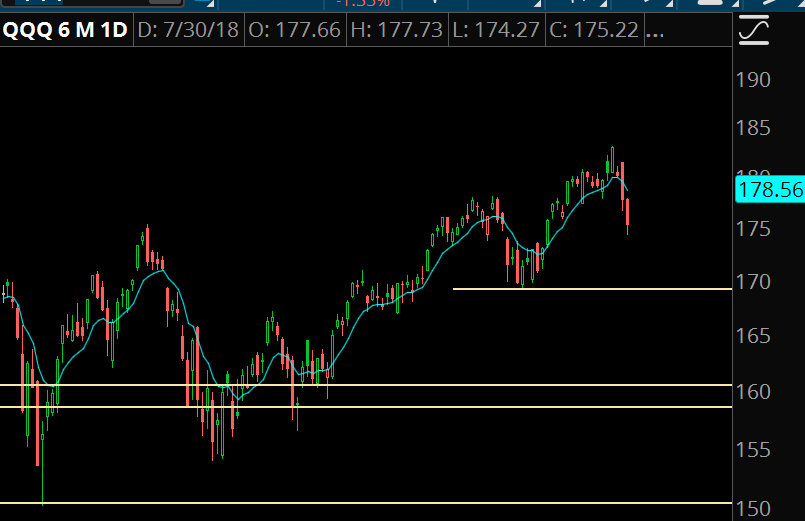

Tech is still getting shmammered on post-earnings moves.

Yes, shmammered. Very technical term.

Facebook and twitter both off 20% on earnings, and GOOGL failed to followthrough.

Sentiment has certainly shifted. All it took was two days of decent selling and it appears as though the collapse of western civilization is due next week.

So far, this is a normal pullback, both statistically and psychologically. We’re not actually seeing significant deterioration across the board. Large cap financials are ripping, and CAT earnings are helping buoy the Dow.

A lot of our setups from previous newsletters are triggering on this move, so pay attention to those. Right now we’ll focus on some pullbacks in strong trending stocks.

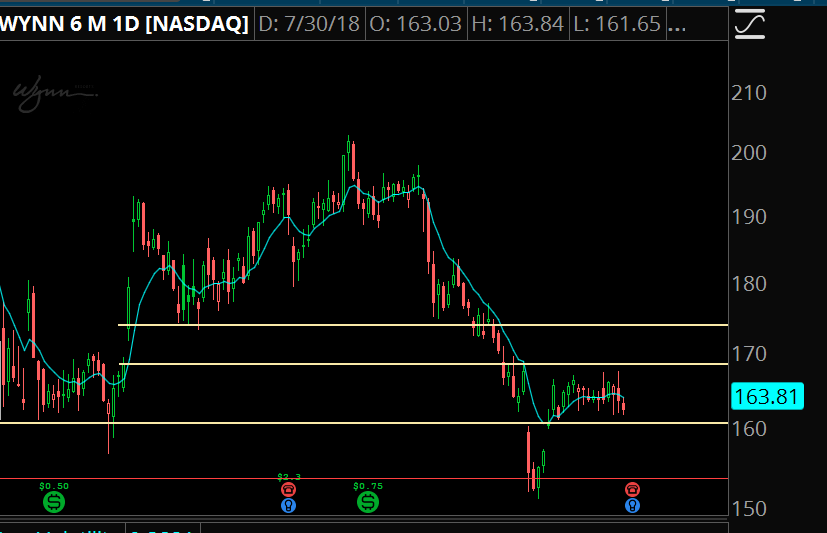

Update to WYNN Trade

In reference to this trade setup… link to full post here.

Original setup was:

Trade Setup

Expected Price: 172

Sell to Open WYNN Aug 150/145 Put Spread

Tier 1: Enter at 0.75, Exit at 0.25

Tier 2: Enter 1.05, Exit at 0.55

Tier 3: Enter at 1.35, Exit at 0.85

Earnings are due in 2 days, and not worth the risk.

