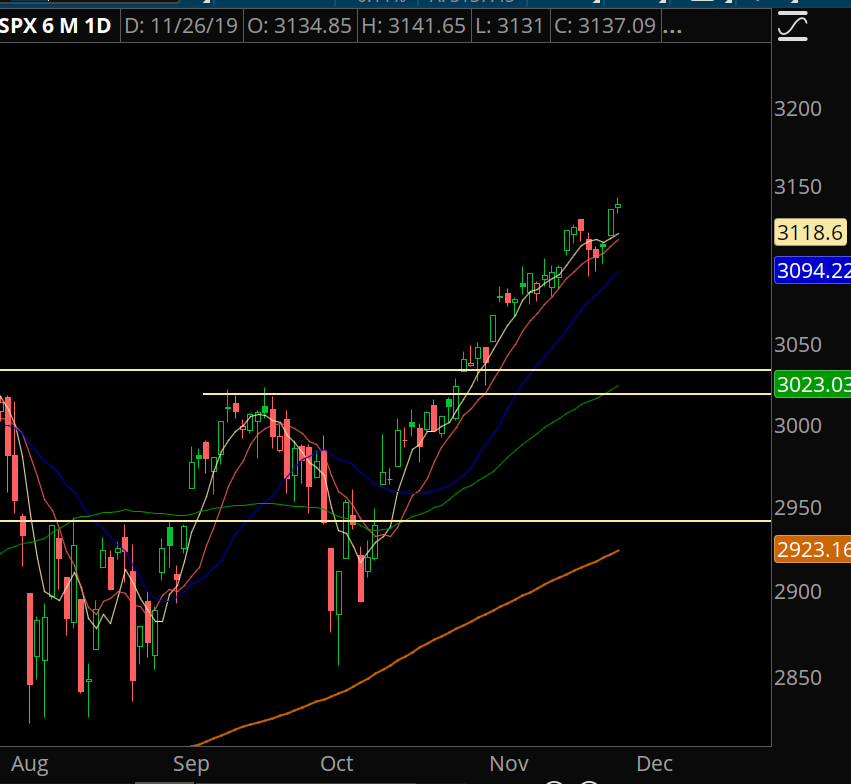

Markets are having a ripper of a holiday week. I think there are still many traders and investors caught on the wrong side of this move… either by being in cash or stuck short calls that need to be adjusted. The pullback from last week was enough to work off some of the overbought conditions. In terms of upside it’s anyone’s guess… but I’m starting to see some nice short setups in stocks and markets.

Trade #1: TSLA

TSLA is retracing a good chunk of its post-earnings move. Knowing how the stock trades, it’ll probably settle into a high volatility, high reversion range. I expect the 327 gap fill to bring in some buyers, as well as a retest of key price levels in the low 300s.

Trade Setup

Expected Price: 326.72

Sell to Open TSLA Jan 280/275 Put Spread

Tier 1: Enter at 0.75, Exit at 0.24

Tier 2: Enter at 1.05, Exit at 0.37

Tier 3: Enter at 1.35, Exit at 0.43

Stop Out If Close Under 280

Trade #2: DIS

DIS is seeing a secondary move from the post Disney+ announcement. I do think the stock is incredibly strong, but the odds of a straight shot without any reversion is low. I want to have a parabolic short in play in case it starts to run.

Trade Setup

Expected Price: 156

Sell to Open DIS Jan 165/170 Call Spread

Tier 1: Enter at 0.7, Exit at 0.18

Tier 2: Enter at 0.98, Exit at 0.29

Tier 3: Enter at 1.26, Exit at 0.32

Stop Out If Close Over 165

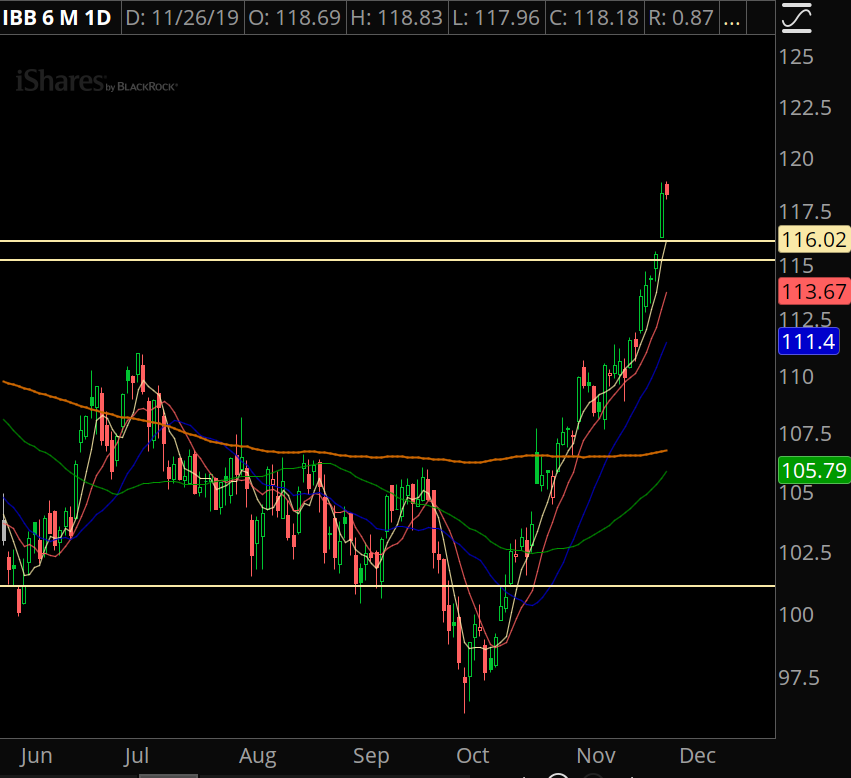

Trade #3: IBB

Large cap biotech is parabolic and ready for some reversion.

Trade Setup

Expected Price: 118.16

Sell to Open IBB Jan 125/130 Call Spread

Tier 1: Enter at 0.7, Exit at 0.18

Tier 2: Enter at 0.98, Exit at 0.29

Tier 3: Enter at 1.26, Exit at 0.32

Stop Out If Close Over 125