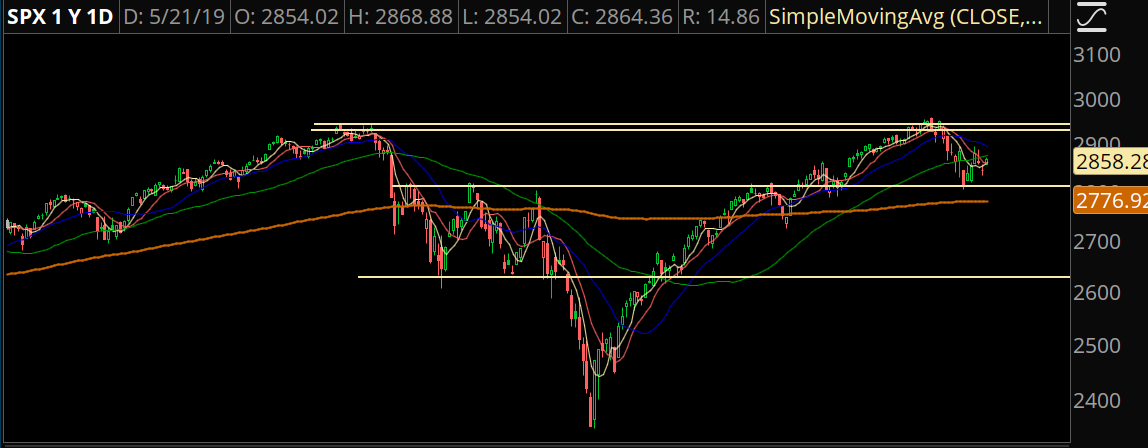

The overall structure of the market favors the upside.

There tends to be an internal logic at key levels. At places where the market “should” pivot. That doesn’t mean it has to pivot, but if it does, it shows that the internal logic is holding.

The SPX pulled back to 2800. That was massive resistance at the end of last year, and for bullish structure to continue, it needed to hold. And it did.

The market bounced where it was “supposed” to bounce.

Now we need to think in terms of time. The longer the market goes on holding that 2800 level, the higher the odds we will break to new highs and run to 3000. I’ve talked for months about the massive amount of cash on sidelines, and any dip is being put to work… that evidence is shown in the 2800 dip buy.

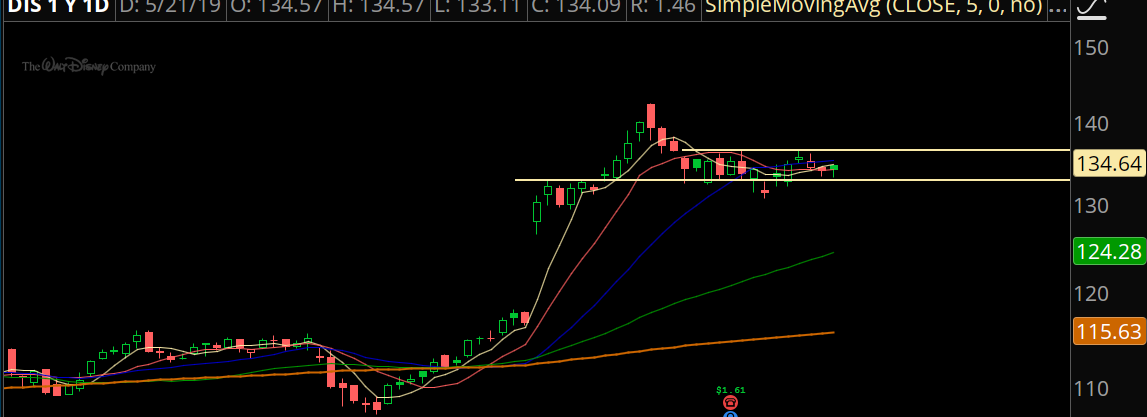

Trade #1: DIS

This is a catalyst continuation trade. The stock ran from 120 to 140 on news of their live streaming service. It’s been rangebound, and the only selling happened around earnings, and even that failed to bring in profit takers. Any failure lower in a stock like this tends to lead to moves higher.

