Not the strongest breakout to new highs I’ve ever seen…

It’s summer chop. We’re seeing plenty of rotation under the surface, but nothing to give us a strong directional move in either direction. This isn’t particularly shocking, as summer trading ranges tend to get tighter. We’ve also got a VIX still trading in the 16s, which seems low, but it won’t be if these tight ranges keep up.

I’ve got to hop on a flight back home, so we’ll leave the market analysis at that. 4130 is still my big level, and holding above that is bullish.

We’ll focus on 3 catalyst plays today.

Trade #1: IBB

Large cap biotech is heating up again. BIIB had an alzheimer’s drug released that caused the push from two days ago. Given how choppy the sector has been, I’m looking for upside continuation, and for the recent lows before the catalyst to hold.

Trade Setup

Expected Price: 159.5

Sell to Open IBB 16Jul21 150/147 Put Spread

Tier 1: Enter at 0.45, Exit at 0.01

Tier 2: Enter at 0.63, Exit at 0.15

Tier 3: Enter at 0.81, Exit at 0.19

Trade #2: MDB

Mongo had a solid move on earnings. It appears the lows are in, with the failed breakdown under 250. It is at resistance, so I am looking for some back and fill before it starts to make its next move.

Mongo options are not the most liquid, so make sure the option prices line up right as the stock pulls into our level.

Trade Setup

Expected Price: 316.87

Sell to Open MDB 16Jul21 270/260 Put Spread

Tier 1: Enter at 2, Exit at 0.64

Tier 2: Enter at 2.8, Exit at 1.36

Tier 3: Enter at 3.6, Exit at 1.8

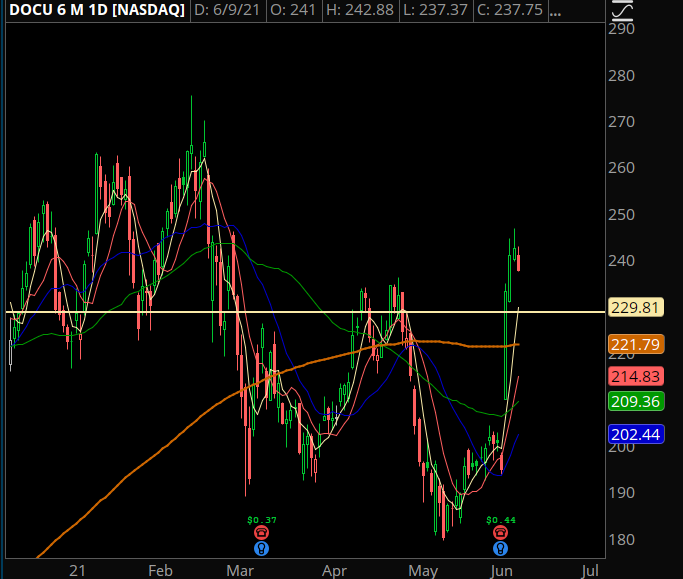

Trade #3: DOCU

Similar setup as in MDB. Failed breakdown, then a good earnings report to take it to the other side of the range. I’m looking to play the anchored VWAP from the earnings event, which is not shown on the chart.

Trade Setup

Expected Price: 232.25

Sell to Open DOCU 16Jul21 210/200 Put Spread

Tier 1: Enter at 1.6, Exit at 0.17

Tier 2: Enter at 2.24, Exit at 0.68

Tier 3: Enter at 2.88, Exit at 0.88