Instead we are going to close out the whole thing at 0.80

That means we have a profit of 0.50 on Tier 3, 25 on Tier 2, and a loss of 0.05 on Tier 1.

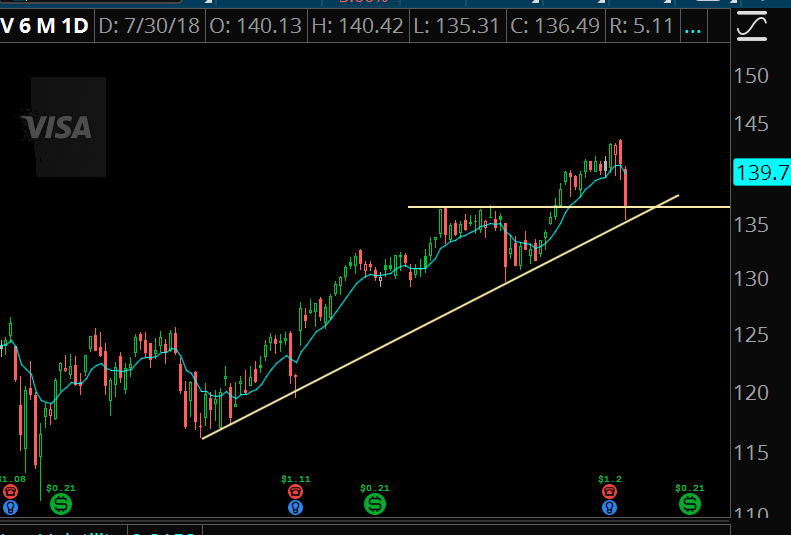

Trade #1: V

Pullback to breakout setup, looks good at current levels.

Trade Setup

Expected Price: 136

Sell to Open V Sep 130/125 Put Spread

Tier 1: Enter at 0.70, Exit at 0.20

Tier 2: Enter at 1.00, Exit at 0.50

Tier 3: Enter at 1.30, Exit at 0.80

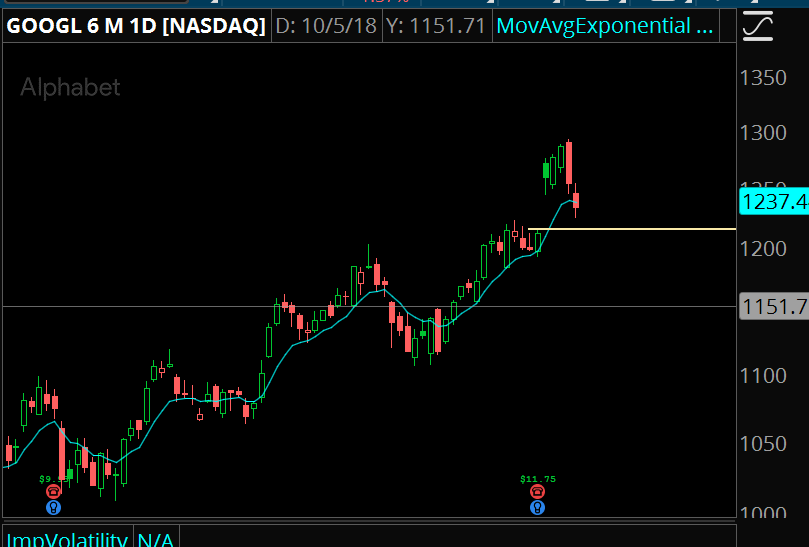

Trade #2: GOOGL

Looking for the post-earnings gap fill.

Trade Setup

Expected Price: 1,211

Sell to Open GOOGL Sep 1115/1110 Put Spread

Tier 1: Enter at 0.70, Exit at 0.20

Tier 2: Enter at 1.00, Exit at 0.50

Tier 3: Enter at 1.30, Exit at 0.80