Seems kinda boring, doesn’t it?

It’s not just you. The past 6 days was the tightest intraday ranges… ever.

The volatility from 2015 and 2016 seems like a decade ago. It’s truly amazing to watch.

Anyways… same gameplan as all year. Until proven otherwise, market corrections will be shallow and rotational.

Key resistance is that upper channel (yellow). And a proper failed breakout would occur if SPX broke under 2474.

Trade #1: AAPL

I’ve mentioned AAPL in previous newsletters, and I just wanted to provide an update. The level we are watching is 150, and for me, this is close enough to start working into a position.

Trade Setup

Expected Price: 154

Sell to Open AAPL Nov 140/135 Put Spread

Tier 1: Enter at 0.65, Close at 0.15

Tier 2: Enter at 0.95, Close at 0.45

Tier 3: Enter at 1.25, Close at 0.65

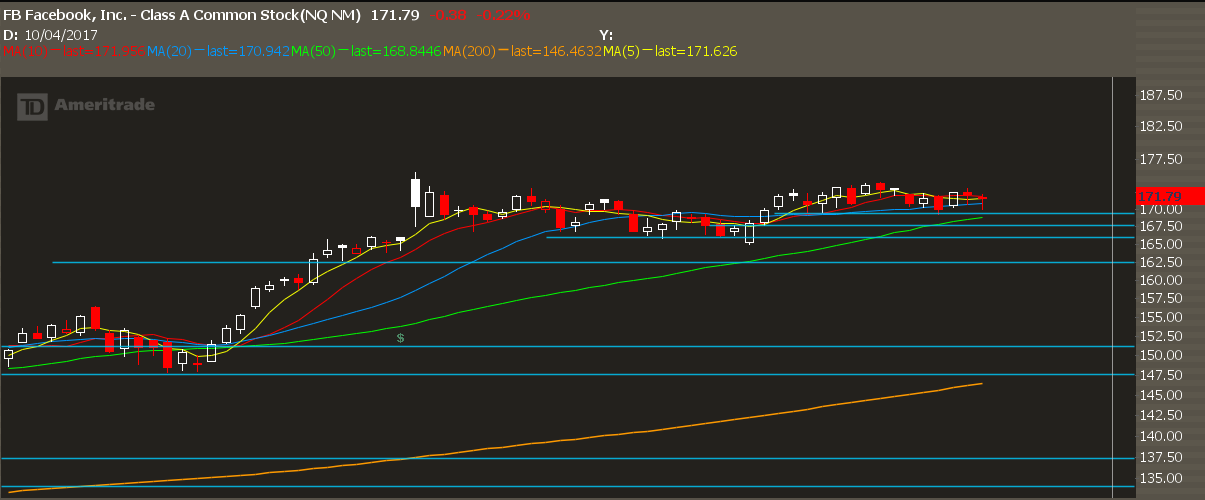

Trade #2: FB

Facebook’s stock has undergone a time-based correction, as it digests its most recent move right around all time highs. Very high odds of trend continuation here.

Trade Setup

Expected Price: 171.50

Sell to Open FB Nov 160/155 Put Spread

Tier 1: Enter at 0.85, Close at 0.15

Tier 2: Enter at 1.15, Close at 0.35

No Tier 3

Trade #3: TSLA

This is a “pullback to breakout” setup. Previous price resistance now acts as support, with a rising 20, 50, and 200 day moving average right below.

Trade Setup

Expected Price: 366

Sell to Open TSLA Nov 320/315 Put Spread

Tier 1: Enter at 0.90, Exit at 0.20

Tier 2: Enter at 1.20, Exit at 0.50

No Tier 3