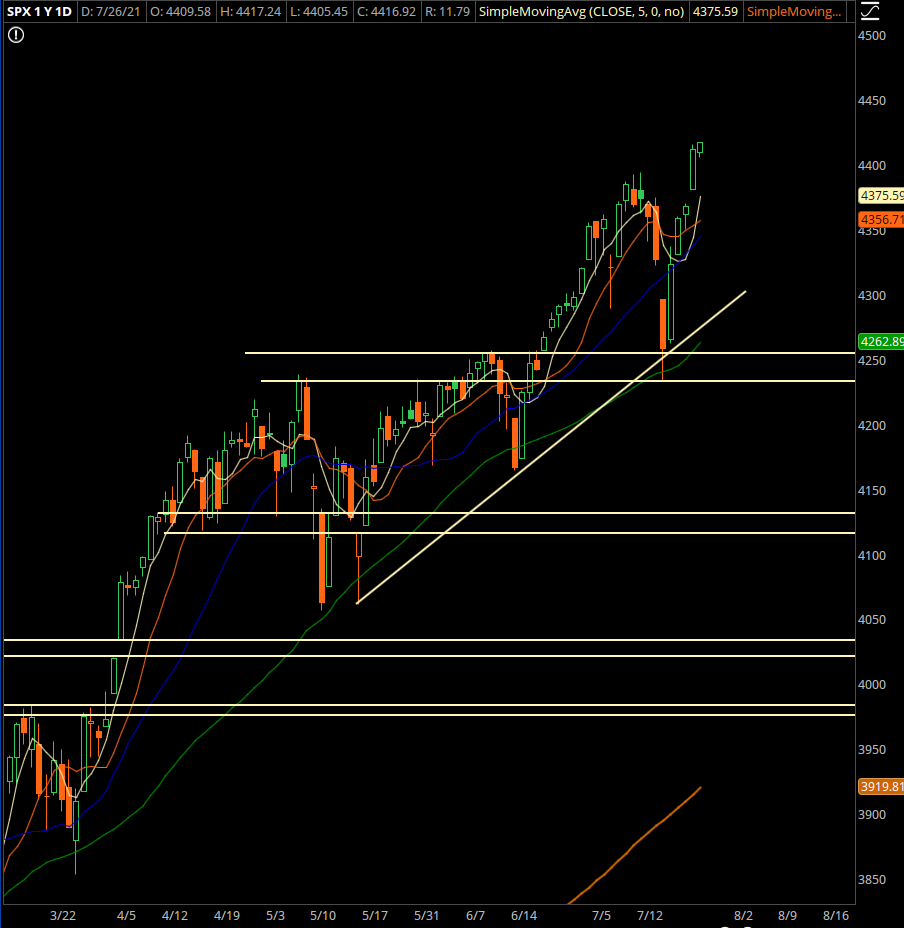

The large cap indices are continuing the march higher into tech earnings. The shakeout we saw to 4250 was short lived as way too many traders picked up hedges on the same day– see the VVIX running to 150 as evidence.

Right now it feels like enough of those traders are stuck on the wrong side of the market as we head into tech earnings. About 35% of the weighting in the S&P is in 5 stocks, and they all report this week. The good numbers out of SNAP and TWTR have led to names like FB running in anticipation of that.

With earnings season, we’re going to see many more setups around those events come into play. There is usually a “hangover” after earnings that allows enough premium to come into play and it can further enhance our edge.

