For the past week, the market thesis has been:

As long as the gap holds, we go higher.

Pretty simple, right? That’s what looks like is going to continue here. The S&P 500 has spent two weeks in a range, consolidating the most recent impulse higher. The underlying market has been rotational in nature, which is healthy.

So the trade thesis remains the same. Until evidence proves otherwise, we need to assume the overall market is setup for continuation.

Trade Setup #1: FB

FB got a little ahead of itself before its most recent earnings event. The Stock had two aggressive gaps higher, only to see those gains given back after earnings.

This is an EPS LL setup. We’re looking for that lower low to flush out the weak hands who are holding into the initial weakness after earnings.

Trade Setup

Expected Price: 145

Sell to open FB Jun 140/135 Put Spread

Tier 1: Enter at 0.70, Exit at 0.20

Tier 2: Enter at 1.00, Exit at 0.70

Tier 3: Enter at 1.30, Exit at 1.00

Trade Setup #2: GOOGL

After a massive gap higher, the stock is ready to rest. Odds are 1,000 will come into play this year, simply because it is a whole number psychological level. But odds are over the next few weeks the stock will pull in or go sideways for a while.

Because the overall market is strong, we need to be very, very picky about which prices to short. We want to see a bit more of a stretch before we put risk on the table.

Trade Setup

Expected Price: 960

Sell to Open GOOGL Jun 1000/1010 Call Spread

Tier 1: Enter at 1.00, Exit at 0.50

Tier 2: Enter at 1.40, Exit at 1.00

No Tier 3

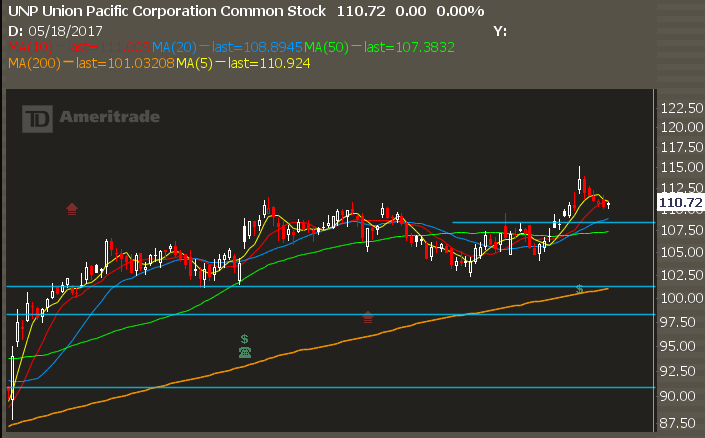

Trade Setup #3: UNP

After a strong earnings gap, the stock has found profit takers and is retesting the top of the previous range. This is a PB2BO setup– we’re looking for the pullback to the breakout level to hold.

Trade Setup

Expected Price: 110

Sell to Open UNP Jun 105/100 Put Spread

Tier 1: Enter at 0.65, Exit at 0.25

Tier 2: Enter at 0.95, Exit at 0.65

Tier 3: Enter at 1.25, Exit at 0.95