The move in March conditioned investors to think in binary terms.

Straight down, straight up. And the range from the past month has chopped up many looking for the retest lower.

For about a month, the market has been in a range between about 2800 and 2950. There was a failure to move lower and then the market spent a week near the range highs, indicating price acceptance.

So far so good, right?

This week the S&P cleared the range and saw a push to 3050. Unless something changes– unless we see proper followthrough with sellers, then we need to assume that the market is establishing a new range higher.

A good upper end of the range would be the countertrend bounce highs from February, and we could just see another range develop.

Within the range we’ll see rotation that give us opportunities in individual stocks, and with the elevated volatility we can still get some great risk/reward on our spread sales.

Trade #1: FB

Facebook (FB) is seeing a little weakness due to the tech sector. It also has headline risk with the potential that social media companies have a change in how they are regulated by the Feds. Whether or not this holds true remains to be seen.

I’m looking for pullback to the rising 20 day moving average and a test of the previous resistance which is now support.

Trade Setup

Expected Price: 216

Sell to Open FB Jun 205/202.5 Put Spread

Tier 1: Enter at 0.56, Exit at 0.32

Tier 2: Enter at 0.784, Exit at 0.484

Tier 3: Enter at 1.008, Exit at 0.628

Stop Out If Close Under 204.89

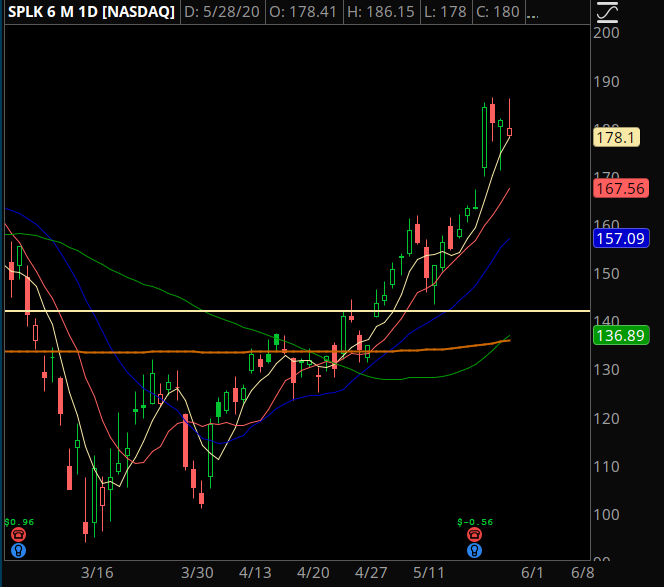

Trade #2: SPLK

SPLK had a good earnings report and price reaction. I like scaling into put spreads sales as the trend should continue in the directions of the earnings move. Bid-ask is a little wide, make sure pricing makes sense before putting on the trade.

Trade Setup

Expected Price: 180

Sell to Open SPLK Jun 167.5/165 Put Spread

Tier 1: Enter at 0.6, Exit at 0.37

Tier 2: Enter at 0.84, Exit at 0.55

Tier 3: Enter at 1.08, Exit at 0.72

Stop Out If Close Under 167.39

Trade #3: PYPL

Looking for a half gap fill into any tech weakness.

Trade Setup

Expected Price: 135.2

Sell to Open PYPL Jun 125/120 Put Spread

Tier 1: Enter at 0.83, Exit at 0.32

Tier 2: Enter at 1.162, Exit at 0.502

Tier 3: Enter at 1.494, Exit at 0.614

Stop Out If Close Under 124.89