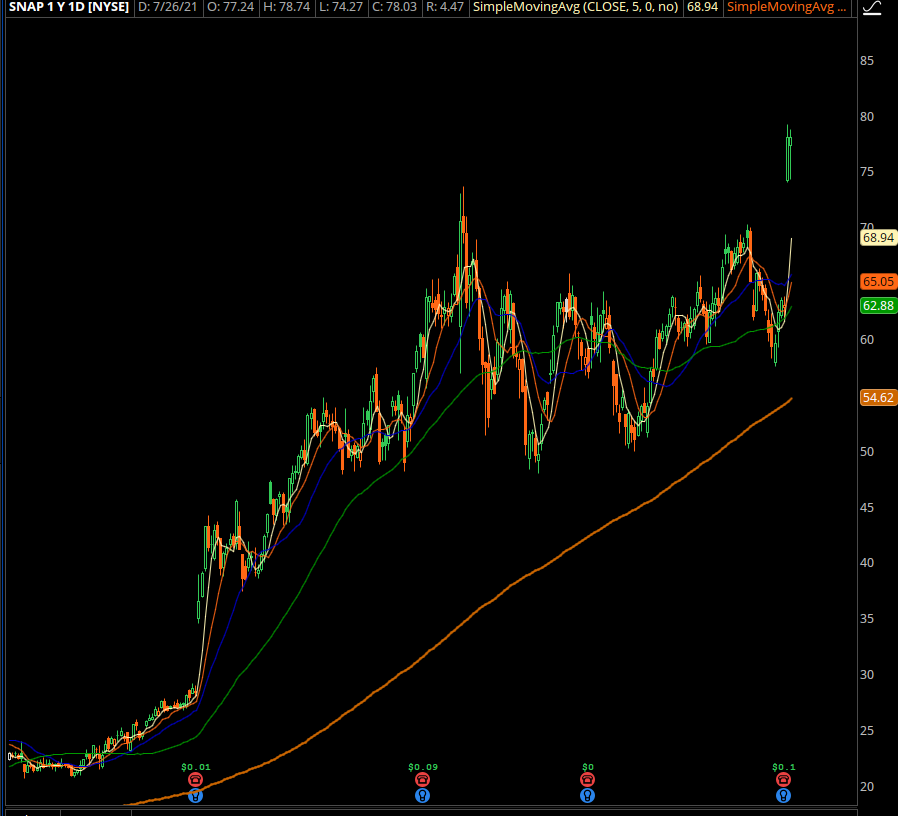

Trade #1: SNAP

Clean earnings breakout on good numbers. We want to play this several times into the rest of the year.

Trade Setup

Expected Price: 78.33

Sell to Open SNAP 20Aug21 70/68 Put Spread

Tier 1: Enter at 0.4, Exit at 0.12

Tier 2: Enter at 0.56, Exit at 0.27

Tier 3: Enter at 0.72, Exit at 0.36

Stop Out If Close Under 69.89

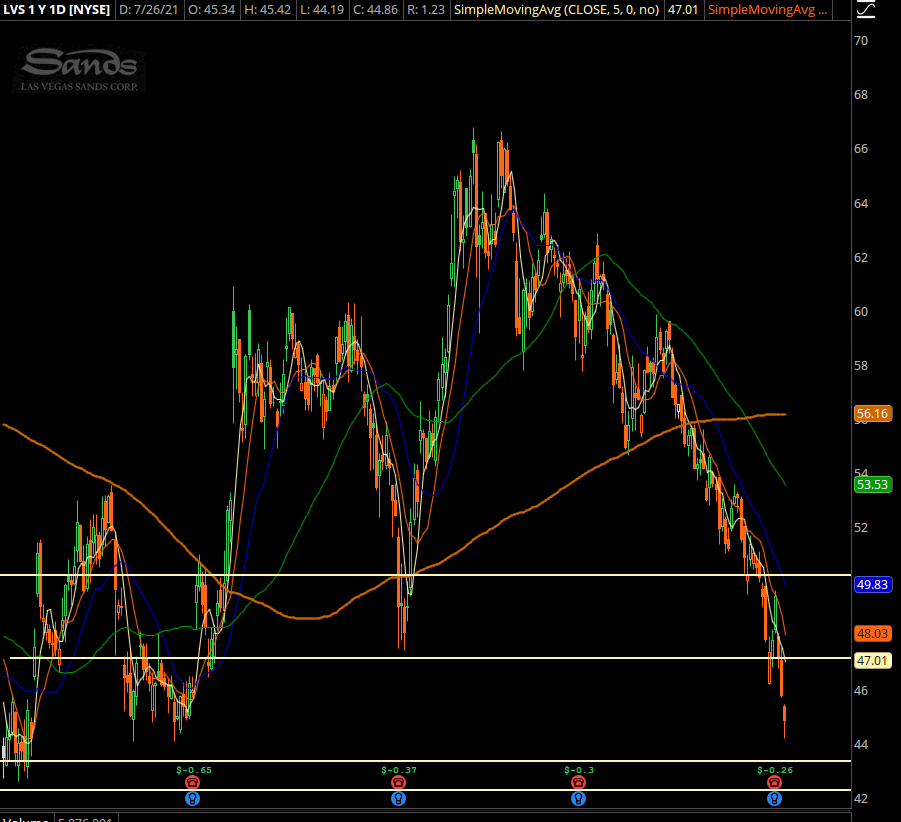

Trade #2: LVS

This company has a “one-two” punch of risk right now.

