My overall opinion on this market is bearish. Short term. It’s parabolic and we’re at price levels where I’m fairly confident that a correction is due. Not “end of the world” just statistically normal. Long term this is still a massive bull run and there isn’t enough evidence to justify that “the” top is just around the corner.

For reference, a 3% correction off the highs is 2785. Just 3%. Traders will think it’s the end of the world when in fact it’s just run of the mill reversion.

The rotation game is still in play so it’s best to look for risk reward on individual dips.

Trade #1: CAT

The “global growth” theme helped the stock run over 20% in about a month, and their earnings numbers were massive. But they were priced in. We’re now seeing some giveback post earnings, which is fine. Anything into 160 is going to be a good trade.

Trade Setup

Expected Price: 160

Sell to Open CAT Mar 145/140 Put Spread

Tier 1: Enter at 0.60, Exit at 0.10

Tier 2: Enter at 0.90, Exit at 0.40

Tier 3: Enter at 1.20, Exit at 0.70

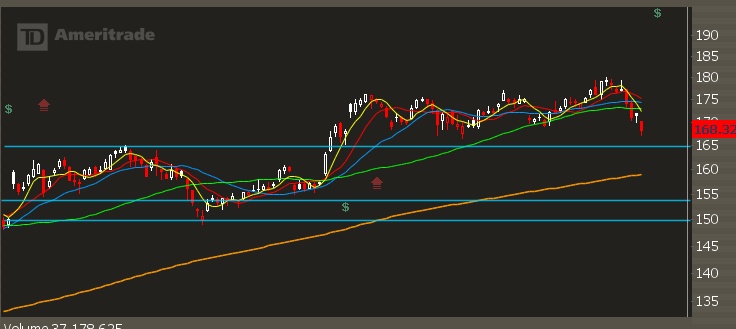

Trade #2: AAPL

AAPL is the lone stock that did not run this month. Whispers of bad sales numbers and other things are probably getting priced in ahead of earnings. I like getting long small on this dip and wider scaling in through earnings.

Trade Setup

Expected Price: 168.31

Sell to Open AAPL Mar 150/145 Put Spread

Tier 1: Enter at 0.55, Exit at 0.05

Tier 2: Enter at 0.95, Exit at 0.40

No Tier 3 Until After Earnings