Trade Setup

Expected Price: 134

Sell to Open DIS Jul 125/120 Put Spread

Tier 1: Enter at 0.60, Exit at 0.10

Tier 2: Enter at 0.90, Exit at 0.40

Tier 3: Enter at 1.20, Exit at 0.70

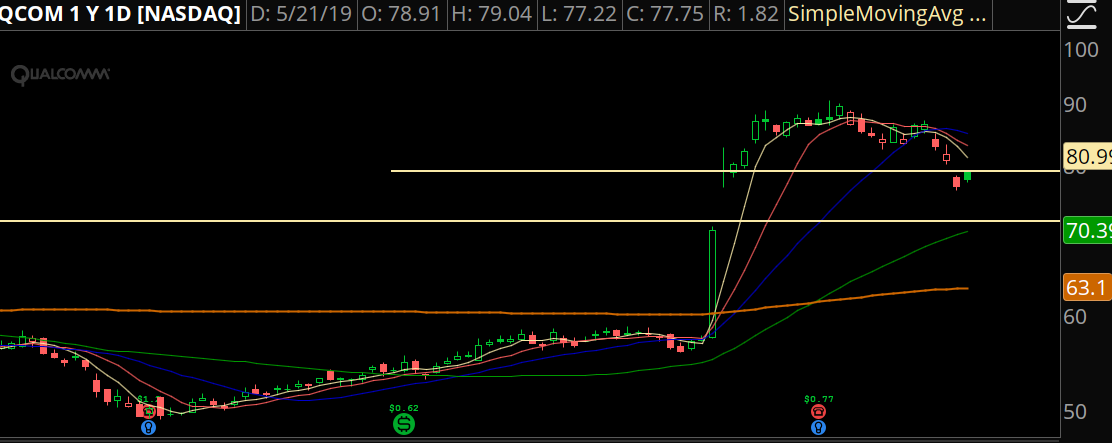

Trade #2: QCOM

Been watching for this gap to fill to get involved. Now some news comes out about a ruling that goes against them and the stock is trading back to the 70s.

Trade Setup

Expected Price: 70

In terms of fills, I’m not sure because the market hasn’t opened yet and I don’t know what prices are available.

I’ll be doing 2.5 wide spreads, and my initial price to come in around 0.30. I think it will be the Jul 62.50/60 Put Spread

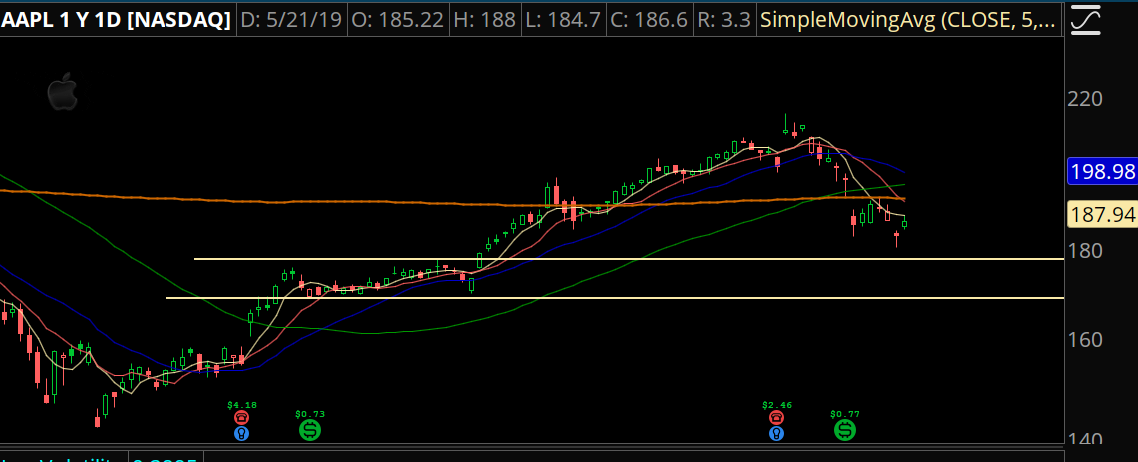

Trade #3: AAPL

Looking for a 50% retracement and a test of the Feb-Mar pivot highs.

Trade Setup

Expected Price: 177.75

Sell to Open AAPL Jul 160/155 Put Spread

Tier 1: Enter at 0.70, Exit at 0.20

Tier 2: Enter at 1.00, Exit at 0.50

Tier 3: Enter at 1.30, Exit at 0.80