First, you’ve got the pandemic and whether they can continue to generate enough cashflow to have good earnings.

Second, you’ve got the exposure in Macau and the regulatory overhang that we’ve seen from China for a few years now. It’s coming to a bit of a head– see DIDI and TME news as recent examples.

Right now, much of the bad news has been priced into the name, with a 34% sellof down to key support.

And this is key support. It was in play in the fall of last yaer, and a reasonable level to play against.

Earnings just came out, and they were bad, but we’re to the point where all the bad news is a “known known” and we should see a sympathy bounce soon.

Note the expiration is September on this trade.

Trade Setup

Expected Price: 44.55

Sell to Open LVS 17Sep21 40/35 Put Spread

Tier 1: Enter at 0.62, Exit at 0.13

Tier 2: Enter at 0.868, Exit at 0.03

Tier 3: Enter at 1.116, Exit at 0.02

Stop Out If Close Under 39.89

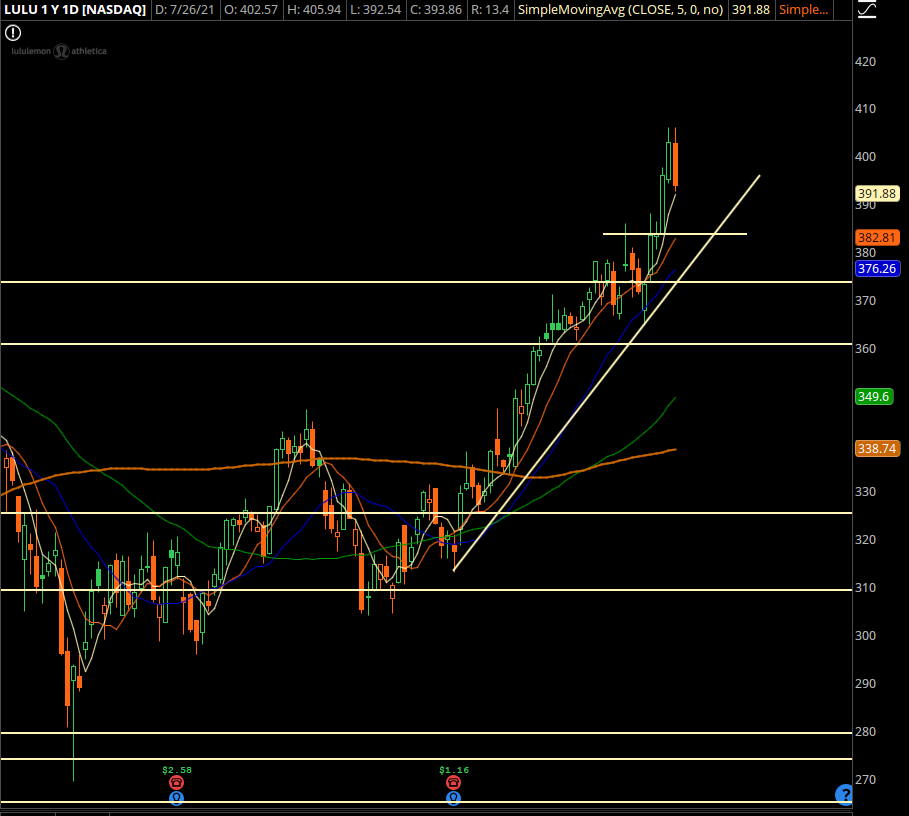

Trade #3: LULU

Great move off the lows, we’re looking for the first pullback after this most recent move. I’m targeting the last area we found sellers, as well as the rising trendline coupled with the 20 day moving average.

Trade Setup

Expected Price: 385.23

Sell to Open LULU 20Aug21 360/355 Put Spread

Tier 1: Enter at 0.77, Exit at 0.05

Tier 2: Enter at 1.078, Exit at 0.28

Tier 3: Enter at 1.386, Exit at 0.36

Stop Out If Close Under 359.89