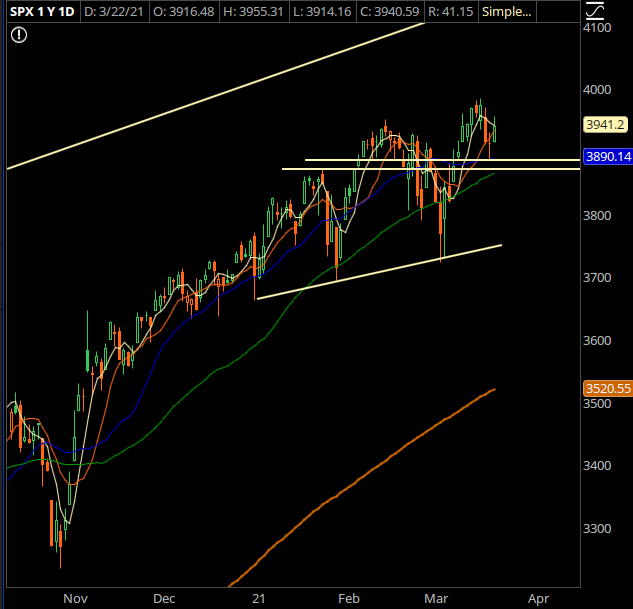

Markets are undergoing a “rotational correction” right now. After lagging for a few weeks, tech had a good run today, while banks, energy, and industrials all took a back seat.

This is driven by the narrative surrounding rates:

- Rising rates are good for banks, and commidities run when inflation expectations increase

- Falling rates are good for tech as they are deflationary in nature

These aren’t set in stone– it’s simply the current narrative that the market is working with.

Let’s talk rates, and bonds. It’s a freefall, complete crash mode as the long bond trade has the worst start to the year since… something like 20 years?

Of course we are coming out of the “deflationary vortex” spiral so some reversion is warranted… just in the short term I’m expecting this relationship to revert a bit.

If that happens we should get some very nice entries in the inflationary theme.

Trade #1: COP

With the hard selloff in crude last week, Conoco has seen a nice pullback here. I think we’ve seen enough blood– if we do knock out a lower low, odds are it will be on the back of a momentum divergence. Given where the stock has come from, I expect buyers to start showing up between here and the low 50s.

Trade Setup

Expected Price: 52.22

Sell to Open COP 21May21 45/42 Put Spread

Tier 1: Enter at 0.48, Exit at 0.05

Tier 2: Enter at 0.672, Exit at 0.2

Tier 3: Enter at 0.864, Exit at 0.26

Stop Out If Close Under 44.89

Trade #2: WYNN

Very nice run from a few months ago, on the continued optimism about travel unlocking soon. I think the premise is sound, it’s just that the stock got a little bit ahead of itself. I want to start a fresh entry off those buying wicks from two weeks ago.

Trade Setup

Expected Price: 127.71

Sell to Open WYNN 21May21 115/110 Put Spread

Tier 1: Enter at 1.05, Exit at 0.37

Tier 2: Enter at 1.47, Exit at 0.76

Tier 3: Enter at 1.89, Exit at 1.01

Stop Out If Close Under 114.89

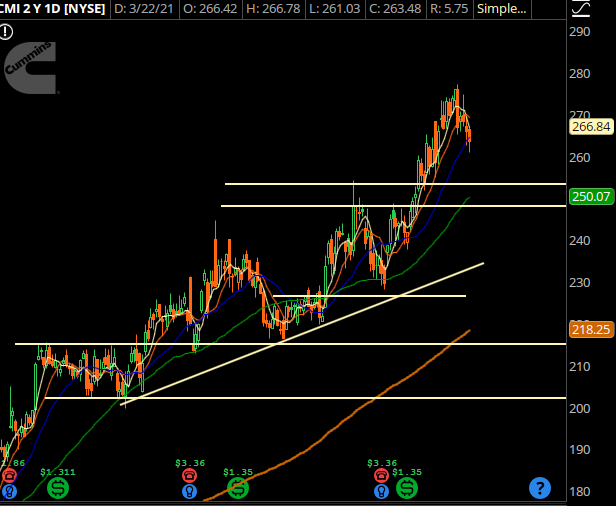

Trade #3: CMI

One of my favorite traders, I’m looking for a deeper pullback here. If we don’t get it, we don’t get it, but I am looking for an attempt of the most recent breakout levels as an entry.

Trade Setup

Expected Price: 257.74

Sell to Open CMI 21May21 240/230 Put Spread

Tier 1: Enter at 2, Exit at 0.64

Tier 2: Enter at 2.8, Exit at 1.36

Tier 3: Enter at 3.6, Exit at 1.8

Stop Out If Close Under 239.89