Become a Great Options Trader

Home › Forums › Market Discussion › Market Talk 3/6 – 3-12

Putting out a parabolic short in RIG:

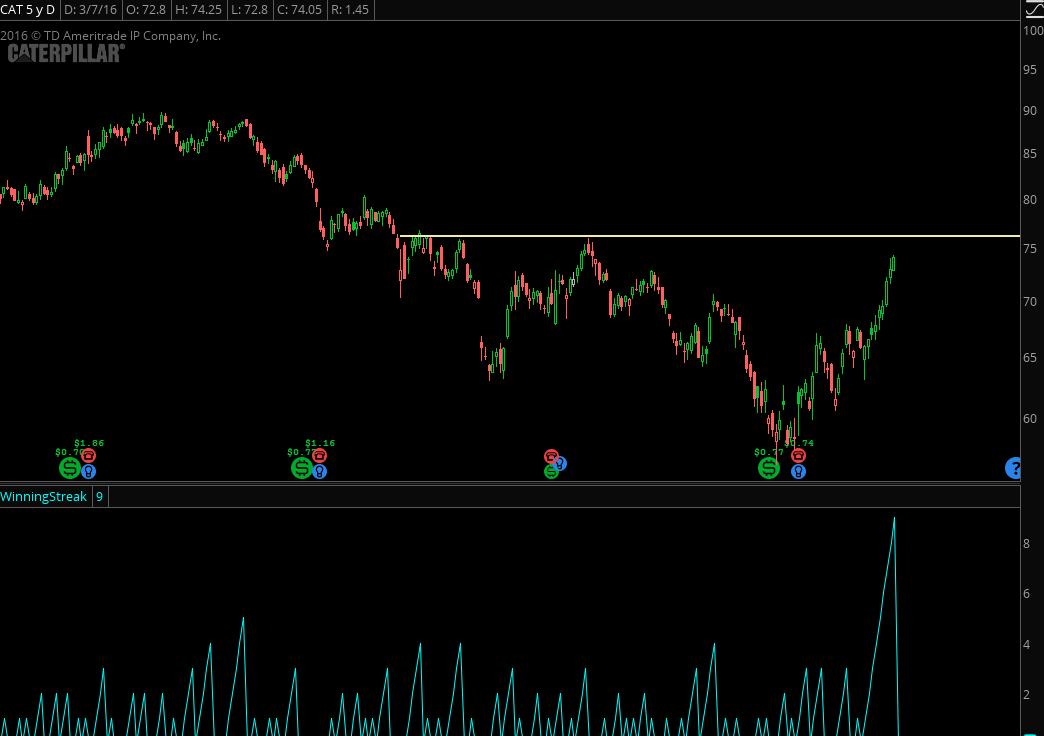

CAT is another one to consider for a short trade. Up 9 days in a row, rallying hard into key resistance levels.

Hope that wasn’t too abrupt!

As a reminder, the chat room is open for 30 minutes before the market open, and an hour after.

You can look through last week’s idea flow here:

Took XOM long, hedging with MCD short. Looks good on the daily chart.

Some more detailed thoughts of my market view:

Potential bottoming pattern in IBB. It’s been a long time coming.

This is interesting because the etf has a good technical look but the large cap biotech space is just kind of “meh.”

I think GILD is the best one, we’ve already got a trade alert set for that one. CELG could be worth a look above 106

Yeah, IBB and GILD.., neither paused or pb this morning. JUNO 26–44 in a month

New short in CAT

Steve, where do you think I should add to TSLA 175/195/215 april butterfly?

What month are you in,Wulin?

I am in the april monthly

I think the hardest part about this trade is being short gamma in a name like TSLA. I think adding a fly with 210 as short strike can work, if IF if sellers show up as the stock runs into 215 level.

Wulin, ideally you get a move above the upper bollinger band before you add. Right now that is 212.20.