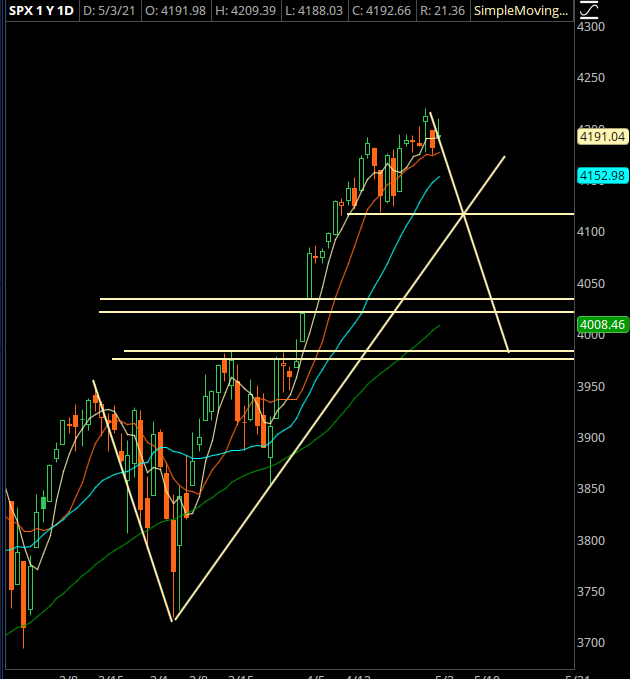

Markets are still hanging on to current levels due to a mix of rotation underneath the surface. Large cap tech earnings are out the door and we’re seeing some fades there, but overall things look fine technically. I am seeing some signs of weakness and while I don’t expect some kind of big crash, I’m looking for just a “normal” pullback.

If we were to see a pullback like we did back in February, then that would take the S&P back to 4000 and test the larger term structure. That downside target is very ambitious as there are a few key levels above that, and if buyers show up in FANG stocks (again) then we’ll find support before then.

I want to look at planning pullbacks in two large cap stocks, and eyeing a fade in UPS.

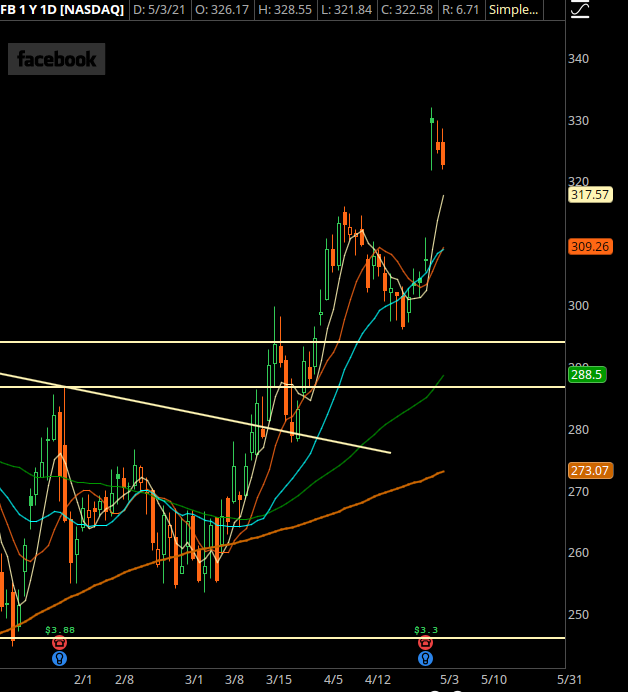

Trade #1: FB

Monster breakout on earnings, but it’s being faded a bit. I want to see a test of the most recent swing high as the first potential support level.

Trade Setup

Expected Price: 316.02

Sell to Open FB 21May21 295/290 Put Spread

Tier 1: Enter at 1.05, Exit at 0.37

Tier 2: Enter at 1.47, Exit at 0.76

Tier 3: Enter at 1.89, Exit at 1.01

Stop Out If Close Under 294.89

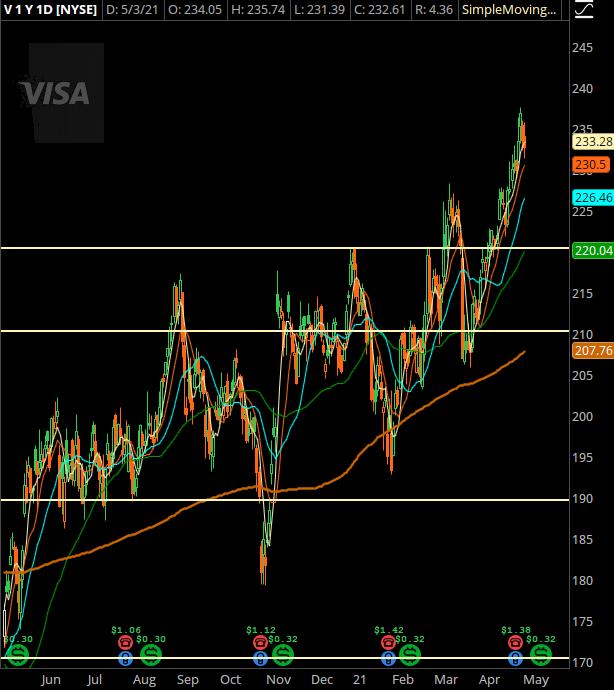

Trade #2: V

V had some nasty news in March about a NY State investigation, but the dip was bought and the stock jammed to new highs. I’m now looking for a dip for a good entry.

Trade Setup

Expected Price: 225.79

Sell to Open V 21May21 215/210 Put Spread

Tier 1: Enter at 1, Exit at 0.32

Tier 2: Enter at 1.4, Exit at 0.68

Tier 3: Enter at 1.8, Exit at 0.9

Stop Out If Close Under 214.89

Trade #3: UPS

UPS is overbought by just about every metric I watch. Sure, earnings helps yet this last move feels a little bit like “panic buying” and I think we’re due for a fade here.

Trade Setup

Expected Price: 212.2

Sell to Open UPS 21May21 220/222.5 Call Spread

Tier 1: Enter at 0.42, Exit at 0.06

Tier 2: Enter at 0.588, Exit at 0.19

Tier 3: Enter at 0.756, Exit at 0.26

Stop Out If Close Over 220.11