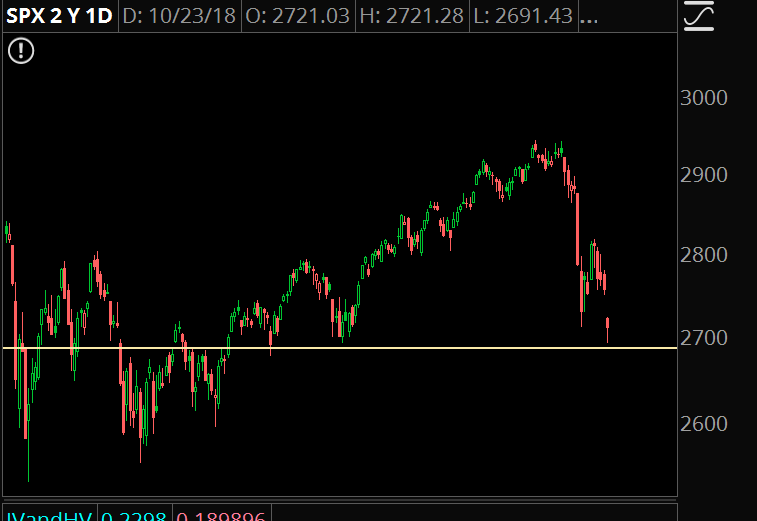

Markets finally got a washout this morning. The big gap down is what I thought should have happened last week, but buyers kept showing up. We’re now seeing signs of capitulation in the market.

The yellow line, at 2700, is the open for the year. It also coincides with support from back in June.

Whether or not this is *the* bottom remains to be seen. Enough technical damage has been done that it’s now a lot simpler to short stocks, but we need to wait for the first very large squeeze higher.

It may not look like it, but this is constructive. We’re seeing a retest of the lows on a gap down, with the VIX and VVIX making a lower high.

We have plenty of risk on in names that are well underwater, so I don’t want to aggressively add more positions until those names bounce and we either scale out or roll out to December options.

Today, we’ll focus on just one trade.

Trade #1: VXX

This trade has some moving parts underneath the surface.

The VIX is not making a huge spike into this gap lower. If and when volatility futures normalize, I’m expecting VXX to fade back to the low 30’s.

Trade Setup

Expected Price: 37.37

Sell to Open VXX Nov 44/47 Call Spread

Tier 1: Enter at 0.40, Exit at 0.05

Tier 2: Enter at 0.60, Exit at 0.20

Tier 3: Enter at 0.80, Exit at 0.40