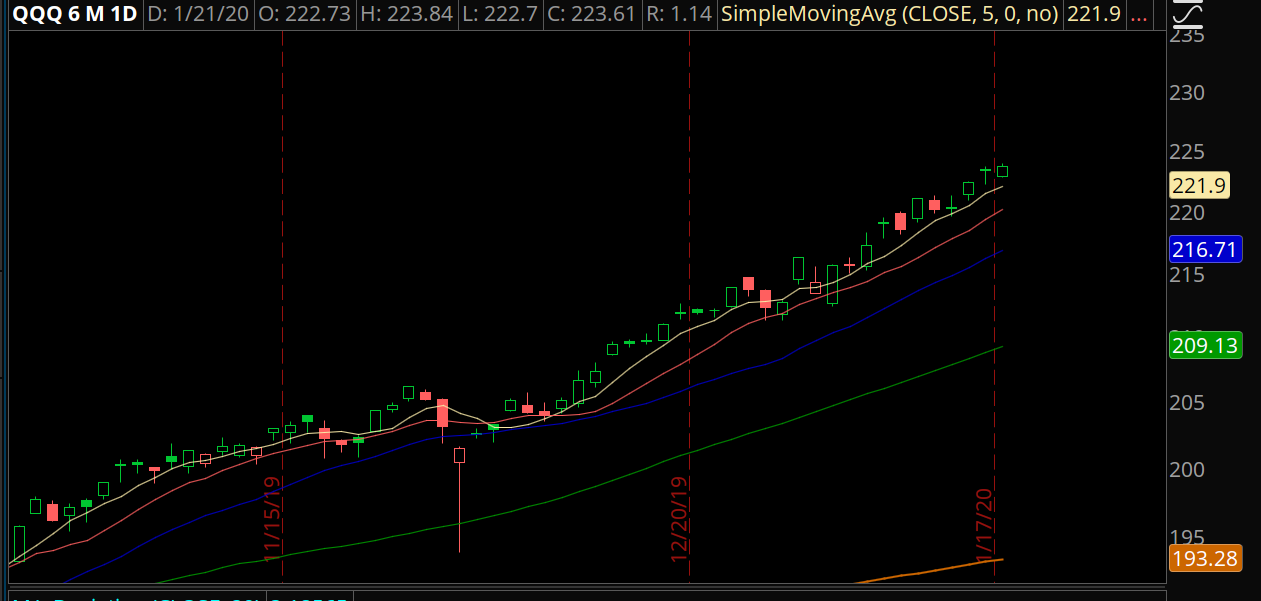

Trade #1: QQQ

As part of that thesis, we can take a bet in the QQQ– which will fall if names like AAPL start to see profit taking during earnings season.

Trade Setup

Expected Price: 223.68

Sell to Open QQQ Feb 230/233 Call Spread

Tier 1: Enter at 0.6, Exit at 0.31

Tier 2: Enter at 0.84, Exit at 0.47

Tier 3: Enter at 1.08, Exit at 0.6

Stop Out If Close Over 231.11

Trade #2: COST

COST is breaking out to new highs on volume. I like selling put spreads expecting continuation into earnings.

Trade Setup

Expected Price: 312.86

Sell to Open COST Feb 300/297.5 Put Spread

Tier 1: Enter at 0.38, Exit at 0.12

Tier 2: Enter at 0.532, Exit at 0.192

Tier 3: Enter at 0.684, Exit at 0.224

Stop Out If Close Under 299.89

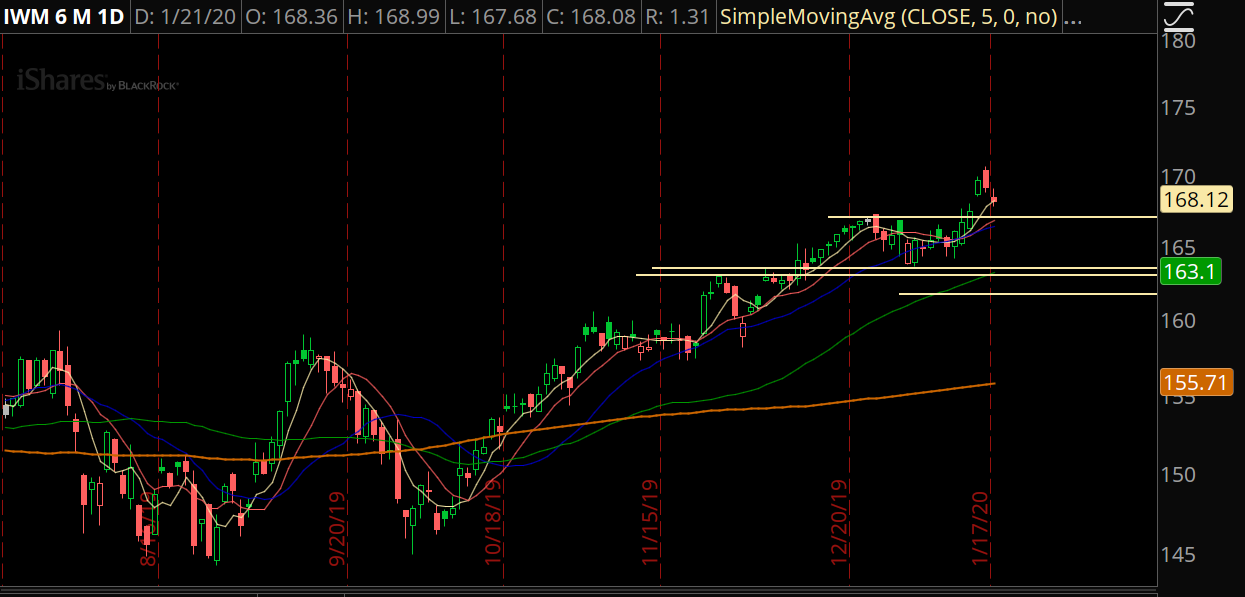

Trade #3: IWM

If IWM pulls back into its rising 20 day moving average, I want to be bullish.

Trade Setup

Expected Price: 166.71

Sell to Open IWM Feb 161/158 Put Spread

Tier 1: Enter at 0.37, Exit at 0.05

Tier 2: Enter at 0.52, Exit at 0.09

Tier 3: Enter at 0.67, Exit at 0.07

Stop Out If Close Under 160.89