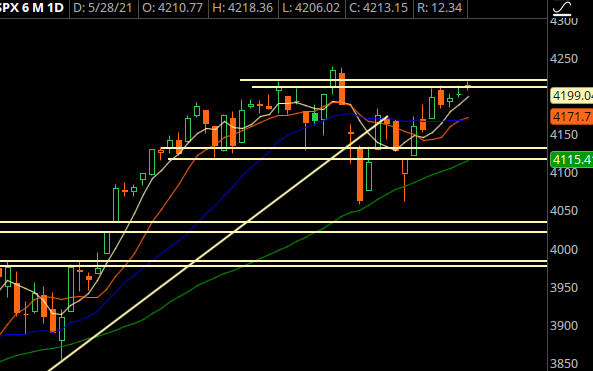

The S&P is continuing to grind into a key resistance level at 4220 as we head into a long weekend. It doesn’t feel like there are at on of buyers, just that the offer continues to lift because we’ve run out of sellers.

Odds are we will see trend continuation, but don’t expect it to be a straight shot. I would not be surprised of a push above 4240 to new all time highs, and then another “gut check.”

A concern I continue to have is the continued weakness in large cap tech. AAPL is still trading like hot garbage… just by the sheer size of the stock it can and will have an effect on the overall markets if it doesn’t manage to hold its current levels right around 125.

Other than that, things are still looking fine. Banks are poised for a move up, rates aren’t skyrocketing, some commodity prices are normalizing, and volatility continues to fall off.

It just feels like yet another summer in the markets.

We’re going to focus on two names that have had stark outperformance against the market, and also a large cap oil name.

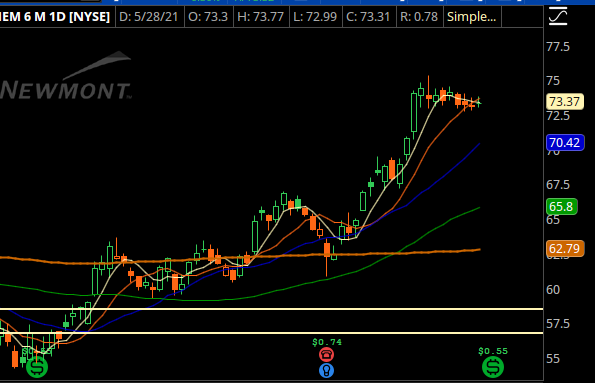

Trade #1: NEM

You’ve got a classic bull flag pattern here in Newmont, and it could easily see a move above 75.

However, if we get a decent pullback in gold, we will see a nice stop run and a retest of some of the key levels below. I’m looking at the rising 20 day moving average as a place to start some risk.

Trade Setup

Expected Price: 70.92

Sell to Open NEM 16Jul21 65/62.5 Put Spread

Tier 1: Enter at 0.38, Exit at 0.01

Tier 2: Enter at 0.532, Exit at 0.13

Tier 3: Enter at 0.684, Exit at 0.17

Stop Out If Close Under 64.89

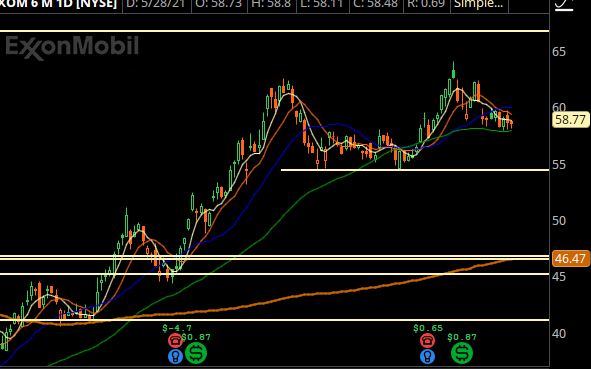

Trade #2: XOM

This is a similar theme as NEM… you have a clear technical setup (falling wedge) that looks great, until you realize that this is tied to commodity prices.

Crude oil is currently failing to breakout, and if we get a reset lower in that, then XOM can easily head to the lower end of the trading range… that’s where I want to get bullish.

Trade Setup

Expected Price: 70.92

Sell to Open XOM 16Jul21 52.5/50 Put Spread

Tier 1: Enter at 0.54, Exit at 0.2

Tier 2: Enter at 0.756, Exit at 0.4

Tier 3: Enter at 0.972, Exit at 0.54

Stop Out If Close Under 52.39

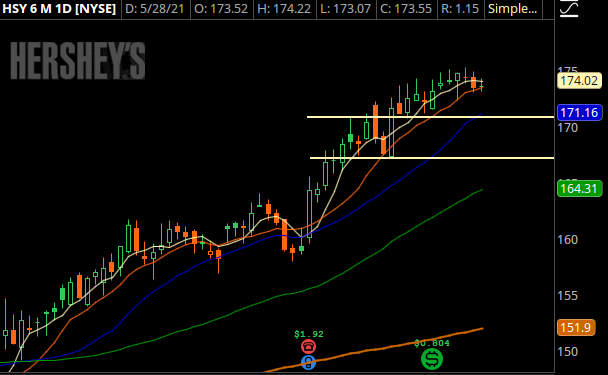

Trade #3: HSY

Hershey’s had a very nice run over the past month. I think the momentum has started to wane, as evidenced by the selling wicks over the past few weeks. I want to see a test of the previous range low, which will coincide with the rising 50 day moving average.

HSY options aren’t the most liquid, so make sure that if our levels are hit, the prices are still good.

Trade Setup

Expected Price: 167.45

Sell to Open HSY 16Jul21 160/155 Put Spread

Tier 1: Enter at 0.75, Exit at 0.02

Tier 2: Enter at 1.05, Exit at 0.26

Tier 3: Enter at 1.35, Exit at 0.32

Stop Out If Close Under 159.89